United Kingdom Truck Rental Market Size, Share, and COVID-19 Impact Analysis, By Size (Light-Duty, Medium-Duty, Heavy-Duty), By Duration (Short-Term, Long-Term), By Propulsion (ICE, Electric), By Service Provider (Rental & Leasing Companies, OEM Captives, Third-party Service Providers), and United Kingdom Truck Rental Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationUnited Kingdom Truck Rental Market Insights Forecasts to 2035

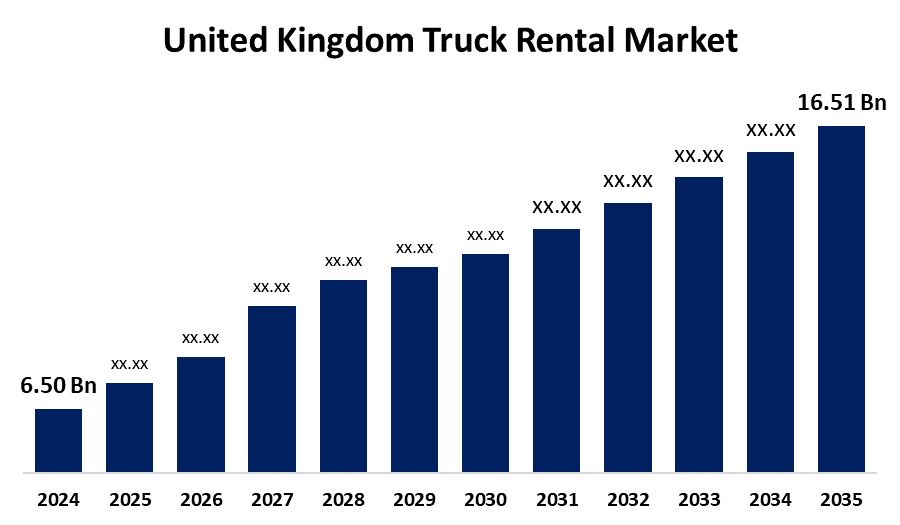

- The United Kingdom Truck Rental Market Size was estimated at USD 6.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.84% from 2025 to 2035

- The United Kingdom Truck Rental Market Size is Expected to Reach USD 16.51 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Truck Rental Market Size is anticipated to reach USD 16.51 Billion by 2035, growing at a CAGR of 8.84% from 2025 to 2035. The expansion of the UK truck rental market is driven by corporate websites, applications, and online platforms due to increased digitization. Concurrently, it is an alternative mode of transportation for reducing automotive emissions.

Market Overview

The United Kingdom truck rental market refers to the business that focuses on the rental and leasing of trucks for short-term and long-term use for a variety of applications, such as freight transportation, business use, and residential relocation. Small and medium-sized firms (SMEs) in particular prefer truck rentals over fleet acquisitions due to their affordability and flexibility. Particularly in cities with extensive distribution networks, this tendency has led to a steady rise in the demand for both short-term and long-term truck rentals. The basic objective of rental services is to offer a flexible and affordable way to move equipment, supplies, and other items without the expenses and commitment associated with owning and operating a fleet of trucks. The need for short-term truck rentals is fueled by businesses' need to move items from warehouses to distribution hubs and then straight to consumers. The reduction in expenses for depreciation, insurance, and maintenance offers a workable alternative instead of a permanent fleet, contributing to the expansion of the truck rental industry across the UK.

Report Coverage

This research report categorizes the market for the United Kingdom truck rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom truck rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom truck rental market.

United Kingdom Truck Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.84% |

| 2035 Value Projection: | USD 16.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Size (Light-Duty, Medium-Duty, Heavy-Duty), By Duration (Short-Term, Long-Term), By Propulsion (ICE, Electric), By Service Provider (Rental & Leasing Companies, OEM Captives, Third-party Service Providers) |

| Companies covered:: | Riverside Truck Rental, Arval, ZIGUP, Northgate, SMH Fleet Solutions, Lex Autolease, Avis UK, Hertz, MC Rental, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for UK truck rental is primarily propelled by the growing e-commerce industry and the need for effective last-mile delivery options, and its expansion. The UK truck rental market is anticipated to grow at a rapid pace due to the country's fast expansion and the rising demand, particularly in industrial, construction, and logistics sectors. The expansion of the British truck rental business is mostly attributed to the government's stringent laws with advantageous trade policies, and variations in fuel prices. This is due to their affordability; rental services are appealing to distinct businesses with seasonal demand patterns or those with tight profit margins, which propel the market expansion.

Restraining Factors

The market of truck rental in the UK is being hampered by high costs for fleet upkeep, high prices for power, and disturbance insurance coverage. Also, sudden employee strikes and rising other expenses are quite costly for rental firms and reduce their wide adoption.

Market Segmentation

The United Kingdom truck rental market share is classified into size, duration, propulsion, and service provider.

- The medium-duty segment accounted for the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom truck rental market is divided by size into light-duty, medium-duty, and heavy-duty. Among these, the medium-duty segment accounted for the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The segment growth is influenced by their versatility, used for transporting small objects and domestic goods. They are also utilized in small and medium sized business settings for distribution of goods and assist them for profitable revenue generation.

- The short-term segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The United Kingdom truck rental market is segmented by duration into short-term, and long-term. Among these, the short-term segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This is due to they have more flexibility and can respond quickly to shifting demands when consumers rent a vehicle for a few days or months (less than six months considered). Besides, the expansion of the e-commerce sector and the rise in independent contractors in the transportation and logistics industries are driving the demand for short-term truck rentals. Further, short-term rentals are frequently preferred by on-demand delivery businesses, relocation companies, by small or medium-sized enterprises to fulfill certain criteria.

- The electric segment held a significant share in 2024 and is predicted to grow at a rapid pace over the forecast period.

The United Kingdom truck rental market is differentiated by service provider into ICE, and electric. Among these, the electric segment held a significant share in 2024 and is predicted to grow at a rapid pace over the forecast period. The segment growth is driven by their lower emissions, making them popular as an alternative fuel for sustainable transportation options. Additionally, a government program that enforcement and introduces grants, tax credits, and subsidies will boost the expansion of this segment.

- The rental & leasing companies segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom truck rental market is segmented by service provider into rental & leasing companies, OEM captives, and third-party service providers. Among these, the rental & leasing companies segment held the highest share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is because transparency from the rental firm during the renting procedure and convenient access to their large fleet. Also, there may be more alternatives for customization and specialized schemes or incentives with the rental provider directly addressing their trustworthy behaviour for more customer engagement, which influences the segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom truck rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Riverside Truck Rental

- Arval

- ZIGUP

- Northgate

- SMH Fleet Solutions

- Lex Autolease

- Avis UK

- Hertz

- MC Rental

- Others

Recent Developments:

- In July 2024, Flexter, a leading online mobility platform for rental trucks and vans, announced its expansion into Europe, starting with the UK market. This move is part of Flexter’s strategy to grow its worldwide presence and provide innovative solutions for truck rentals. The company is partnering with trusted truck rental suppliers in the UK to ensure a strong network and seamless booking experience for customers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom truck rental market based on the below-mentioned segments:

United Kingdom Truck Rental Market, By Size

- Light Duty

- Medium Duty

- Heavy Duty

United Kingdom Truck Rental Market, By Duration

- Short-Term

- Long-Term

United Kingdom Truck Rental Market, By Propulsion

- ICE

- Electric

United Kingdom Truck Rental Market, By Service Provider

- Rental & Leasing Companies

- OEM Captives

- Third-party Service Providers

Need help to buy this report?