U.S Veterinary Services Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Companion Animals and Production Animals), By Service Type (Medical Services and Non-Medical Services), and North America, Veterinary Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareU.S Veterinary Services Market Insights Forecasts to 2035

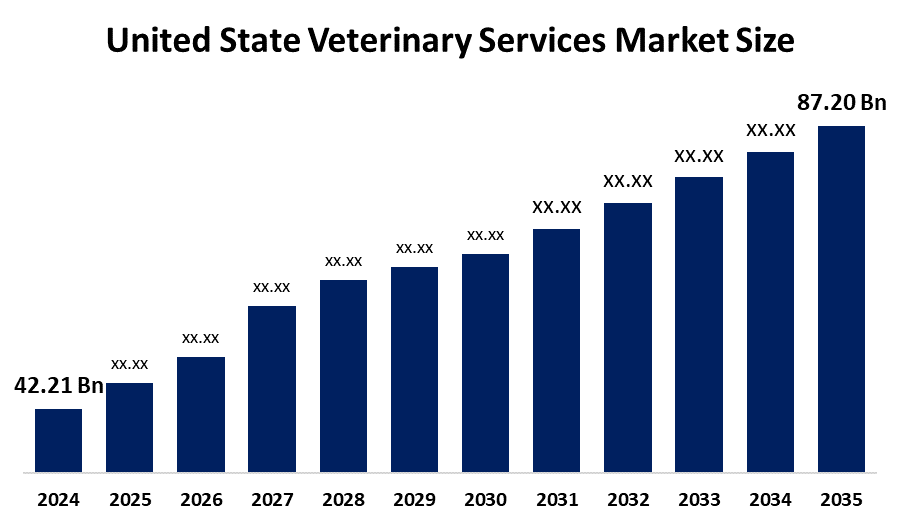

- The U.S Veterinary Services Market Size Was Estimated at USD 42.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.82% from 2025 to 2035

- The U.S Veterinary Services Market Size is Expected to Reach USD 87.20 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The U.S Veterinary Services Market Size is anticipated to reach USD 87.20 Billion by 2035, growing at a CAGR of 6.82% from 2025 to 2035. Improvements in pet healthcare, rising pet ownership, telemedicine use, specialty treatments, and the rising demand for companion animal services and preventative care have created substantial opportunities for the U.S. veterinary services market.

Market Overview

The market for veterinary services in the United States includes all authorized medical, surgical, preventative, diagnostic, grooming, boarding, and associated care services for cattle, wildlife, and companion animals. According to federal statutes under the Animal Health Protection Act (7 U.S.C. § 8301 et seq.) and under the supervision of the Animal and Plant Health Inspection Service (APHIS) of the U.S. Department of Agriculture, the U.S. Veterinary Services Market is the total economic sector that provides diagnostic, therapeutic, preventive, and surgical interventions for companion animals, livestock, and exotic species. The main driver of the market is the sharp rise in food-borne and zoonotic diseases worldwide. The veterinary services are essential for maintaining the sanitary safety of international trade and safeguarding the health and welfare of animals. The market for U.S veterinary services is expected to grow as a result of rising animal illnesses and zoonotic diseases, in addition to growing pet health awareness and the desire for effective medical care.

Report Coverage

This research report categorizes the market for U.S veterinary services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S veterinary services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S veterinary services market.

United State Veterinary Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.82% |

| 2035 Value Projection: | USD 87.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Animal Type, By Service Type |

| Companies covered:: | PetSmart, Greencross Vets, Fetch! Pet Care, IVC Evidensia, CVS Group PLC, Airpets International, Pets at Home Group PLC, National Veterinary Associates, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The veterinary services market in the United States is driven by several interconnected elements that represent shifting technological, sociological, and economic dynamics. The growing human-animal link is another important element that has prompted pet owners to spend more on their pets' well-being, including specialized treatment like orthopedic, dermatological, and dental services. Growing knowledge of animal health and food safety, combined with the rising prevalence of zoonotic and chronic animal diseases, is driving up veterinarian demand in the companion animal and livestock sectors. Furthermore, the scope and caliber of care have been improved by developments in veterinary technology, including telemedicine, diagnostic imaging, and less invasive surgical techniques.

Restraining Factors

The U.S. veterinary services market faces restraints such as high treatment costs, limited access in rural areas, veterinary workforce shortages, and uneven insurance coverage, which collectively hinder service affordability, accessibility, and the consistent delivery of advanced veterinary care.

Market Segmentation

The U.S veterinary services market share is classified into animal type and service type.

- The production animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The U.S veterinary services market is segmented by animal type into companion animals and production animals. Among these, the production animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing demand for foods derived from animals, such as meat, dairy, and eggs, as well as growing worries about food safety, disease prevention, and animal health, are the main factors driving the rise in the production animals market.

- The medical services segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S veterinary services market is segmented by service type into medical services and non-medical services. Among these, the medical services segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growing awareness of animal health and wellbeing, as well as the frequency of infectious and chronic diseases in companion and production animals, are factors driving the medical services market. The segment's growth is further supported by the increasing use of specialist therapies, enhanced diagnostic methods, and surgical procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S veterinary services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PetSmart

- Greencross Vets

- Fetch! Pet Care

- IVC Evidensia

- CVS Group PLC

- Airpets International

- Pets at Home Group PLC

- National Veterinary Associates

- Others

Recent Developments

- In September 2025, the USDA launched a Rural Veterinary Action Plan to address critical shortages of veterinarians in underserved areas. With nearly every U.S. state affected, the plan supports APHIS and FSIS efforts to combat diseases like avian influenza and screwworm, while safeguarding livestock health and national food safety standards.

- In August 2025, to protect American ranchers, animals, and our food supply, U.S. Secretary of Agriculture Brooke L. Rollins today announced to take new steps to recruit new veterinarians to join the U.S. Department of Agriculture (USDA) and help expand the number of rural food animal veterinarians nationwide.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S veterinary services market based on the below-mentioned segments:

U.S Veterinary Services Market, By Animal Type

- Companion Animals

- Production Animals

U.S Veterinary Services Market, By Service Type

- Medical Services

- Non-Medical Services

Need help to buy this report?