United Kingdom Tires Market Size, Share, and COVID-19 Impact Analysis, By Seasonal Tire Type (Summer, Winter, and All-season), By Rim Size (Less than 15 inch, 15-20 inch, More than 20 inch), By Distribution Channel Type (OEM, and Aftermarket), and United Kingdom Tires Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Tires Market Insights Forecasts to 2035

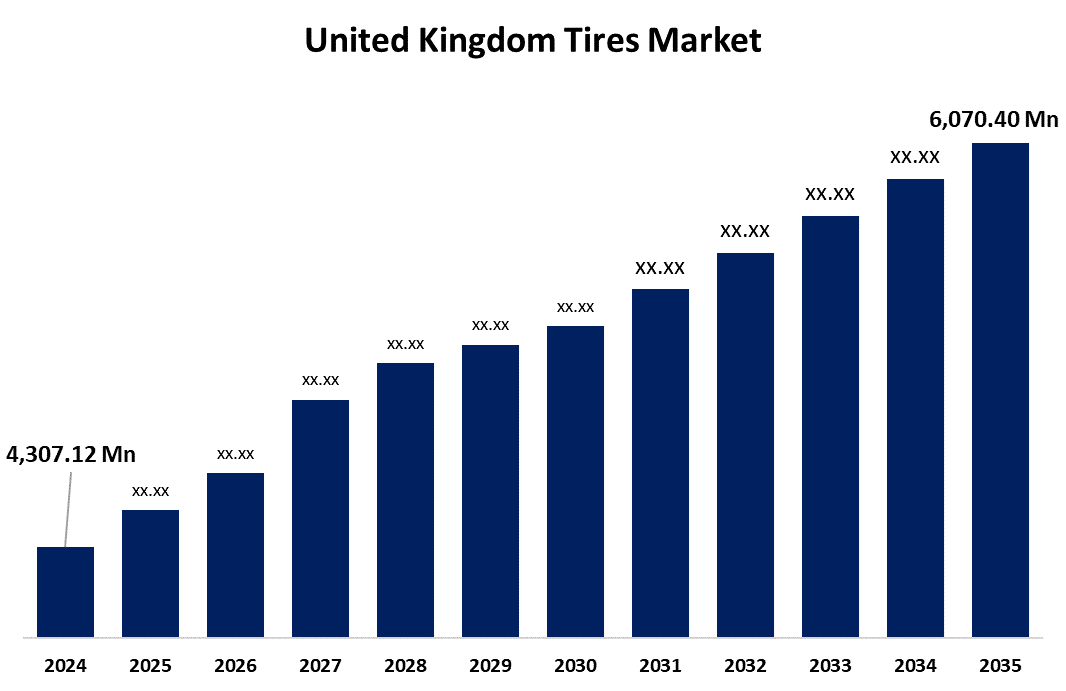

- The United Kingdom Tires Market Size was Estimated at USD 4,307.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.17% from 2025 to 2035

- The United Kingdom Tires Market Size is Expected to Reach USD 6,070.40 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Tires Market Size is anticipated to reach USD 6,070.40 Million by 2035, Growing at a CAGR of 3.17% from 2025 to 2035. The market development would be changed drastically due to growing vehicle ownership, expansion of the automotive industry with technical support, and development in material science technology due to the need for sustainable products.

Market Overview

The United Kingdom tires market refers to the industry that serves the automotive industry, which focuses on the production and application of a cylindrical piece of rubber or synthetic rubber that fits around the wheel rim of a car is known as a tire. Its main purpose is to give the car a robust and flexible interface with the road surface, enabling controlled and smooth movement while also offering traction and shock absorption. The automotive and industrial industries remain highly dependent on the tire economy. In addition, the tire market is driven by rising car production, sales in all vehicle segments, and competition among tire manufacturers. Furthermore, it is anticipated that integrating state-of-the-art technology into the manufacturing process will hasten the expansion of the automobile tire market. Although development news showcases the market expansion, such as in September 2021, Goodyear extended its 25-year partnership with the UK Police Force, securing a new four-year contract to continue supplying, servicing, and maintaining police fleet tyres. As part of the agreement, Goodyear provided high-performance tyres, including tyre fitment and maintenance services through Goodyear’s HiQ Fleet Services network.

Report Coverage

This research report categorizes the market for the United Kingdom tires market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom tires market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom tires market.

United Kingdom Tires Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,307.12 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 3.17% |

| 2035 Value Projection: | USD 6,070.40 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Seasonal Tire Type, By Rim Size, By Distribution Channel Type |

| Companies covered:: | Michelin Tyre Plc, Lodge Tyre Company, Tyre Bay Nelson, HiQ Tyres & Autocare Halton, Sully’s Tyres, 365 Mobiletyres, Goodyear Tyres, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom tires is primarily driven by rapid industrialization, which has increased sales of commercial vehicles, such as trucks, tractors, and trailers. Further, rising disposable income and living standards also have a growing sales of luxury passenger cars and high-end motorcycles. Concurrently, sales of electric vehicles are also assisting in the widespread acceptance of the tire market. Furthermore, the globalization of the automotive industry, which leads to local and foreign automakers merging and purchasing one another, stimulates the expansion of the automotive sector and affects the market share of automobile tires. Additionally, governments are responding to growing safety concerns by imposing stringent tire performance regulations, bolstering the market adoption.

Restraining Factors

The price volatility of raw materials, such as polyester and nylon, is one of the obstacles that hamper the market expansion. Additionally, tires require both natural and synthetic rubber, a basic component whose price varies greatly. Moreover, the price of these fundamental components has a big impact on the tire's ultimate cost due to their fluctuation resulting from market changes.

Market Segmentation

The United Kingdom tires market share is classified into seasonal tire type, rim size, and distribution channel.

- The all-season segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom tires market is segmented by seasonal tire type into summer, winter, and all-season. Among these, the all-season segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. The widespread usage of such tires provides balanced performance in both summer and winter weather circumstances, making them a versatile choice for drivers and avoiding seasonal tyre changes. Also, technological development in the automotive sector boosts the segment growth. Moreover, its unique tread compositions found in summer tires enhance handling and traction on both dry and wet surfaces and improve traction and stability while managing high speeds, and provide quick steering.

- The 15-20 inch segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom tires market is divided by rim size into less than 15 inch, 15-20 inch, and more than 20 inch. Among these, the 15-20 inch segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is due to these rim size tires provide higher traction, particularly for cars that are heavier than usual. Further, less than 17-inch tires offer the most comfortable ride because of their broader sidewall.

- The OEM segment held the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United Kingdom tires market is divided by distribution channel into OEM and aftermarket. Among these, the OEM segment held the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is growing consumer demand and developing automotive manufacturing capacity, and compliance with regulatory adherence. The need for OEM tires is being further increased as automakers concentrate on outfitting cars with cutting-edge tires that improve durability, safety, and fuel economy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom tires market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Michelin Tyre Plc

- Lodge Tyre Company

- Tyre Bay Nelson

- HiQ Tyres & Autocare Halton

- Sully's Tyres

- 365 Mobiletyres

- Goodyear Tyres

- Others

Recent Developments:

- In April 2025, ENSO introduced a new Premium tire range specifically designed for Tesla and other high-performance EVs. These ultra-high-performance (UHP) tires have been engineered to enhance EV efficiency, safety, and sustainability.

- In December 2024, Oak Tyres and Linglong Tire celebrated the first anniversary of their strategic partnership. Oak Tyres has been the exclusive distributor of Linglong’s summer, winter, and all-season PCR tyres across the UK.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom tires market based on the below-mentioned segments:

United Kingdom Tires Market, By Seasonal Tire Type

- Summer

- Winter

- All-season

United Kingdom Tires Market, By Rim Size

- Less than 15 inch

- 15-20 inch

- More than 20 inch

United Kingdom Tires Market, By Distribution Channel

- OEM

- Aftermarket

Need help to buy this report?