United Kingdom Thermal Insulation Material Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Fiberglass, Stone Wool, Foam, and Wood Fiber), By Temperature (0-100°C, 100-500°C, and 500°C & Above), and United Kingdom Thermal Insulation Material Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited Kingdom Thermal Insulation Material Market Insights Forecasts to 2035

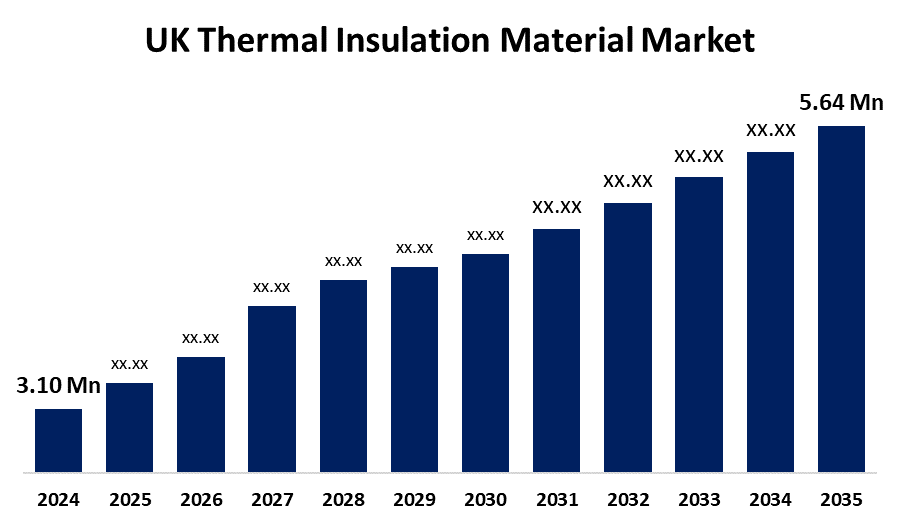

- The United Kingdom Thermal Insulation Material Market Size Was Estimated at USD 3.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.59% from 2025 to 2035

- The United Kingdom Thermal Insulation Material Market Size is Expected to Reach USD 5.64 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Thermal Insulation Material Market Size is anticipated to reach USD 5.64 Million by 2035, growing at a CAGR of 5.59% from 2025 to 2035. The growing awareness of sustainable building methods, more construction activity, and higher energy efficiency regulations. Adoption is increasing in the commercial, industrial, and residential sectors due to the demand for fewer greenhouse gases and energy usage.

Market Overview

The United Kingdom thermal insulation material market refers to the industry focused on materials intended for improving energy efficiency and reducing heat transfer in industrial and building environments. Fiberglass, mineral wool, foam boards, and reflective insulation are some of the materials that assist in regulating indoor temperatures, saving energy expenses, and compliance with environmental standards. Thermal insulation, which is widely employed in the commercial, industrial, and residential sectors, promotes environmentally friendly building practices and lowers energy and carbon emissions. The country's dedication to more stringent energy efficiency laws and net-zero emissions. The market potential is growing as a consequence of the expansion of green building projects, the retrofitting of existing infrastructure, and the growing use of sustainable building materials. Additional opportunities are presented by advancements in high-performance and environmentally friendly insulation systems, and the move toward insulated, energy-efficient buildings across a range of industries is further boosted by government incentives and growing consumer awareness. Innovations include vacuum insulation panels (VIPs) and aerogel panels, which provide remarkable thin-profile thermal resistance; intelligent insulation systems that adjust to temperature changes; and bio-based materials ( like hemp, sheep's wool, and recycled fibers) for environmentally friendly, sustainable applications.

Report Coverage

This research report categorizes the market for the United Kingdom thermal insulation material market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom thermal insulation material market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom thermal insulation material market.

United Kingdom Thermal Insulation Material Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.10 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.59% |

| 2035 Value Projection: | USD 5.64 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Material Type and By Temperature |

| Companies covered:: | Saint Gobain SA, Recticel, Kingspan Group, Rockwool International A/S, GAF Material Corporation, Owens Corning, Knauf Insulation, Evonik, E. I. du Pont de Nemours and Company, Berkshire Hathaway (Johns Manville), Bayer AG, Dow Chemicals Company, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing energy expenses, more laws governing energy efficiency, and a significant push for environmentally friendly building methods. Widespread use of insulating materials in the commercial, industrial, and residential sectors is being promoted by government programs supporting green buildings and carbon reduction. Demand is additionally supported by the rising emphasis on renovating existing buildings to improve energy performance. The development of high-performance and environmentally friendly insulating solutions as a result of technological breakthroughs has further accelerated market expansion. Furthermore, the construction industry's emphasis on long-term cost reductions and customers' increasing concern for the environment have accelerated up the incorporation of thermal insulation into contemporary building designs.

Restraining Factors

The substantial initial installation costs, particularly for innovative products like VIPs and aerogels. Widespread adoption and moderate market expansion are further hampered by insufficient expertise in particular industries, problems with older structures, and disruptions in the raw material supply chain.

Market Segmentation

The United Kingdom Thermal Insulation Material Market share is classified into material type and temperature.

- The fiberglass segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period

The United Kingdom thermal insulation material market is segmented by material type into fiberglass, stone wool, foam, and wood fiber. Among these, the fiberglass segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to its affordability, acoustic and thermal efficiency, and speed of installation. Growing needs for energy efficiency in addition to its ability to adapt to residential, commercial, and industrial applications continue to propel its more widespread adoption.

- The 0-100°C segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom thermal insulation material market is segmented by temperature into 0-100°C, 100-500°C, and 500°C & Above. Among these, the 0-100°C segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the growing demand for energy-efficient insulation in residential and commercial structures. Widespread use in this range is supported by applications in HVAC systems, walls, and refrigeration systems, as well as growing energy prices and sustainability concerns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom thermal insulation material market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saint Gobain SA

- Recticel

- Kingspan Group

- Rockwool International A/S

- GAF Material Corporation

- Owens Corning

- Knauf Insulation

- Evonik

- E. I. du Pont de Nemours and Company

- Berkshire Hathaway (Johns Manville)

- Bayer AG

- Dow Chemicals Company

- Others.

Recent Developments:

- In May 2024, Mannok launched a next-generation insulation line featuring enhanced heat retention and sustainable materials. This product significantly improves energy efficiency and aligns with the growing demand for eco-friendly building solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom thermal insulation material market based on the below-mentioned segments:

United Kingdom Thermal Insulation Material Market, By Material Type

- Fiberglass

- Stone Wool

- Foam

- Wood Fiber

United Kingdom Thermal Insulation Material Market, By Temperature

- 0-100°C

- 100-500°C

- 500°C

Need help to buy this report?