United State Anti-aging Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Facial Serum, Moisturizer, Creams, & Lotions, Eye Care Products, Facial Cleanser & Exfoliators, Facial Masks & Peels, Sunscreen & Sun Protection, and Others), By Distribution Channels (Supermarkets & Hypermarkets, Pharmacy/Drugstores, Specialty Beauty Stores, Online/E-commerce, and Others), and U.S. Anti-aging Products Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsU.S. Anti-aging Products Market Insights Forecasts to 2035

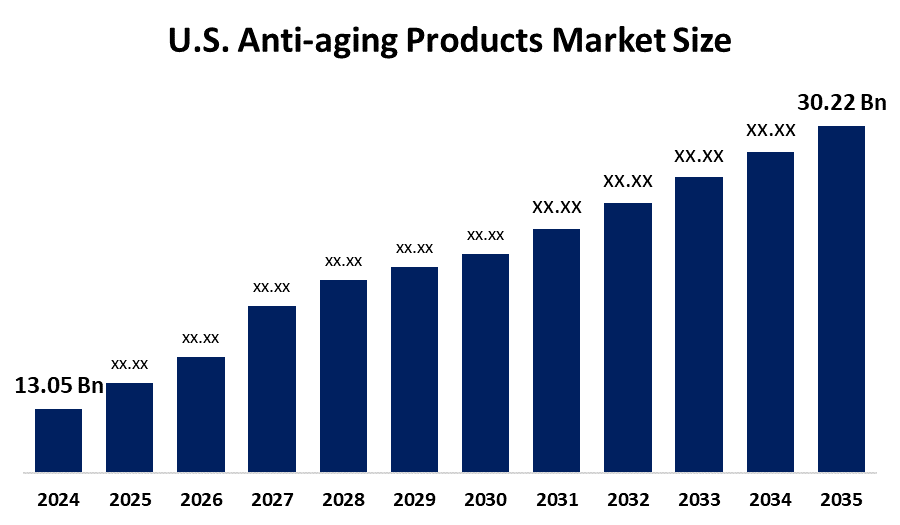

- The U.S. Anti-aging Products Market Size Was Estimated at USD 13.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.93 % from 2025 to 2035

- The U.S. Anti-aging Products Market Size is Expected to Reach USD 30.22 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The U.S. Anti-aging Products market is anticipated to reach USD 30.22 Billion by 2035, growing at a CAGR of 7.93% from 2025 to 2035. The U.S. anti-aging products market is driven by rising aging population, increasing consumer focus on skincare and wellness, growing disposable income, technological innovations in formulations, and higher awareness of preventive and cosmetic solutions.

Market Overview

The U.S. anti-aging products market is that section of the market where the products are dedicated to alleviating, slowing down, or eradicating apparent signs of aging, i.e., fine lines, wrinkles, sagging, and age spots. The product encompasses skincare creams, serums, pills, and cosmetic treatments for both cosmetic and functional issues, for healthier and younger-looking skin. In the United States, increasing life expectancy and a rapidly growing population fuel the business of anti-aging. As of 2030, nearly 20% of the population will be 65 and older, as reported by the U.S. Census Bureau. Older consumers are looking for solutions for lines, wrinkles, and age spots, creating consistent demand for anti-aging related products. The rising preferences for natural and organ products are one of the key trends of this market. There is an emerging potential to design personalized skin care products based on specific skin type, age, and lifestyle, with focused anti-aging benefits and greater consumer satisfaction.

Report Coverage

This research report categorizes the market for the U.S. anti-aging products market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. anti-aging products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. anti-aging products market.

United State Anti-aging Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.93% |

| 2035 Value Projection: | USD 30.22 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product and By Distribution Channels |

| Companies covered:: | Procter & Gamble, Johnson & Johnson, Estee Lauder Inc., PMD Beauty (Age Sciences Inc.), ZO Skin Health, Inc., Avon Products, Inc., L’Oreal Group, Unilever, Shiseido Company, and Beiersdorf AG |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The rising aging population is one of the key drivers for this market. The consumers are becoming more aware about skin health which leads to rising consumer focus on appearance, skin health, and youthful looks which further drives demand for anti-aging products and professional skincare services. Rising disposable incomes allow more customers to buy premium anti-aging goods and services, broadening market reach and boosting sales growth in the US anti-aging business. Additionally, technological advancements and expansion of e commerce play an important role in the market growth.

Restraining Factors

High production cost associated with premium antiaging creams, serums, and treatments become unaffordable for prices sensitive consumers is one of the notable restraints for this market. Additionally, saturation of skincare brands leads price war and reduce profit.

Market Segmentation

The U.S. anti-aging products market share is classified into product and distribution channel.

- The moisturizer, creams, & lotions segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. anti-aging products market is segmented by product into facial serum, moisturizer, creams, & lotions, eye care products, facial cleanser & exfoliators, facial masks & peels, sunscreen & sun protection, and others. Among these, the moisturizer, creams, & lotions segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its ease of use and daily applications in skincare routines. Additionally, these products provide hydration, which is important for keeping skin supple and decreasing the appearance of aging symptoms.

- The supermarkets & hypermarkets segment held a highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. anti-aging products market is segmented by distribution channel into supermarkets & hypermarkets, pharmacy/drugstores, specialty beauty stores, online/e-commerce, and others. Among these, the supermarkets & hypermarkets segment held a highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed due to they offer wide variety of brands and products types under one roof. Additionally, their large-scale presence and strategic locations make such products easily available to a wide range of consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. Anti-aging Products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Procter & Gamble

- Johnson & Johnson

- Estee Lauder Inc.

- PMD Beauty (Age Sciences Inc.)

- ZO Skin Health, Inc.

- Avon Products, Inc.

- L’Oreal Group

- Unilever

- Shiseido Company

- Beiersdorf AG

Recent Developments

In January 2024, Eucerin launched the Immersive Hydration Collection in the U.S., featuring multi-weight hyaluronic acid to hydrate skin, reduce fine lines, and visibly diminish wrinkles for anti-aging benefits.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. anti-aging products market based on the below-mentioned segments:

U.S. Anti-aging Products Market, By Product

- Facial Serum, Moisturizer, Creams, & Lotions

- Eye Care Products

- Facial Cleanser & Exfoliators

- Facial Masks & Peels

- Sunscreen & Sun Protection

- Others

U.S. Anti-aging Products Market, By Distribution Channel

- Supermarkets & Hypermarket

- Pharmacy/Drugstores

- Specialty Beauty Stores

- Online/E-commerce

- Others

Need help to buy this report?