United States Acrylonitrile Market Size, Share, and COVID-19 Impact Analysis, By Purity (Up to 99% and Above 99%), By Application (Acrylic Fibers, Adiponitrile, Styrene Acrylonitrile, ABS, Acrylamide, Carbon Fiber, and Others), and United States Acrylonitrile Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Acrylonitrile Market Insights Forecasts to 2035

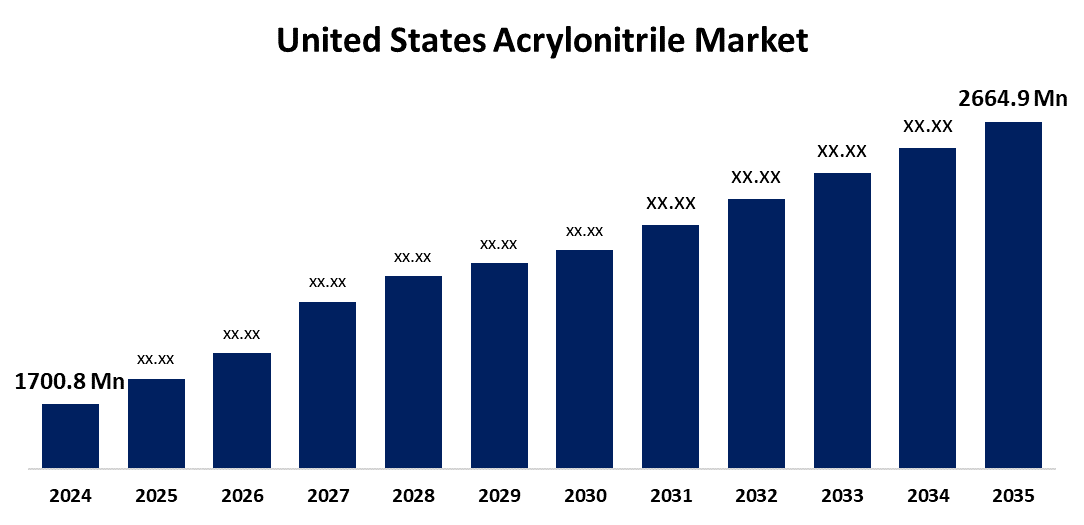

- The US Acrylonitrile Market Size Was Estimated at USD 1700.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The US Acrylonitrile Market Size is Expected to Reach USD 2664.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Acrylonitrile Market Size is Anticipated to Reach USD 2664.9 Million by 2035, Growing at a CAGR of 4.17% from 2025 to 2035. The expansion of the United States acrylonitrile market is propelled by the growing need for acrylonitrile in sectors including construction and automotive.

Market Overview

The acrylonitrile is a colourless, flammable liquid that smells strongly of onions or garlic. The need for acrylonitrile in the United States has been exhibiting considerable progress, mainly as a critical precursor for acrylic fibers, resins, and many plastics. Acrylonitrile, the key monomer in the formation of polyacrylonitrile fibers, is a primary precursor of acrylic textiles, apparel, and carpets. The upsurge in growth in the textile and apparel industry, combined with acrylic fiber's inherent properties and versatility, has meant that demand will continue to sustain acrylonitrile for some time in the U.S. In addition to textiles, acrylonitrile is a precursor to several resins, for example, acrylonitrile butadiene styrene (ABS) and styrene acrylonitrile (SAN). ABS resins are known for their properties, inherent strength, impact resistance, and versatility, which are used in the manufacture of automotive parts, appliances, and consumer products.

The U.S. Environmental Protection Agency is responsible for enforcing the Toxic Substances Control Act, which is essential for monitoring the safety of compounds like acrylonitrile. Under the TSCA, the EPA regulates chemicals that might provide an unjustified risk to human health or the environment and assesses novel compounds before they are put on the market. The manufacturing and use of acrylonitrile are guaranteed to comply with strict safety and environmental standards due to this regulatory control.

Report Coverage

This research report categorizes the market for the United States acrylonitrile market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States acrylonitrile market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States acrylonitrile market.

United States Acrylonitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1700.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.17% |

| 2035 Value Projection: | USD 2664.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Purity, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Ascend Performance Materials, INEOS Nitriles, LyondellBasell, Huntsman Corporation, Trinseo, AdvanSix, Asahi Kasei Corporation, Formosa Plastics Group, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States acrylonitrile market is boosted by the increasing use of lightweight materials in the automotive and aerospace sectors. The push for lightweight materials is being driven by the need to improve fuel efficiency and reduce greenhouse gas emissions. The use of acrylonitrile in the production of acrylonitrile butadiene styrene and carbon fiber composites is appealing because acrylonitrile offers a huge weight savings compared to traditional materials. The automotive and aerospace industries are continuing to adopt and incorporate these composites in their designs and manufacturing efforts. This trend towards lightweight materials is a result of pressures on the environmental side and the continuing desire to optimize performance, which is continuing to drive the acrylonitrile market forward.

Restraining Factors

The United States acrylonitrile market faces obstacles like the upward volatility of raw material prices, specifically propylene, the main precursor in acrylonitrile production. Fluctuating prices for propylene can produce varying-priced production, which can affect profitability for manufacturers.

Market Segmentation

The United States acrylonitrile market share is classified into purity and application.

- The above 99% segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States acrylonitrile market is segmented by purity into up to 99% and above 99%. Among these, the above 99% segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because demand for high-purity acrylonitrile is very high as its need in the production of acrylic fibers, acrylonitrile butadiene styrene resins, and styrene acrylonitrile resins. These examples are important functional applications in consumers' lives where the strength, thermal stability, and chemical resistance provided by high-purity acrylonitrile are highly valued.

- The acrylic fibers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States acrylonitrile market is segmented into acrylic fibers, adiponitrile, styrene acrylonitrile, ABS, acrylamide, carbon fiber, and others. Among these, the acrylic fibers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the widespread use of acrylic fibers in apparel, home furnishings, and industrial textiles in the textile sector. The resistance to moths and oils, mild acids and bases, UV light, and the ability to dye well make acrylic fibers consistently valued within a wide variety of consumer and industrial applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States acrylonitrile market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ascend Performance Materials

- INEOS Nitriles

- LyondellBasell

- Huntsman Corporation

- Trinseo

- AdvanSix

- Asahi Kasei Corporation

- Formosa Plastics Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States acrylonitrile market based on the following segments:

United States Acrylonitrile Market, By Purity

- Up to 99%

- Above 99%

United States Acrylonitrile Market, By Application

- Acrylic Fibers

- Adiponitrile

- Styrene Acrylonitrile

- ABS

- Acrylamide

- Carbon Fiber

- Others

Need help to buy this report?