United Kingdom Telehealth Market Size, Share, and COVID-19 Impact Analysis, By Hosting Type (Cloud-based & Web-based, and On-premises), By Technology (Video Conferencing, mHealth Solutions, and Others), By Application (Teleconsultation and Telementoring, Medical Education and Training, Teleradiology, Telecardiology, Tele-ICU, Tele-Psychiatry, Tele-Dermatology and Others), and UK Telehealth Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Telehealth Market Forecasts to 2035

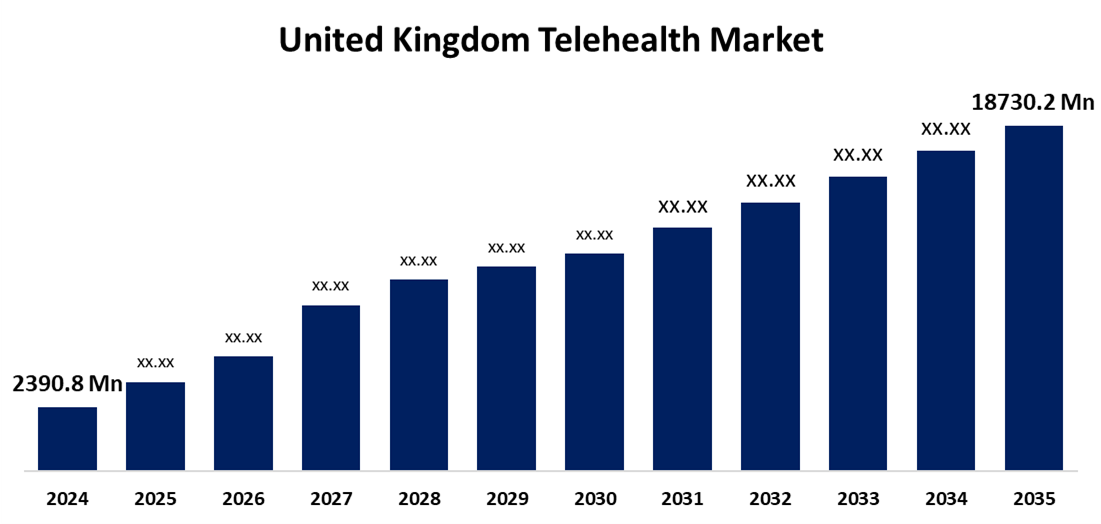

- The United Kingdom Telehealth Market Size Was Estimated at USD 2,390.8 Million in 2024

- The UK Telehealth Market Size is Expected to Grow at a CAGR of around 20.58% from 2025 to 2035

- The UK Telehealth Market Size is Expected to Reach USD 18,730.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Telehealth Market Size is anticipated to Reach USD 18,730.2 Million by 2035, Growing at a CAGR of 20.58% from 2025 to 2035. The market is driven by the demand for efficient healthcare delivery, shifting patient priorities, and widespread adoption of digital technology. Virtual consultations are now more accessible. Along with government financing for the NHS's digital transformation, healthcare professionals' need to reduce wait times and improve patient management also contributes to adoption and increases the UK telehealth market share's growth and competitiveness.

Market Overview

The telehealth industry in the United Kingdom consists of medical services delivered at a distance through electronic communication channels. Electronic health data, along with remote patient monitoring and virtual consultations, make up this system. The technology serves multiple purposes, such as virtual consultations and remote diagnostics and follow-ups, and chronic illness management. The United Kingdom has made telehealth services more accessible through advanced technological infrastructure and quick internet connections. The growing number of patients using telehealth services drives the continuous growth of the telehealth industry. Visitors, along with UK citizens who require immediate medical attention for non-emergency conditions, can use this platform to receive prompt care. This platform delivers significant value to patients who find it difficult to secure doctor appointments and those requiring assistance during regular hours. The growing popularity of remote healthcare, along with digital medical equipment and government policies, is driving the UK telehealth industry to expand. Technological innovations like AI, data analytics, and wearable devices enhance diagnosis, treatment planning, and patient monitoring. User-friendly teleconsultation platforms improve access to care, especially in underserved areas, promoting a more efficient, patient-centered healthcare system. The UK began performing annual digital maturity assessments in July 2022 to measure social care and digital health within the NHS. The program secured USD 2.37 billion to enhance remote patient monitoring services and implement electronic patient records (EPRs).

Report Coverage

This research report categorizes the market for the UK telehealth market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom telehealth market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom telehealth market.

United Kingdom Telehealth Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,390.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 20.58% |

| 2035 Value Projection: | USD 18,730.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Hosting Type, By Technology, By Application |

| Companies covered:: | Babylon Health, eConsult Health, Push Doctor, Doctor Care Anywhere., Numan, Medicspot, Doro Care UK, Tyntec, Appello, Tunstall, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding use of remote healthcare services represents a primary factor that drives growth in the UK telehealth sector. Virtual healthcare delivery demonstrates high effectiveness in managing ongoing medical conditions while also being beneficial for psychological treatment and surgical recovery, according to healthcare professionals. The telehealth industry received crucial support from government policies through NHS funding, which helped build better infrastructure while making regulatory processes more adaptable. Digital healthcare transformation receives support from both the NHS AI Lab and Long-term Plan initiatives. Remote patient monitoring (RPM) devices that combine wearable technology with artificial intelligence provide patients with real-time health data tracking, which leads to prompt medical responses. Through successful implementation, Scotland’s home blood pressure monitoring program demonstrates how RPM systems deliver cost-effective healthcare solutions while showing their potential to create a more individualized healthcare approach across the UK.

Restraining Factors

The UK telehealth industry faces major obstacles because some population segments, including older adults, lack computer literacy skills. The delivery of telehealth services across the United Kingdom encounters obstacles from data protection concerns and inconsistent internet connectivity in rural areas, and the lack of standardised legislation. This factor can hamper the UK telehealth market during the forecast period.

Market Segmentation

The United Kingdom telehealth market share is classified into hosting type, technology, and application.

- The cloud-based & web-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom telehealth market is segmented by hosting type into cloud-based & web-based, and on-premises. Among these, the cloud-based & web-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its accessibility, affordability, and scalability. Cloud-based solutions allow healthcare practitioners to store and manage patient data on remote servers, making it available from any place with an internet connection. This flexibility makes it easier to engage with electronic medical information, conduct remote consultations, and monitor patients in real time. Web-based apps, which operate in web browsers, further enhance accessibility by eliminating the need to install specialised software. These hosting alternatives ensure compliance with healthcare regulations while also offering robust data security safeguards.

- The video conferencing segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom telehealth market is segmented by technology into video conferencing, mHealth solutions, and others. Among these, the video conferencing segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Video conferencing stands as the most popular communication tool at present, which transforms how patients interact with healthcare providers. Remote medical appointments depend on platforms such as Zoom and Microsoft Teams, and the NHS's Attend Anywhere that enable live video discussions between doctors and their patients.

- The teleconsultation and telementoring segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom telehealth market is segmented by application into teleconsultation and telementoring, medical education and training, teleradiology, telecardiology, tele-ICU, tele-psychiatry, tele-dermatology, and others. Among these, the teleconsultation and telementoring segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Teleconsultation and telementoring allow patients to receive medical advice and diagnosis from a distance, which relieves the burden on healthcare facilities and improves access, especially in rural or underserved areas. It is currently the preferred method for routine exams, mental health support, and controlling chronic illnesses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom telehealth market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Babylon Health

- eConsult Health

- Push Doctor

- Doctor Care Anywhere.

- Numan

- Medicspot

- Doro Care UK

- Tyntec

- Appello

- Tunstall

- Others

Recent Developments:

- In April 2025, Neko Health opens its largest health centre in London's Spitalfields Market, focusing on preventive treatment via sophisticated telehealth services. Assesses risk for illnesses like as heart disease and skin cancer. Results are supplied within an hour of a doctor-led consultation, promoting early detection and proactive health treatment.

- In April 2025, Doctor Care Anywhere, a London-based digital healthcare company, collaborated with global health AI startup Huma to increase telehealth access in the UK and alleviate NHS appointment bottlenecks. The collaboration makes use of Huma's myGP app, an independent NHS GP booking platform, to fulfil growing demand for digital General Practitioner (GP) services.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom telehealth market based on the below-mentioned segments:

United Kingdom Telehealth Market, By Hosting Type

- Cloud-based & Web-based

- On-premises

United Kingdom Telehealth Market, By Technology

- Video Conferencing

- mHealth Solutions

- Others

United Kingdom Telehealth Market, By Application

- Teleconsultation and Telementoring

- Medical Education and Training

- Teleradiology

- Telecardiology

- Tele-ICU

- Tele-Psychiatry

- Tele-Dermatology

- Others

Need help to buy this report?