United Kingdom Tofu Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Firm Tofu and Soft Tofu), By Distribution Channel (Supermarkets & Hypermarkets and Online Retail), and United Kingdom Tofu Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Tofu Market Insights Forecasts to 2035

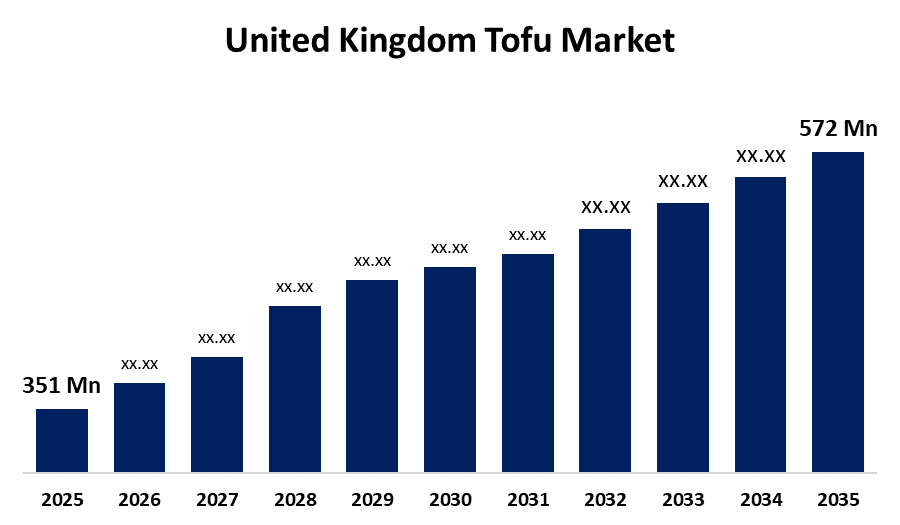

- The United Kingdom Tofu Market Size Was Estimated at USD 351 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.54% from 2025 to 2035

- The United Kingdom Tofu Market Size is Expected to Reach USD 572 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Tofu Market Size is anticipated to reach USD 572 Million by 2035, Growing at a CAGR of 4.54% from 2025 to 2035. The increasing demand for plant-based, high-protein alternatives, growing vegan and vegetarian adoption, and growing health consciousness. Sustainability concerns and creative tofu-based product offerings additionally drive consumer interest and market expansion in the retail and foodservice sectors.

Market Overview

The United Kingdom tofu market refers to the industry includes manufacturing, distributing, and consuming tofu, a plant-based protein derived from soybeans, in the United Kingdom. Tofu is becoming more and more well-liked as a mainstay in vegetarian and vegan diets because of its sustainability, adaptability, and health advantages. Supermarkets, health food stores, and foodservice establishments sell a variety of tofu products, including firm, smooth, flavored, and organic varieties. The industry is steadily expanding due to rising consumer interest in plant-based and high-protein diets. The growing need for sustainable protein sources, flexitarian lifestyles, and veganism. Health-conscious customers may be interested to innovative tofu-based ready meals, flavored variants, and organic products. Market reach is further increased by extending distribution through supermarkets, internet sites, and foodservice outlets; educational marketing raises expertise of the nutritional and gastronomic advantages of tofu. The launch of clean-label and organic products, ready-to-eat, flavored tofu slices, and substitute protein sources, including chickpea tofu. These developments meet the needs of health-conscious customers who require plant-based protein options that are sustainable, easy to obtain, and minimal processed.

Report Coverage

This research report categorizes the market for the United Kingdom tofu market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom tofu market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom tofu market.

United Kingdom Tofu Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 351 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.54% |

| 2035 Value Projection: | USD 572 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Cauldron Foods, The Tofu Shop, Kikkoman, Yutaka, Tofoo Co.,and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for plant-based, high-protein, low-fat diets has grown due to growing health and wellness consciousness, and tofu has emerged as a wholesome substitute for meat. The growing popularity of vegetarian, vegan, and flexitarian diets increases demand. Concerns regarding ethics and the environment are promoting more sustainable eating habits, which is increasing the use of tofu. Tofu is also becoming easier to get thanks to its growing availability in traditional supermarkets, new products including flavored and ready-to-eat tofu, and growing online shopping channels. Additional factors driving market expansion include government encouragement of plant-based diets and educational initiatives supporting soy-based proteins.

Restraining Factors

The adoption is hampered by taste preferences, a lack of culinary information, and false beliefs concerning soy use. Market constraints also include supply chain difficulties in locating non-GMO soybeans and competition from alternative plant-based proteins.

Market Segmentation

The United Kingdom tofu market share is classified into product type and distribution channel.

- The firm tofu segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom tofu market is segmented by product type into firm tofu and soft tofu. Among these, the firm tofu segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed because it has a texture identical to meat, can be cooked in a variety of ways, including grilling, frying, and baking, and is highly popular with plant-based and flexitarian consumers. It is suitable for a variety of dishes because of their ability to retain shape and absorb flavors.

- The supermarkets & hypermarkets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom tofu market is segmented by distribution channel into supermarkets & hypermarkets and online retail. Among these, the supermarkets & hypermarkets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increasing customer demand for easy, one-stop shopping, expanding shelf space for plant-based items, and smart alliances with tofu businesses. Large supermarkets like Tesco and Sainsbury's increase accessibility and sales by providing a variety of reasonably priced tofu options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom tofu market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cauldron Foods

- The Tofu Shop

- Kikkoman

- Yutaka

- Tofoo Co.

- Others.

Recent Developments:

- In September 2024, the Tofoo Co. launched Tofoo Katsu, consisting of two Naked Tofoo fillets coated in a katsu-style breadcrumb. This product caters to the growing demand for convenient, plant-based meal options and is available in selected Sainsbury’s stores.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom tofu market based on the below-mentioned segments:

United Kingdom Tofu Market, By Product Type

- Firm Tofu

- Soft Tofu

United Kingdom Tofu Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Retail

Need help to buy this report?