United Kingdom Space Technology Market Size, Share, and COVID-19 Impact Analysis, By Technology (Satellite Systems, Launch Systems, Ground Systems, In Space Infrastructure Systems, Others), By End User (Commercial, Government), and United Kingdom Space Technology Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseUnited Kingdom Space Technology Market Insights Forecasts to 2035

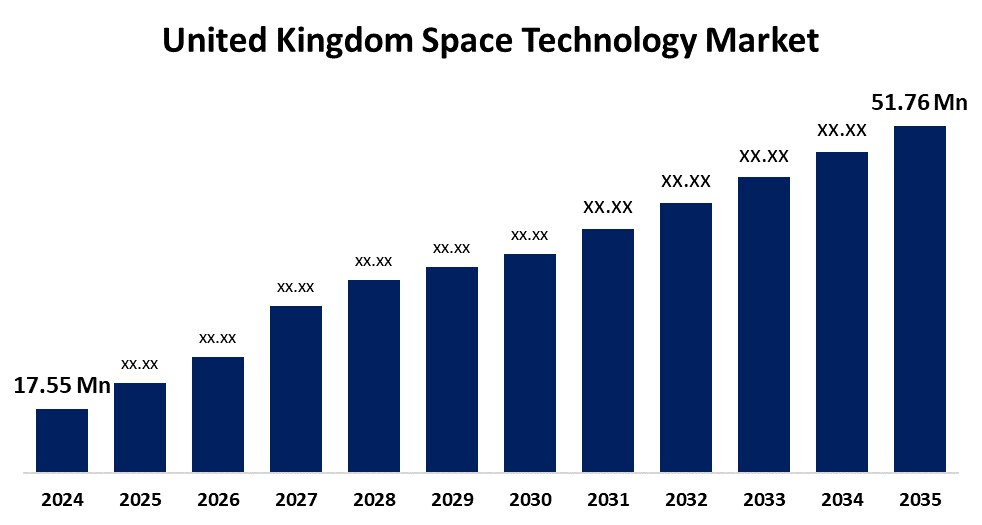

- The United Kingdom Space Technology Market Size was Estimated at USD 17.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.33% from 2025 to 2035

- The United Kingdom Space Technology Market Size is Expected to Reach USD 51.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Space Technology Market Size is anticipated to reach USD 51.76 Million by 2035, growing at a CAGR of 10.33% from 2025 to 2035. An increase in both public and private sector investments in vital fields, including satellite communications, earth observation, space tourism, and interplanetary exploration, is driving this growing trend. Increased investment in satellite defense capabilities is being driven by national security agendas and growing geopolitical tensions.

Market Overview

The United Kingdom space technology market refers to the industry focused on the production and application of technology or technical support, which has heightened the space sector with sustainable growth. Space technology includes all of the equipment, systems, and information created for space exploration and use. Advanced propulsion systems that enable far space missions are among them, as are satellites and spacecraft for scientific study, communication, and Earth observation. We may explore far-off celestial bodies, comprehend our planet, and advance human understanding thanks to this technology. Scientific discoveries, navigation, weather forecasting, and telecommunications have all benefited from it. Space technology continues to be essential to deepening our knowledge of the cosmos and improving many facets of Earthly existence as space exploration develops. The development of spaceports to become a major player in the market for small satellite launches, especially in Cornwall and Scotland. The United Kingdom’s goal is to give small satellite operators flexible, affordable access to space, with companies like Orbex and Skyrora at the forefront. Regulatory frameworks and government investment aimed at promoting the United Kingdom as a desirable location for commercial space launches encourage this trend.

Report Coverage

This research report categorizes the market for the United Kingdom space technology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom space technology market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom space technology market.

United Kingdom Space Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.55 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.33% |

| 2035 Value Projection: | USD 51.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Technology and By End User |

| Companies covered:: | Airbus Defence and Space, Surrey Satellite Technology Limited (SSTL), Clyde Space Ltd, OneWeb, Telespazio VEGA UK, STAR-Dundee, Gravitilab, Craft Prospect, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom space technology is driven by high robotics, artificial intelligence, and nanotechnology developments are spurring innovation in space missions, while the development of commercial spaceports and reusable rockets. At the same time, there is a surge in investment in satellite defense capabilities due to growing geopolitical tensions and national security goals. Space tourism has become a popular idea that has drawn interest from the general public as well as investment. Adventures in suborbital space tourism provide breathtaking vistas of Earth and fleeting moments of weightlessness. The increased accessibility to these activities is attracting the attention of adventurers and aficionados.

Restraining Factors

However, the high cost of creating and deploying satellites and spacecraft is a significant barrier to the space technology sector. The design, manufacture, testing, and launch of satellites continue to be costly, and the infrastructure needed for space operations, including mission control centers, launch pads, and ground stations, also raises the final cost. The legal and regulatory environment in which the space industry operates is complicated and crosses both national and international borders.

Market Segmentation

The United Kingdom Space Technology Market share is classified into technology, and end user.

- The satellite systems segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom space technology market is differentiated by technology into satellite systems, launch systems, ground systems, in space infrastructure systems, and others. Among these, the satellite systems segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is due to increased demand for secure communications, worldwide internet access, and real-time data is driving the satellite systems market's expansion. The transition is essential for contemporary applications like smart agriculture, IoT connections, and driverless cars. The strategic significance of space assets is reflected in the growing expenditures made by governments and corporate entities in dual-use satellites for both defense and civilian uses.

- The government segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom space technology market is segmented by end user into commercial and government. Among these, the government segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because significant expenditures in secure satellite communication and surveillance systems are being driven by government agencies' growing perception of space as a crucial area for national security. The market for space technology (SpaceTech) is undergoing improved defense initiatives that incorporate cyber defense, surveillance, and missile early-warning capabilities. The goal of these initiatives is to protect critical space assets from possible dangers and new cyberthreats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom space technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus Defence and Space

- Surrey Satellite Technology Limited (SSTL)

- Clyde Space Ltd

- OneWeb

- Telespazio VEGA UK

- STAR-Dundee

- Gravitilab

- Craft Prospect

- Others

Recent Developments:

- In May 2025, Space Forge, a UK-based space manufacturing startup, secured a record-breaking £22.6 million (approximately $30 million) in Series A funding, the largest Series A investment in UK space tech history. The funding round was led by the NATO Innovation Fund, with additional backing from World Fund, the National Security Strategic Investment Fund (NSSIF), and the British Business Bank.

- In January 2025, A landmark Scottish rocket launched to solidify the UK’s position as a European leader in the space race, following a £20 million government investment in UK launch company Orbex. The funding will support the construction and launch of Orbex’s rocket, Prime, the first UK-manufactured and UK-launched orbital rocket, scheduled to take off in late 2025 from the SaxaVord spaceport in Scotland.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom space technology market based on the below-mentioned segments:

United Kingdom Space Technology Market, By Technology

- Satellite Systems

- Launch Systems

- Ground Systems

- In Space Infrastructure Systems

- Others

United Kingdom Space Technology Market, By End User

- Commercial

- Government

Need help to buy this report?