United Kingdom Sugar Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Type (Mannitol, Sorbitol, Xylitol, Maltitol, and Isomalt), By Form (Powder and Crystal, Liquid and Syrup), and United Kingdom sugar alcohol Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Sugar Alcohol Market Insights Forecasts to 2035

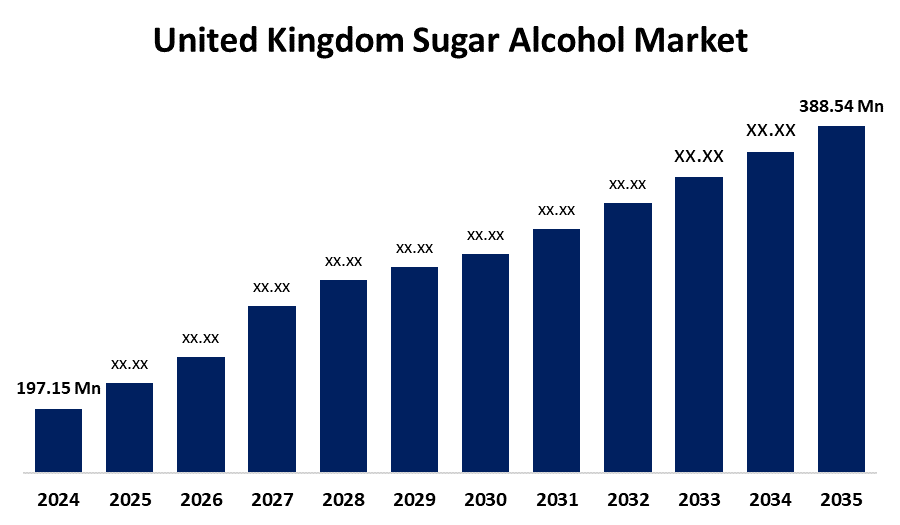

- The United Kingdom Sugar Alcohol Market Size was Estimated at USD 197.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.36% from 2025 to 2035

- The United Kingdom Sugar Alcohol Market Size is Expected to Reach USD 388.54 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Sugar Alcohol Market Size is anticipated to reach USD 388.54 million by 2035, growing at a CAGR of 6.36% from 2025 to 2035. The growing demand for low-calorie food items as a result of growing health and obesity concerns is one of the main drivers propelling the market's expansion.

Market Overview

The United Kingdom sugar alcohol market refers to the industry that produces, distributes, and sells sugar alcohols, organic compounds made from sugars that act as low-calorie sweeteners and sugar substitutes. Sugar alcohol is a naturally occurring mixture of sugars. Another solvent that can be found in trace amounts in a variety of vegetables and organic goods is sugar alcohol. Sugar alcohol is made from starch and sugar. Additionally, they are complemented by low-calorie sugar in foods and beverages. Sugar alcohols are also organic substances that belong to the polyol class. These are white solids that dissolve in water and can be made naturally or artificially from sugars. Sorbitol, xylitol, and erythritol are examples of sugar alcohols that are becoming more and more popular as people look for healthier alternatives to sugar. They are frequently found in sugar-free and reduced-sugar products and offer sweetness with fewer calories. Sugar alcohol's purity (absence of additions) makes it safe for human consumption. The intended use of the alcohol determines its grade, concentration, and purity. Many plants, such as sugarcane, sugar beet, molasses, grains, and fruits, are the source of it.

Report Coverage

This research report categorizes the market for the United Kingdom sugar alcohol market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sugar alcohol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sugar alcohol market.

United Kingdom Sugar Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 197.15 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.36% |

| 2035 Value Projection: | USD 388.54 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Airedale Group, Newport Industries, Tate & Lyle PLC, ARCITEKBio Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom sugar alcohol is driven by the increasing consumption of gum confectionery products such as chewing gum. The majority of the production of the polyol is consumed by the food and beverage end-user sector, wherein the bakery and confectionery hold the largest market share. Moreover, the fast-paced lifestyle, consumers prefer sugar-free food products, which will aid market growth. The sugar alcohol market is anticipated to increase over the coming years due to rising demand for low-carbohydrate foods and beverages, as well as consumer health consciousness. Furthermore, the growing number with diabetes and obesity will increase industry demand.

Restraining Factors

One significant obstacle is the possibility of gastrointestinal adverse effects, like bloating, diarrhea, and laxative symptoms, which can arise from consuming too much sugar alcohols like maltitol and sorbitol, and cause consumer reluctance. Furthermore, some sugar alcohols can be more costly to produce than conventional sweeteners, which can restrict regional labeling requirements, and regulatory restrictions may make market penetration more difficult.

Market Segmentation

The United Kingdom sugar alcohol market share is classified into type and form.

- The sorbitol segment accounted for the highest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

The United Kingdom sugar alcohol market is segmented by type into mannitol, sorbitol, xylitol, maltitol, and isomalt. Among these, the sorbitol segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segment growth is driven by to widespread use of sugar substitutes, which are used to make pharmaceuticals, confectionery, and mouthwash. growing consumer awareness and acceptance of sorbitol's use in a variety of industries. Moreover, the growing number of diabetes patients, this market segment is anticipated to generate the largest share of revenue.

- The liquid and syrup segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sugar alcohol market is segmented by form into powder and crystal, liquid and syrup. Among these, the press-and-sinter segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they are simpler to use and handle than their liquid counterparts. The category with the greatest growth potential is liquids and syrups. In beverages and hot beverages, liquid and syrup sugar alcohols take the place of dry sweeteners. The better option is liquid sugar alcohols, particularly for drinks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sugar alcohol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airedale Group

- Newport Industries

- Tate & Lyle PLC

- ARCITEKBio Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sugar alcohol market based on the below-mentioned segments:

United Kingdom Sugar Alcohol Market, By Type

- Mannitol

- Sorbitol

- Xylitol

- Maltitol

- Isomalt

United Kingdom Sugar Alcohol Market, By Form

- Powder and Crystal

- Liquid and Syrup

Need help to buy this report?