United Kingdom Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Source (Synthetic, Biobased), By Product (Non-Ionic, Amphoteric), and UK Surfactants Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited Kingdom Surfactants Market Forecasts to 2035

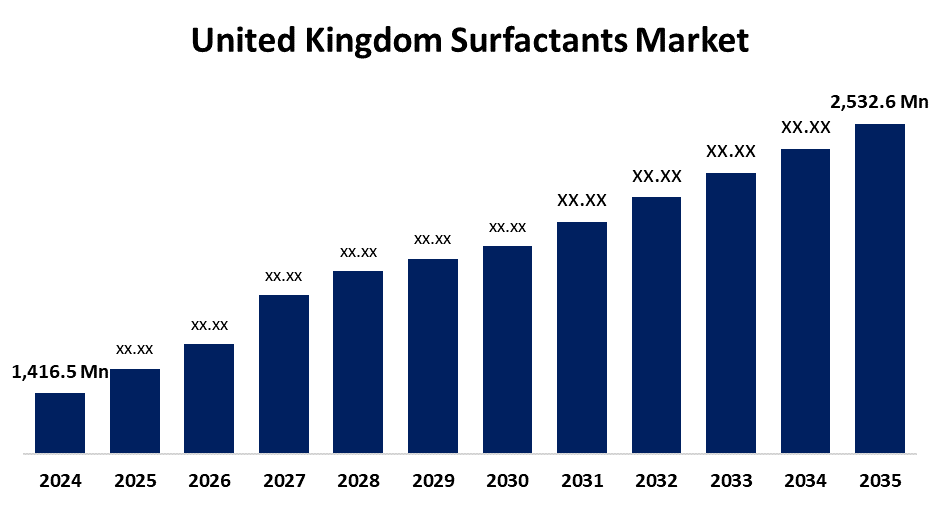

- The United Kingdom Surfactants Market Size Was Estimated at USD 1,416.5 Million in 2024

- The UK Surfactants Market Size is Expected to Grow at a CAGR of around 5.42% from 2025 to 2035

- The UK Surfactants Market Size is Expected to Reach USD 2,532.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Surfactants Market Size is anticipated to reach USD 2,532.6 Million by 2035, growing at a CAGR of 5.42% from 2025 to 2035. The market for surfactants has mostly been driven by the rising demand for personal care products, such as skincare, haircare, and cosmetics. In order to improve the washing and foaming qualities of products like shampoos, shower gels, and lotions, these compounds are essential.

Market Overview

The UK surfactants market refers to the surface-active agents, which are a broad class of chemical compounds that lower the surface tension between two substances, such as a liquid and a solid, a gas and a liquid, or two liquids. By focusing on these substances' interface, they can change the interfacial characteristics and improve interaction. The UK surfactants market is experiencing significant growth, driven by increasing demand for eco-friendly, biodegradable alternatives to traditional petroleum-based products. Surfactants, known for their dispersing, wetting, and emulsifying properties, are widely used in household cleaning, industrial processes, agriculture, textiles, and personal care. A key market trend is the rising consumer and regulatory focus on sustainability, prompting manufacturers to develop bio-based surfactants that align with environmental goals and offer effective performance.

Technological advancements have also enhanced the cost-efficiency of surfactants in applications like oil recovery in the oil & gas sector. In the personal care segment, UK consumers are showing a strong preference for natural and organic products, boosting demand for mild, yet functional surfactants. E-commerce growth is further supporting niche and green surfactant formulations. Household cleaning products are another area of interest, with multifunctional and disinfectant solutions gaining popularity due to heightened hygiene awareness. This has led to increased R&D investments aimed at creating safe, high-performance formulations that meet evolving consumer needs. Overall, the UK surfactants market is being shaped by sustainability, innovation, and a shift in consumer preferences toward safer, greener, and more effective products across a range of industries.

Report Coverage

This research report categorizes the market for the UK surfactants market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom surfactants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom surfactants market.

United Kingdom Surfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,416.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.42% |

| 2035 Value Projection: | USD 2,532.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Product |

| Companies covered:: | Unilever, Clariant, Stepan Company, Wilmar International, SABIC, Dow, AkzoNobel, Huntsman Corporation, Croda International, Elementis, S API, Evonik Industries, ASF, Solvay, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for environmentally friendly and sustainable products is driving the rapid growth of the UK surfactants market. As a result of a 25% increase in customer interest in biodegradable surfactants, spurred by environmental awareness and government legislation, major players like Unilever and P&G are spending on R&D to develop more sustainable surfactants. Technological advancements have also led to greater use of bio-based feedstocks and improved efficiency. Companies like Croda International are at the forefront of sustainable developments for surfactants. Urbanization and a 12% growth in sales of personal care products are also driving demand for surfactants in home and personal care, suggesting a positive outlook for the UK surfactant market.

Restraining Factors

The high price of speciality and bio-based surfactants in comparison to their traditional synthetic counterparts is a major barrier to the UK surfactants market. Furthermore, scalability and the adoption of environmentally friendly surfactant solutions across industries may be slowed by complicated regulatory compliance and restricted raw material availability for sustainable production. These factors hamper the surfactants market during the forecast period.

Market Segmentation

The United Kingdom surfactants market share is classified into source and product.

- The synthetic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom surfactants market is segmented by source into synthetic, biobased. Among these, the synthetic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Synthetic surfactants, specifically, have gained popularity as a result of their availability and prominent role in cleaning products, shampoos, and household cleaning agents. However, as environmental concern grows, metallic toxicity and non-degradable products have become more problematic for anionic surfactants. While these impacts on the environment should continue to lessen with research and development initiatives to improve surfactant efficacy and environmental impact, this will help increase growth in the market

- The amphoteric segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom surfactants market is segmented by product into non-ionic, amphoteric. Among these, the amphoteric segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The mildness and skin compatibility of these products make them ideal for luxury cosmetics, baby care products, and products for sensitive skin. The demand for them is due to their remarkable ability to foam, stability in hard water, and good compatibility with other surfactants. In addition, people want natural and mild ingredients in commonplace items like toothpaste, shampoos, body washes, detergents, and surface cleansers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom surfactants market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever

- Clariant

- Stepan Company

- Wilmar International

- SABIC

- Dow

- AkzoNobel

- Huntsman Corporation

- Croda International

- Elementis

- S API

- Evonik Industries

- ASF

- Solvay

- Others

Recent Developments:

- In Aug 2022, for over £22 million in 2022 sales, international chemicals distributor Brenntag purchased UK-based Prime Surfactants Limited, a leader in personal care surfactants. Brenntag's portfolio of specialty and sustainable surfactants is strengthened by this action.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom surfactants market based on the below-mentioned segments:

United Kingdom Surfactants Market, By Source

- Synthetic

- Biobased

United Kingdom Surfactants Market, By Product

- Non-Ionic

- Amphoteric

Need help to buy this report?