United Kingdom Steerable Needles Market Size, Share, and COVID-19 Impact Analysis, By Type (Bevel-tip Flexible Needles, Symmetric-tip Needles, and Tendonactuated Tips), By Application (Biopsy, Tumor Ablation, Pain Management, and Robotic Assisted Surgery), and United Kingdom Steerable Needles Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Steerable Needles Market Size Insights Forecasts to 2035

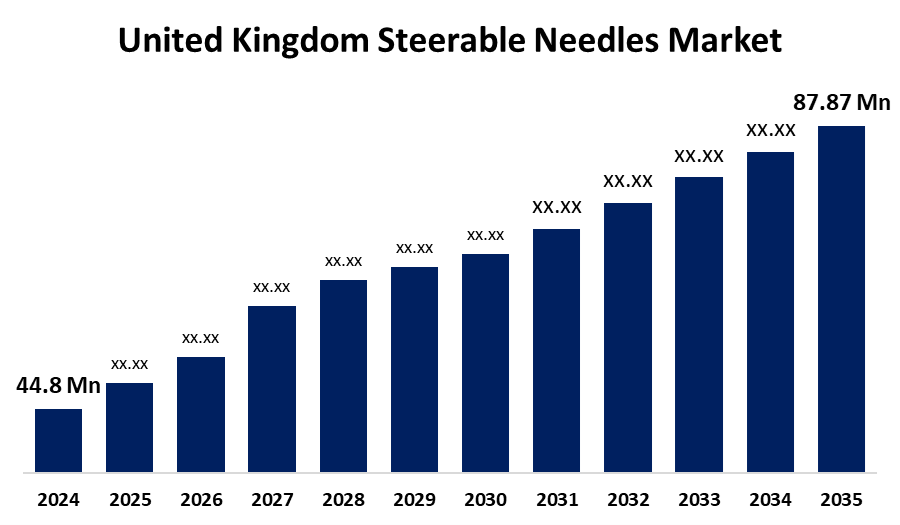

- The United Kingdom Steerable Needles Market Size was estimated at USD 44.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.3% from 2025 to 2035

- The United Kingdom Steerable Needles Market Size is Expected to Reach USD 87.87 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United Kingdom Steerable Needles Market Size is anticipated to reach USD 87.87 million by 2035, growing at a CAGR of 6.3% from 2025 to 2035. The demand for steerable needles with improved maneuverability and targeting capabilities has increased recently as a result of several benefits that these procedures offer, such as decreased discomfort, shorter hospital stays, and quicker recovery.

Market Overview

The United Kingdom steerable needles market refers to the subsector of healthcare focused on the production and application of minimally invasive needle-based devices that may be actively maneuvered or steered along intricate or curved pathways within the human body. Steerable needles are made with flexible shafts, segmented joints, or unique tip mechanisms that provide real-time directional control during procedures, in contrast to traditional rigid needles. Applications where great precision is crucial, such as neurosurgery, interventional radiology, cancer, and targeted drug delivery, use these devices. Healthcare providers, academic research organizations, robotics firms, and makers of medical devices that are implementing or developing steerable needle technology for therapeutic and diagnostic applications are all part of the market. Steerable needles are medical instruments with a flexible tip that may be steered or guided through organs and tissues to get to particular target areas inside the body. The need for focused intervention tools is also growing as the number of chronic diseases and cancer diagnoses rises, particularly those that call for exact biopsies or localized drug administration.

Report Coverage

This research report categorizes the market for the United Kingdom steerable needles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom steerable needles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom steerable needles market.

United Kingdom Steerable Needles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 44.87 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.3% |

| 2035 Value Projection: | USD 87.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | CMR Surgical, Imperial College (STING), Prosurgics, Renishaw PLC, Endomag, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom steerable needles is influenced by the increasing requirement for minimally invasive surgical techniques that accelerate patient recovery, lower the risk of complications, and increase procedural precision. By providing improved control and precision, these tools let medical professionals navigate curved or delicate anatomical routes that would be challenging or impossible to accomplish with rigid instruments. The functional capabilities of steerable needles are also being expanded by ongoing technical innovation, such as magnetic steering, real-time imaging compatibility, and bio-inspired designs, which further positions them as essential instruments in the upcoming generation of surgical systems.

Restraining Factors

The market expansion could suffer from several obstacles, such as a lack of clinical experience and training presents additional challenges; a lot of medical personnel are not used to steerable devices, necessitating the use of simulation and teaching. Additionally, the absence of standardized platforms and interfaces with current surgical systems decreases compatibility and delays hospital procurement.

Market Segmentation

The United Kingdom steerable needles market share is classified into type, and application.

- The bevel-tip flexible needles segment accounted for the highest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

The United Kingdom steerable needles market is segmented by type into bevel-tip flexible needles, symmetric-tip needles, and tendonactuated tips. Among these, the bevel-tip flexible needles segment accounted for the highest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. These flexible bevel-tip needles are an improvement over clinical puncture needles and may help improve puncture accuracy and lessen surgical trauma. Another factor driving the segment's expansion is the creation and introduction of new, technologically sophisticated floor-standing steerable vehicles.

- The biopsy segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom steerable needles market is divided by application into biopsy, tumor ablation, pain management, and robotic assisted surgery. Among these, the biopsy segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is supported by the rise in biopsy operations and the use of steerable needles in hospitals for illness diagnosis and treatment. Also, core needles are now used in over half of all breast biopsies, and demand for steerable needles is expected to increase during the projection period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom steerable needles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CMR Surgical

- Imperial College (STING)

- Prosurgics

- Renishaw PLC

- Endomag

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom steerable needles market based on the below-mentioned segments:

United Kingdom Steerable Needles Market, By Type

- Bevel-tip Flexible Needles

- Symmetric-tip Needles

- Tendonactuated Tips

United Kingdom Steerable Needles Market, By Application

- Biopsy

- Tumor Ablation

- Pain Management

- Robotic Assisted Surgery

Need help to buy this report?