United Kingdom Toy Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Building & Construction Set, Dolls, Infant & Preschool Toys, Outdoor & Sports Toys, and Games & Puzzles), By Age Group (18+ Years, 12 to 18 Years, 5 to Below 12 Years, 3 to Below 5 Years, and 0 to Below 3 Years), and United Kingdom Toy Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited Kingdom Toy Market Insights Forecasts to 2035

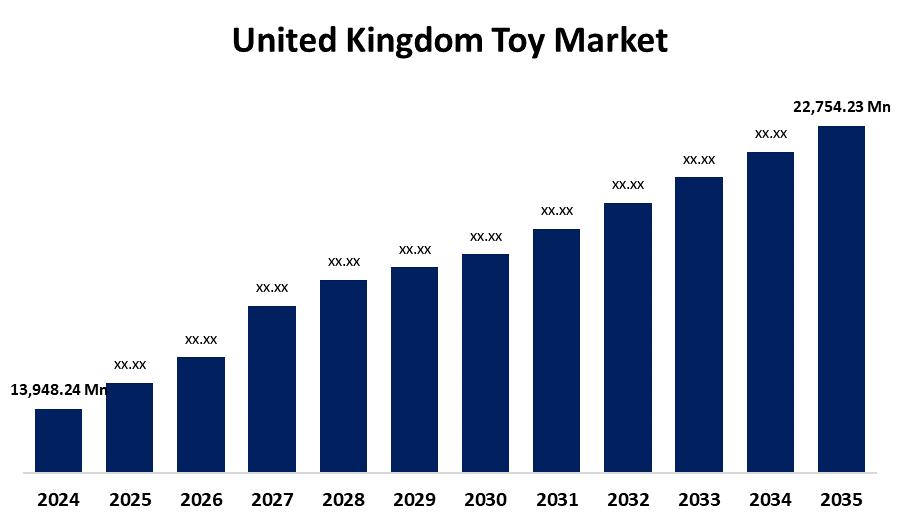

- The United Kingdom Toy Market Size Was Estimated at USD 13,948.24 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.55% from 2025 To 2035

- The United Kingdom Toy Market Size is Expected to Reach USD 22,754.23 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Toy Market Size is Anticipated to reach USD 22,754.23 Million By 2035, Growing at a CAGR of 4.55% from 2025 to 2035. The increasing online shopping platforms, robust brand licensing, increased disposable income, and growing demand for tech-based and educational toys. Innovation and sustainability trends also increase consumer engagement and market growth.

Market Overview

The United Kingdom toy market refers to the industry includes the creation, marketing, and distribution of games and toys for both adults and children. It provides a wide range of products, including educational toys, electronic toys, collectibles, and vintage games. The market is a dynamic and competitive segment within the larger retail and entertainment industries, driven by innovation, seasonal demand, and changing customer preferences. It also reflects developments in technology, sustainability, and entertainment. The increasing demand for sustainable and eco-friendly items, STEM and educational toys, and tech-integrated toys like robots and augmented reality. Opportunities for growth are also presented by expanding online retail platforms and rising demand for licensed goods and collectibles. Furthermore, consumer preferences for toys that are customized and culturally diverse open up fresh opportunities for product creation and innovation, which boosts market expansion and brand distinction. incorporating contemporary technologies such as artificial intelligence, augmented reality, and robotics. Sustainable materials and eco-friendly designs are also growing among consumers. Furthermore, play experiences are changing due to personalized and interactive toys, which are in line with the trend toward educational value and changing consumer expectations.

Report Coverage

This research report categorizes the market for the United Kingdom toy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom toy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom toy market.

United Kingdom Toy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13,948.24 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.55% |

| 2035 Value Projection: | USD 22,754.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Age Group and COVID-19 Impact Analysis |

| Companies covered:: | Hasbro, Inc., Hornby Hobbies, The Entertainer, Mattel, Inc., Lego Group, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The consumer expenditure on high-quality and instructional toys has increased due to shifting lifestyle patterns and rising disposable income. Demand is prompted by parents' increasing awareness of the benefits educational and STEM-based toys have for development. Furthermore, the growth of e-commerce platforms encourages purchases by offering a greater selection of products and easy access. Brand licensing from recognized media firms is another significant element affecting toy buying. Artificial intelligence (AI) and interactive toy elements are examples of technological innovations that increase attractiveness. Consistent market growth is also supported by birthday festivities, seasonal gifts, and emerging collecting trends.

Restraining Factors

The high production costs, complicated compliance requirements, and strict safety restrictions. Interest in physical toys declines as a consequence of competition from digital entertainment, such as video streaming and smartphone apps. For manufacturers and retailers, market saturation and short product life cycles also pose challenges to long-term growth and innovation.

Market Segmentation

The United Kingdom toy market share is classified into product type and age group.

- The infant & preschool toys segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom toy market is segmented by product type into building & construction set, dolls, infant & preschool toys, outdoor & sports toys, games & puzzles. Among these, the infant & preschool toys segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for STEM and educational toys, the use of technology like AI and AR, consumer preferences for sustainable products, and the growth of online shopping. Additionally, licensed toys from recognized media organizations significantly boost customer attention and sales.

- The 5 to below 12 years segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom toy market is segmented by age group into 18+ years, 12 to 18 years, 5 to below 12 years, 3 to below 5 years, and 0 to below 3 years. Among these, the 5 to below 12 years segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increased consumer interest in sustainability, growing demand for educational and STEM toys, growing appeal of tech-integrated items, and expanding e-commerce platforms. Additionally, licensed toys and collectibles encourage market expansion across a range of age groups.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom toy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hasbro, Inc.

- Hornby Hobbies

- The Entertainer

- Mattel, Inc.

- Lego Group

- Others.

Recent Developments:

- In May 2025, McDonald's Australia has introduced 14 exclusive Squishmallows plush toys in Happy Meals, featuring characters like Rossi the purple cheetah and Halley the intergalactic axolotl. This collaboration taps into the "kidult" trend, appealing to both children and collectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom toy market based on the below-mentioned segments

United Kingdom Toy Market, By Product Type

- Building & Construction Set

- Dolls

- Infant & Preschool Toys

- Outdoor & Sports Toys

- Games & Puzzles

United Kingdom Toy Market, By Age Group

- 18+ Years

- 12 to 18 Years

- 5 to Below 12 Years

- 3 to Below 5 Years

- 0 to Below 3 Years

Need help to buy this report?