United Kingdom Surgical Imaging Market Size, Share, and COVID-19 Impact Analysis, By Modality (C-arms, Computed Tomography, X-ray, and Ultrasound), By End Use (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others), and United Kingdom Surgical Imaging Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Surgical Imaging Market Insights Forecasts to 2035

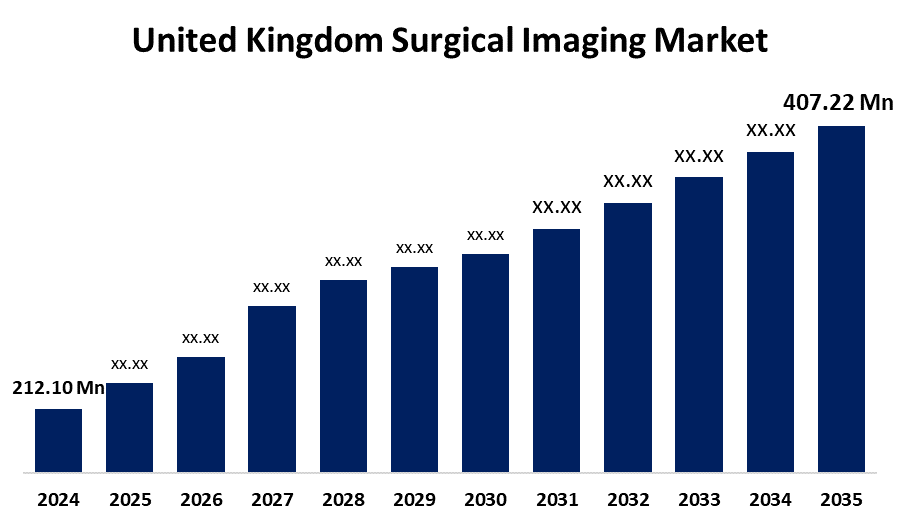

- The United Kingdom Surgical Imaging Market Size was estimated at USD 212.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.11% from 2025 to 2035

- The United Kingdom Surgical Imaging Market Size is Expected to Reach USD 407.22 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Surgical Imaging Market is anticipated to reach USD 407.22 million by 2035, growing at a CAGR of 6.11% from 2025 to 2035. Rising awareness of radiography procedures, the aging population, and the prevalence of chronic diseases are the main drivers of market expansion. Additionally, the technological advancements are probably going to fuel the market.

Market Overview

The United Kingdom surgical imaging market refers to the industry focused on the production and application of technologies used in therapeutic and diagnostic services to check for surgical issues. Surgical imaging encompasses fine-grained images of the surgical spots, and surrounding tissues. Additionally, the expanding number of surgeries performed, the convenience with which patients can access medical imaging services, and the increasing prevalence of chronic illnesses are all expected to boost demand for the market expansion. Surgical diagnosis, treatment planning, and condition progression tracking are all aided by these pictures. The market for surgical imaging has enormous potential as a result of artificial intelligence integration to improve imaging quality, help with real-time decision-making, and automate some imaging tasks, such as tissue segmentation or anomaly detection. AI algorithms also lessen the workload for surgeons and increase the precision of diagnoses, allowing for more accurate and effective procedures.

Report Coverage

This research report categorizes the market for the United Kingdom surgical imaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom surgical imaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom surgical imaging market.

United Kingdom Surgical Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 212.10 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.11% |

| 2035 Value Projection: | USD 407.22 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Modality, By End Use |

| Companies covered:: | CMR Surgical Ltd, Endomag Ltd, Olympus UK Ltd, Imaging Consultancy Services Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom surgical imaging is primarily driven by the growing demand as a result of more public and private sector investments in research and development. Furthermore, improved accessibility, the growing need for surgical imaging technology in high-priority cases, and the rising prevalence of high healthcare facilities with adequate reimbursement systems are some of the reasons driving the country market expansion. Additionally, the application of improved surgical imaging technology has been aided by growing healthcare infrastructure and increased expenses for healthcare across the country, which boosts the market expansion.

Restraining Factors

The market expansion could be restricted due to the high price of sophisticated imaging systems, and integration infrastructure is one of the main factors limiting the surgical imaging business. In addition to the smaller institutions and public healthcare systems with tighter finances, this makes adoption due to long procurement cycles, regulatory obstacles, and issues with data integration with current hospital systems can also slow down market expansion.

Market Segmentation

The United Kingdom surgical imaging market share is classified into modality, and end use.

- The ultrasound segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom surgical imaging market is segmented by modality into c-arms, computed tomography, x-ray, and ultrasound. Among these, the ultrasound segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to providing ultrasound is real-time, non-ionizing, and economical; it is an essential component of surgical imaging. Besides, in neurosurgery, hepatobiliary surgeries, and tumor resections, intraoperative ultrasound (IOUS) is very useful because it allows for dynamic viewing of soft tissues, vascular systems, and lesion borders during surgery.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom surgical imaging market is segmented by application into hospitals, specialty clinics, ambulatory surgical centers, and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its the rise in the increasing number of patients suffering from a variety of conditions, such as cancer, arteriovenous malformation, traumatic brain injury, brain aneurysms, ischemic and hemorrhagic stroke, and cataracts.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom surgical imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CMR Surgical Ltd

- Endomag Ltd

- Olympus UK Ltd

- Imaging Consultancy Services Ltd

- Others

Recent Developments:

- In July 2025, EnAcuity pushed the boundaries of surgical imaging with AI-powered innovation. The joint spinout from Imperial College London and University College London was awarded a prestigious £300,840 Innovate UK Smart Grant to advance its software-only hyperspectral imaging solution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom surgical imaging market based on the below-mentioned segments:

United Kingdom Surgical Imaging Market, By Modality

- C-arms

- Computed Tomography

- X-ray

- Ultrasound

United Kingdom Surgical Imaging Market, By End Use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Need help to buy this report?