United Kingdom Water Treatment Systems Market Size, Share, and COVID-19 Impact Analysis, By Technology (Water Softeners, Filtration Systems, Disinfection Systems, RO Systems, Distillation Systems, Others), By Installation (POU (Point-of-Use), POE (Point-of-Entry)), By Application (Residential, Commercial, Industrial, Others), and United Kingdom Water Treatment Systems Market Insights, Industry Trend, Forecasts to 2035.

Industry: Machinery & EquipmentUnited Kingdom Water Treatment Systems Market Insights Forecasts to 2035

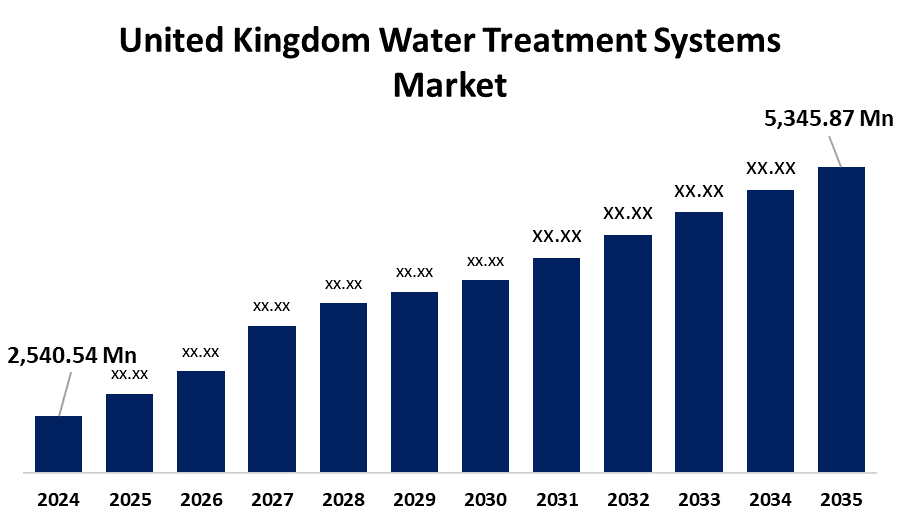

- The United Kingdom Water Treatment Systems Market Size was estimated at USD 2,540.54 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.00% from 2025 to 2035

- The United Kingdom Water Treatment Systems Market Size is Expected to Reach USD 5,345.87 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Water Treatment Systems Market Size is anticipated to reach USD 5,345.87 Million by 2035, growing at a CAGR of 7.00% from 2025 to 2035. The sector is expected to increase as a result of rising freshwater scarcity, declining groundwater levels, and different government programs related to water quality improvements.

Market Overview

The United Kingdom water treatment systems market is described to the business focused on the integration and utilization of equipment and machinery to purify, filter, and treat water and supply it more purely. This market encompasses a range of treatment methods such as reverse osmosis, distillation, filtration, and disinfection to ensure water quality and safety. Water treatment systems perform a vital role by purifying wastewater to help restrict the spread of contamination resources. Drinking water can be treated at a central processing plant, at houses or other distribution sites, or the source before being made available to consumers. The development of pathogen-caused waterborne infections is one of the biggest public health issues which highlighting its significant needs. Because it is less costly, underdeveloped nations usually simply employ one treatment method, like chlorination, which only eliminates some of the pollutants, including heavy metals and other variables. The UK Government announced £11.5 million in extra funding to support 180 local projects aimed at improving water quality, tree planting, habitat restoration, and flood management across England. This funding, part of the Water Environment Improvement Fund (WEIF), is expected to unlock an additional £11.5 million from various organizations, bringing the total potential investment to £23 million.

Report Coverage

This research report categorizes the market for the United Kingdom water treatment systems market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom water treatment systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom water treatment systems market.

United Kingdom Water Treatment Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,540.54 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.00% |

| 2035 Value Projection: | USD 5,345.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology (Water Softeners, Filtration Systems, Disinfection Systems, RO Systems, Distillation Systems, Others), By Installation (POU (Point-of-Use), POE (Point-of-Entry)), By Application (Residential, Commercial, Industrial, Others) |

| Companies covered:: | Evove, LAT Water, Oxmosis, WCS Group, Comfort Services Group, Salinity Solutions, Salinity Solutions, SwitchSafe Environmental, Ashford FM, Aquatech Environmental Services Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom water treatment systems is flourishing due to the growing development and industrialization across the country. The desire for clean and pure water is increasing in every sector that relies on water systems and focuses on smart cities. Additionally, to efficiently treat wastewater and meet the rising demand for clean water, local regulatory bodies are introducing and enforcing contemporary water treatment systems. The market expansion for water treatment systems in India is mostly driven by the Internet of Water system. IoT is a disruptive force for water treatment utilities because, in these water-scarce times, it gives those living in isolated and remote regions a steady supply of water.

Restraining Factors

The market for water treatment systems in the UK suffers significant challenges, including accessibility problems and gaps in the infrastructure, high cost of running and maintaining water treatment plants. For small and medium-sized businesses with tight budgets, this makes it difficult for them to continuously invest in the newest and most effective water treatment technologies.

Market Segmentation

The United Kingdom water treatment systems market share is classified into technology, installation, and application.

- The RO systems segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom water treatment systems market is divided by technology into water softeners, filtration systems, disinfection systems, RO systems, distillation systems, and others. Among these, the RO systems segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because they dissolved or suspended bacterial and amoebic particles in water can be eliminated using reverse osmosis and filtration with carbon and sediment. Moreover, the RO system eliminates dirt, debris, foul taste, and chlorine through the distillation system section. Besides, they only generate a limited volume of treated water, distillation units are placed as point-of-use devices at the faucet rather than being utilized to treat all of the water entering the house.

- The POE (point-of-entry) segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom water treatment systems market is differentiated by process into POU (point-of-use), and POE (point-of-entry). Among these, the POE (point-of-entry) segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is because the main advantages of PoE for small communities include easier implementation, simpler maintenance and operation, and speedier and less expensive installation. Further, in individual business enterprises, including lodges, hotels, restaurants, schools, and other public buildings, the PoE water treatment technology could drive the significant revenue scale.

- The commercial segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom water treatment systems market is segmented by application into residential, commercial, industrial, and others. Among these, the commercial segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it lowers the risk of water-borne diseases such as cryptosporidiosis and cholera, increases consumer awareness of health issues, which has a significant impact on the adoption of water treatment technology. to stop the spread of waterborne illnesses. Also, the water treatment requirements of establishments that use large volumes of high-quality water, such as malls, offices, retail stores, restaurants, hotels, manufacturing facilities, schools, and labs, propel the segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom water treatment systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Evove

- LAT Water

- Oxmosis

- WCS Group

- Comfort Services Group

- Salinity Solutions

- Salinity Solutions

- SwitchSafe Environmental

- Ashford FM

- Aquatech Environmental Services Limited

- Others

Recent Developments:

- In May 2025, ACCIONA selected to renovate the Coppermills Water Treatment Plant in London, which supplies about one-third of Greater London’s drinking water. The project, valued at £400 million (€465 million), will include the design, construction, and commissioning of upgraded infrastructure.

- In February 2025, Envirogen introduced SimPACK, a Regenerable Ion Exchange (IX) system, to the UK municipal market as part of AMP82. This system is designed to remove nitrate from boreholes and other water sources contaminated by fertilizers and farm animal effluent.

- In August 2024, Siemens introduced Water Quality Analytics as a Service (WQAaaS) for UK drinking water companies. This innovative solution provides real-time water quality data and insights, helping utilities predict and prevent issues in drinking water networks. Siemens developed WQAaaS in collaboration with Northumbrian Water and the University of Sheffield.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom water treatment systems market based on the below-mentioned segments:

United Kingdom Water Treatment Systems Market, By Technology

- Water Softeners

- Filtration Systems

- Disinfection Systems

- RO Systems

- Distillation Systems

- Others

United Kingdom Water Treatment Systems Market, By Installation

- POU (Point-of-Use)

- POE (Point-of-Entry)

United Kingdom Water Treatment Systems Market, By Application

- Residential

- Commercial

- Industrial

- Others

Need help to buy this report?