United Kingdom Used Car Market Size, Share, and COVID-19 Impact Analysis, By Vendor Type (Organized and Unorganized), By Fuel Type (Petrol, Diesel, Electric, Hybrid), By Sales Channel (Online and Offline), and United Kingdom Used Car Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationUnited Kingdom Used Car Market Insights Forecasts to 2035

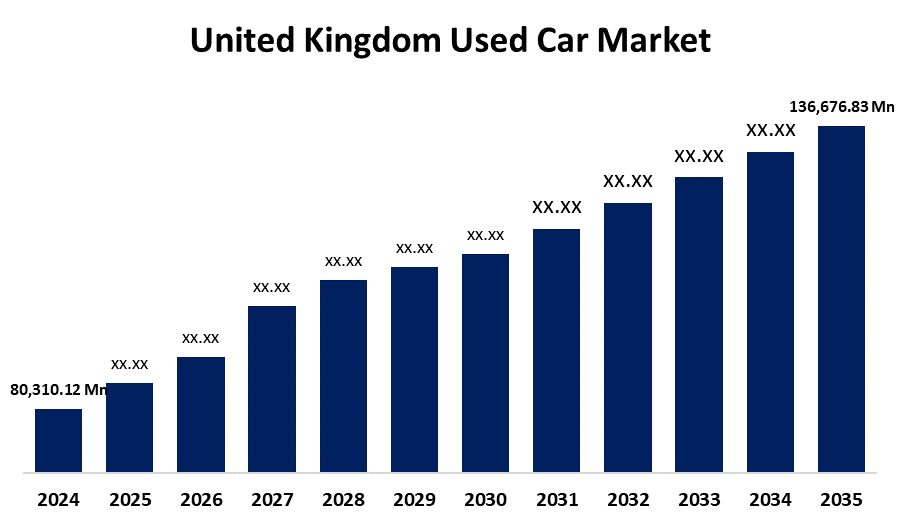

- The United Kingdom Used Car Market Size was estimated at USD 80,310.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.95% from 2025 to 2035

- The United Kingdom Used Car Market Size is Expected to Reach USD 136,676.83 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Used Car Market Size is Anticipated to reach USD 136,676.83 Million By 2035, Growing at a CAGR of 4.95% from 2025 to 2035. The industry has been expanding significantly due to several causes, such as shifting customer preferences, technological improvements, and economic shifts. Also, many consumers are looking at used cars as a more cost-effective option as the price of new cars rises.

Market Overview

The United Kingdom used car market refers to the business that is a portion of the automotive and transportation industry that focuses on the market where used cars are purchased and sold. This market provides information on brand reputation, mileage, car condition, and many economic factors that assist the trade. Additionally, customers tend to pick used automobiles based on their daily usage, which is the main reason they avoid spending excessive amounts of money. Further, to upgrade or get rid of their old cars, the sellers are also listing their used autos at the same time. For Instance, in May 2024, the £5,000 EV grant was exclusive to Uber drivers in London. This initiative, launched by Uber, aimed to accelerate the transition to electric vehicles among its drivers. The grant could have been used for purchasing, leasing, or hiring a new or used EV, and it could have been combined with other discounts, potentially saving drivers up to £22,000 on certain models, which would influence the market expansion.

Report Coverage

This research report categorizes the market for the United Kingdom used car market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom used car market.

United Kingdom Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 80,310.12 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.95% |

| 2035 Value Projection: | USD 136,676.83 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Vendor Type, By Fuel Type, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Cinch Cars Limited, Constellation Automotive Group Limited, Aramis Group, Cazoo Ltd, Arnold Clark Automobiles Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United Kingdom used car market is primarily driven by a variety of variables, such as shifting consumer preferences, technological advancements, and economic shifts. Consumer are also looking for cars that fit their new routines, as such of the rise of remote work and lifestyle changes will increase the market expansion. In addition to making the process more convenient, the growing number of online platforms for used car sales and purchases has given buyers more options. Moreover, the additional government efforts with their schemes and growing awareness regarding the health benefits of resource preservation and reducing waste along the spot via this shift in behaviour expand the market.

Restraining Factors

The United Kingdom used car market growth is being restricted due to the high cost of maintenance and servicing. Moreover, the affordability and accessibility of replacement parts, possible problems from prior ownership, and wear and tear on vehicle components are some of the factors that restrict the expansion of the market.

Market Segmentation

The United Kingdom used car market share is classified into vendor type, fuel type, and sales channel.

- The organized segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom used car market is divided by vendor type into organized and unorganized. Among these, the organized segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the nation's automotive infrastructure grows stronger, and the established players offer a more reliable purchasing experience through upholding better standards for vehicle quality and customer service to draw in cautious customers. Additionally, features like comprehensive vehicle history reports, warranties, and readily available financing alternatives help to accelerate segmental expansion.

- The electric segment dominated the market in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The United Kingdom used car market is differentiated by fuel type into petrol, diesel, electric, and hybrid. Among these, the electric segment dominated the market in 2024 and is anticipated to grow at a significant CAGR over the forecast period. This segment growth is influenced by well-established and increasing investment in EV charging infrastructure across the UK is the main factor contributing to the positive influence on consumer demand. Further, the high rate of electric car adoption by individual transit patterns, such as choosing more environmentally friendly habits and accepting novel modes of transportation, has also resulted in substantial segment revenue and its expansion.

- The online segment accounted for the highest share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

The United Kingdom used car market is segmented by sales channel into online and offline. Among these, the online segment accounted for the highest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. This is due to the proliferation of e-commerce websites, the pervasive use of cutting-edge technology, and the successful tactics used by various companies to achieve their aims of corporate expansion and support the growth of the market. The online segment's dominance is further improved by these platforms, which display all of the vehicle's data, including make, model, mileage, engine capacity, and situation, without consuming clients' precious time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cinch Cars Limited

- Constellation Automotive Group Limited

- Aramis Group

- Cazoo Ltd

- Arnold Clark Automobiles Limited

- Others

Recent Developments:

- In July 2024, Cinch, the online used car marketplace, launched its first physical store in the UK. The store opened on Bedford Road, Northampton. Cinch expanded further, with new stores opening in Birmingham, Bristol, and Manchester during July and August. These stores allowed customers to see, touch, and test drive cars before purchasing, while still following Cinch’s online buying process.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom used car market based on the below-mentioned segments

United Kingdom Used Car Market, By Vendor Type

- Organized

- Unorganized

United Kingdom Used Car Market, By Fuel Type

- Petrol

- Diesel

- Electric

- Hybrid

United Kingdom Used Car Market, By Sales Channel

- Online

- Offline

Need help to buy this report?