United States Acetone Market Size, Share, and COVID-19 Impact Analysis, By Application (Solvents, Methyl Methacrylate, Bisphenol A, and Others), By Distribution Channel (Manufacturer-to-distributor and Manufacturer-to-end-user), and United States Acetone Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Acetone Market Insights Forecasts to 2035

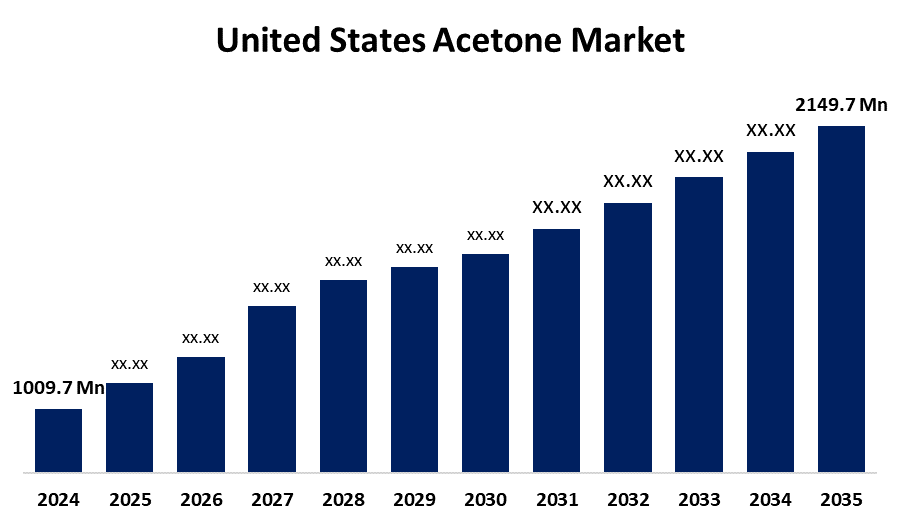

- The US Acetone Market Size Was Estimated at USD 1009.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.11% from 2025 to 2035

- The US Acetone Market Size is Expected to Reach USD 2149.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Acetone Market Size is anticipated to reach USD 2149.7 Million by 2035, growing at a CAGR of 7.11% from 2025 to 2035. The expansion of the United States acetone market is driven by the growth of end-use sectors, such as paints and coatings, and medicines, as well as the increasing use of acetone in the production of personal care products.

Market Overview

Acetone is a colourless, extremely volatile, and combustible liquid that is also known by its IUPAC designation, propanone. A host of trends in the US acetone market are being driven by growing demand from a variety of end-use markets, principally because of the growing use of solvents, chemicals, and plastics. Acetone is an essential raw material whose consumption is rising due to the growth of markets such as electronics, pharmaceuticals, and automotive. there is a surge in demand for sustainable and eco-friendly products due to the US government's focus on reducing greenhouse gas emissions and sustainable practices, which is pushing companies to explore renewable sources of acetone. Biobased acetone is a growing market opportunity since it could engage environmentally conscious end users as well as companies that must meet sustainability regulations. Furthermore, there may be reduced costs and improved efficiencies as a result of innovations to industrial processes, thus creating valuable opportunities for US companies to remain competitive.

The U.S. government supports the acetone market through trade enforcement actions, EPA regulations, and subsidies for bio-based production. Significantly, acetone is classified by the EPA as a VOC-exempt solvent under the Clean Air Act, which facilitates its usage in adhesives, coatings, and reflects its minimal contribution to ozone production.

Report Coverage

This research report categorizes the market for the United States acetone market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States acetone market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States acetone market.

United States Acetone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1009.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.11% |

| 2035 Value Projection: | USD 2149.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application and By Distribution Channel |

| Companies covered:: | Domo Inc, Honeywell International Inc, Altivia, Shell plc, SABIC, Arkema, Solvay, DOMO Chemicals, Kumho P&B Chemicals, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States acetone market is boosted by the development of the chemical industry and the never-ending growth of the plastics production market. Acetone becomes more critical to the industry as the chemical market expands. An adaptable chemical that serves as a solvent and precursor in several chemical reactions, acetone is imperative to the development of various compounds, including industrial chemicals, adhesives, and medications. The production of acetone, which supports synthesis, purification, and formulation activities, is needed as the chemical market grows, generating increased growth of the entire market.

Restraining Factors

The United States acetone market faces obstacles like price volatility and supply chain interruptions. The certainty of being able to access acetone can be problematic due to supply chain issues. There can be obstacles in the supply chain in terms of transportation, logistics, obtaining materials, and these supply issues can hinder the flow of acetone from the supplier to end-users.

Market Segmentation

The United States acetone market share is classified into application and distribution channel.

- The solvents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States acetone market is segmented by application into solvents, methyl methacrylate, bisphenol A, and others. Among these, the solvents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because an increase in demand for acetone primarily due to its use as an excipient in medicinal products and as an ingredient in the manufacturing of hand sanitiser. Active fillers employ acetone as a solvent to guarantee that each dosage of a prescription contains the correct amount of drug.

- The manufacturer-to-end-user segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States Acetone market is segmented into manufacturer-to-distributor and manufacturer-to-end-user. Among these, the manufacturer-to-end-user segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by to ensure product availability and transparency in the acetone market, the distribution chain from the manufacturer to the end-user is important. Large-scale acetone production allows producers to eliminate the middlemen and sell directly to end-users, which may include chemical companies or manufacturers from various different industries and sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States acetone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Domo Inc

- Honeywell International Inc

- Altivia

- Shell plc

- SABIC

- Arkema

- Solvay

- DOMO Chemicals

- Kumho P&B Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States acetone market based on the following segments:

United States Acetone Market, By Application

- Solvents

- Methyl Methacrylate

- Bisphenol A

- Others

United States Acetone Market, By Distribution Channel

- Manufacturer-to-distributor

- Manufacturer-to-end-user

Need help to buy this report?