United Kingdom Sustainable Office Furniture Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Seating, Tables, Storage, and Desks), By Material (Wood, Bamboo, and PET), and United Kingdom Sustainable Office Furniture Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Sustainable Office Furniture Market Insights Forecasts to 2035

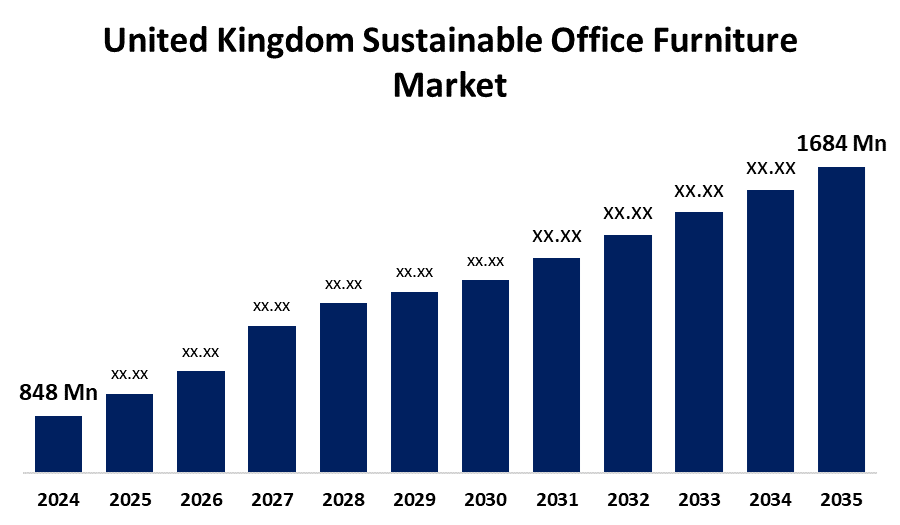

- The United Kingdom Sustainable Office Furniture Market Size Was Estimated at USD 848 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.44% from 2025 to 2035

- The United Kingdom Sustainable Office Furniture Market Size is Expected to Reach USD 1684 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Sustainable Office Furniture Market is anticipated to reach USD 1684 million by 2035, growing at a CAGR of 6.44% from 2025 to 2035. The increasing government legislation that encourages eco-friendly office solutions, corporate sustainability activities, growing environmental awareness, the trend toward green buildings, and the use of circular economy concepts in workplace design, and others.

Market Overview

The United Kingdom sustainable office furniture market refers to the industry focused on creating, producing, and distributing office furniture that is resource-efficient, eco-friendly, and composed of recycled or sustainable materials. Durability, recyclability, and a low environmental effect throughout the course of the product lifecycle are key factors in this industry. In line with the UK's larger environmental and circular economy objectives, it promotes sustainable workspaces and is propelled by corporate sustainability goals and green construction regulations. Increasing corporate emphasis on sustainability, government incentives for green initiatives, and growing demand for eco-friendly workplaces. The demand for sustainable home office setups is also being pushed by the growth of remote and hybrid work models, while developments in circular design and recyclable materials further expand market potential and draw in eco-aware enterprises and consumers. The utilization of energy-efficient smart furniture, modular and multipurpose designs, and recyclable and biodegradable materials. Customization, waste reduction, and increased sustainability are also supported throughout the office furniture product lifetime by developments in 3D printing and environmentally friendly production techniques.

Report Coverage

This research report categorizes the market for the United Kingdom sustainable office furniture market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sustainable office furniture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sustainable office furniture market.

United Kingdom Sustainable Office Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 848 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.44% |

| 2035 Value Projection: | USD 1684 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Material and COVID-19 Impact Analysis |

| Companies covered:: | Lee & Plumpton, Verve Workspace, Frem, Metric Office Furniture, Office Reality, Others. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing corporate obligation towards sustainability, growing demand for ergonomic and eco-friendly office solutions, and growing consumer and company environmental awareness. The use of sustainable furniture is being promoted by laws and green building certifications like BREEAM. Additionally, the need for eco-friendly home office arrangements is being driven by the shift towards remote and hybrid work patterns. The market is expanding as a result of technological developments in sustainable materials and growing consumer preference for circular economy principles. All of these elements combine to fuel the growing need for ethical and sustainable workplace furniture alternatives.

Restraining Factors

The reduced customer awareness in some markets, difficulties locating sustainable raw materials, and increased production costs as a consequence of eco-friendly components. The expansion of the market may also be hampered by the absence of uniform laws and the scarcity of competent workers for green manufacturing techniques.

Market Segmentation

The United Kingdom sustainable office furniture market share is classified into product type and material.

- The seating segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sustainable office furniture market is segmented by product type into seating, tables, storage, and desks. Among these, the seating segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for ergonomic designs that improve individual well-being, the trend toward hybrid work models arguing for comfortable home office arrangements, and a strong emphasis on sustainability and circular economy concepts by businesses.

- The wood segment accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sustainable office furniture market is segmented by material into wood, bamboo, and PET. Among these, the wood segment accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of growing consumer appetite for aesthetic appeal, the need for renewable and sustainably sourced resources in workplaces, the demand for natural, long-lasting, and environmentally friendly materials, and certifications like FSC.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sustainable office furniture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lee & Plumpton

- Verve Workspace

- Frem

- Metric Office Furniture

- Office Reality

- Others.

Recent Developments:

- In January 2024, Staverton introduced the Executive Workwall at the Workspace Design Show in London. This modular and sustainable furniture solution caters to modern office needs, emphasizing flexibility and eco-friendly materials.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sustainable office furniture market based on the below-mentioned segments:

United Kingdom Sustainable Office Furniture Market, By Product Type

- Seating

- Tables

- Storage

- Desks

United Kingdom Sustainable Office Furniture Market, By Material

- Wood

- Bamboo

- PET

Need help to buy this report?