United Kingdom Sustainable Finance Market Size, Share, and COVID-19 Impact Analysis, By Asset Class (Equities, Fixed-income, Multi-asset), By Offerings (Equity Funds, Bond Funds, ETFs/Index Funds), By Investment Style (Active, Passive), and United Kingdom Sustainable Finance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Sustainable Finance Market Insights Forecasts to 2035

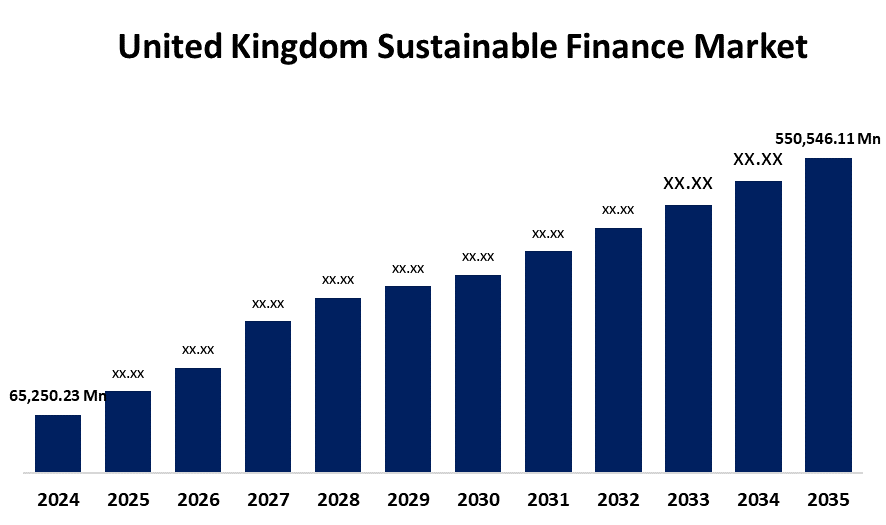

- The United Kingdom Sustainable Finance Market Size was estimated at USD 65,250.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.40% from 2025 to 2035

- The United Kingdom Sustainable Finance Market Size is Expected to Reach USD 550,546.11 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the United Kingdom sustainable finance Market is anticipated to reach USD 550,546.11 million by 2035, growing at a CAGR of 21.40% from 2025 to 2035. The market expansion across the country is flourishing due to strong governmental backing and regulations that encourage sustainable finance.

Market Overview

The United Kingdom sustainable finance market refers to the business center related to banking and the financial industry, having focused on allocating funds to initiatives, companies, and projects that support environmentally friendly practices, address environmental problems, and have a positive social impact. Sustainable finance refers to financial operations that incorporate environmental, social, and governance (ESG) factors into capital allocation and investment decision-making. Europe is actually at the forefront of the sustainable finance race due to regional Taxonomy, SFDR (Sustainable Finance Disclosure Regulation), and Green Bond Standard, and key countries, which all provide strong regulatory frameworks. With this, the UK could be considered a key venue for all investors and vendors. Furthermore, efforts are being made to standardize sustainability reporting standards and encourage the adoption of nationally and internationally accepted frameworks through partnerships between financial institutions, trade associations, and regulatory agencies. Moreover, the government's focus and positive steps for this make market expansion in an upsurge trajectory way like the UK government announced new partnerships with the financial sector to drive economic growth both domestically and internationally. This initiative, announced by the Ministry for Development, focuses on tackling climate change and boosting investment. This initiative aims to position the UK as a leader in sustainable finance, ensuring long-term economic stability while addressing global challenges.

Report Coverage

This research report categorizes the market for the United Kingdom sustainable finance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sustainable finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sustainable finance market.

United Kingdom Sustainable Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 65,250.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.40% |

| 2035 Value Projection: | USD 550,546.11 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Asset Class, By Offerings, By Investment Style and COVID-19 Impact Analysis |

| Companies covered:: | Financial Conduct Authority (FCA), Barclays, HSBC, Triodos Bank UK, Green Finance Institute, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom sustainable finance is primarily driven by the apparent shift in investor behavior toward giving ESG considerations top priority when making investment decisions. The market's expansion is anticipated to be aided by the increased consumer knowledge and concern about environmental and social challenges, including resource depletion, social injustice, and climate change. The need for sustainable finance solutions has grown as a result of this greater awareness, as local key organizations and enterprises look to make investments that reflect their values and help create more opportunities for market expansion. Additionally, advances in AI and machine learning have now improved the accuracy and dependability of reporting in the social, governance, and environmental domains and have provided the financial sector with seamless access and performance.

Restraining Factors

The market growth across the country could be slowed down by some obstacles, such as the lack of accepted descriptions, metrics, and upkeep for tracking systems for sustainability. However, market expansion is constrained by difficulties with diversification and expensive operating expenses.

Market Segmentation

The United Kingdom sustainable finance market share is classified into asset class, offerings, and investment style.

- The multi-asset segment accounted for a significant share in 2024 and is projected to grow at a rapid pace during the forecast period.

The United Kingdom sustainable finance market is segmented by asset class into equities, fixed-income, and multi-asset. Among these, the multi-asset segment accounted for a significant share in 2024 and is projected to grow at a rapid pace during the forecast period. This segmental growth is propelled by a variety of asset classes, such as stocks, fixed income, real estate, and alternative assets, which are available to investors through multi-asset strategies. Investors looking for an integrated approach to sustainable investing will find this diversification intriguing as it reduces risk and creates a more balanced portfolio. Furthermore, a variety of sustainable investment options can be allocated with flexibility via multi-asset methods.

- The equity funds segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom sustainable finance market is differentiated by offerings into equity funds, bond funds, and ETFs/index funds. Among these, the equity funds segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is due to large and mid-cap firms that exhibit solid financial performance and meet certain social and sustainability standards are strategically invested in by this fund. The sustainable equity fund seeks to foster sustainability traits and produce good long-term capital appreciation by emphasizing sustainable company practices and taking ESG considerations into account.

- The passive segment held a significant share in 2024 and is predicted to grow at a rapid pace during the forecast period.

The United Kingdom sustainable finance market is divided by investment style into active, and passive. Among these, the passive segment held a significant share in 2024 and is predicted to grow at a rapid pace during the forecast period. This is because of its wide exposure to a diverse portfolio of sustainable businesses that correspond with their beliefs and sustainability objectives, investors are drawn to them. Further, the need for transparent, affordable, and easily accessible sustainable investing solutions has led to a notable influx of capital into passive investment products like index funds and ESG-focused exchange-traded funds (ETFs).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sustainable finance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Financial Conduct Authority (FCA)

- Barclays

- HSBC

- Triodos Bank UK

- Green Finance Institute

- Others

Recent Developments:

- In May 2025, CaixaBank led a €1.6 billion green financing deal for Scottish Power, in collaboration with the National Wealth Fund (NWF). This funding will support the development of smart electricity grids in the UK, helping to integrate renewable energy more efficiently.

- In March 2025, the UK launched new nature finance standards to prevent greenwashing and encourage high-quality environmental investments. These government-backed standards, developed by the British Standards Institution (BSI), aim to boost confidence among businesses investing in nature restoration projects. This initiative is expected to drive capital into nature-friendly projects, ensuring long-term environmental benefits while supporting the UK’s Plan for Change.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sustainable finance market based on the below-mentioned segments:

United Kingdom Sustainable Finance Market, By Asset Class

- Equities

- Fixed-income

- Multi-asset

United Kingdom Sustainable Finance Market, By Offerings

- Equity Funds

- Bond Funds

- ETFs/Index Funds

United Kingdom Sustainable Finance Market, By Investment Style

- Active

- Passive

Need help to buy this report?