United Kingdom Space Camera Market Size, Share, and COVID-19 Impact Analysis, By Type (Satellite Cameras, CubeSat Cameras, Onboard Spacecraft Cameras, and Others), By Technology (Electro-Optical (EO) Cameras, Infrared (IR) Cameras, Multispectral Cameras, Hyperspectral Cameras, and Others), and United Kingdom Space Camera Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseUnited Kingdom Space Camera Market Size Insights Forecasts to 2035

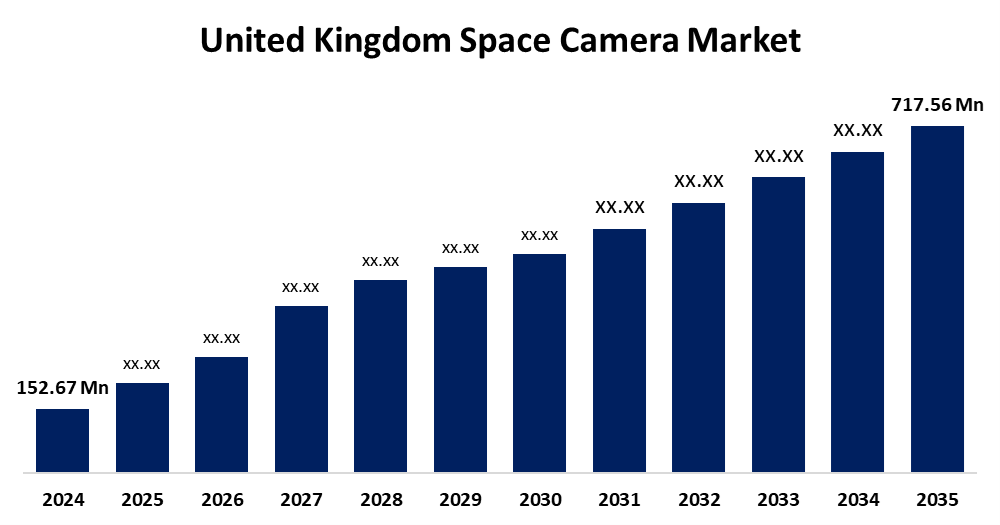

- The United Kingdom Space Camera Market Size was estimated at USD 152.67 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.11% from 2025 to 2035

- The United Kingdom Space Camera Market Size is Expected to Reach USD 717.56 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United Kingdom Space Camera Market Size is anticipated to reach USD 717.56 million by 2035, growing at a CAGR of 15.11% from 2025 to 2035. The demand for space cameras is increasing due to private sector activities, including satellite-based analytics, space tourism, and space-based internet services, as well as the growing adoption of sophisticated imaging technologies.

Market Overview

The United Kingdom space camera market refers to the sector devoted to the creation, production, and use of high-resolution imaging equipment for space applications such as astrophotography, satellite navigation, deep space exploration, and Earth observation. Satellites, space probes, and crewed missions all use these cutting-edge cameras to take detailed pictures for use in commercial, military, scientific, and climate monitoring purposes. The space camera sector is also adopting LiDAR and 3D imaging technologies at an increasing rate. Spacecraft navigation, asteroid surface investigation, and precise topographic mapping are made possible by these advancements. Further, local market players and their novel initiative efforts, which propelled the market expansion, for instance, in March 2024, an advancement in near-real-time space imaging has been made with the launch of an AI-powered Earth observation satellite by UK-based startup Open Cosmos. This project places Open Cosmos at the forefront of space-based environmental intelligence by showcasing UK innovation in embedded AI, hyperspectral photography, and small satellite architecture. Additionally, the use of automated anomaly detection, real-time data analytics, and AI-driven image processing enhances image accuracy and operational efficiency, which propels market expansion.

Report Coverage

This research report categorizes the market for the United Kingdom space camera market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom space camera market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom space camera market.

United Kingdom Space Camera Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 152.67 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.11% |

| 2035 Value Projection: | USD 717.56 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | XCAM Ltd, Raptor Photonics, Teledyne e2v, Andor/ Oxford Instruments, Photek Ltd, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom space camera is propelled by the growing financial commitments from both private aerospace companies and government space organizations. The strategic investment is anticipated to leverage cutting-edge technology and promote cooperation between area businesses and research institutions, while enhancing regional innovation and industrial growth within the space industry. Modern space cameras are essential for mapping alien landscapes, taking fine-grained pictures of planets, and facilitating scientific research that drives the market expansion. For disaster relief, infrastructure development, and climate monitoring. Besides, governments and private companies are working together to develop innovative satellite imaging technology.

Restraining Factors

Despite significant market growth, they face some hurdles, such as the development process being made more difficult by regulatory obstacles and strict safety requirements, the advancement of the space camera industry, and high manufacturing costs, especially for small and medium-sized businesses.

Market Segmentation

The United Kingdom space camera market share is classified into type, technology, and application.

- The CubeSat cameras segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom space camera market is segmented by type into satellite cameras, cubesat cameras, onboard spacecraft cameras, and others. Among these, the CubeSat cameras segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to their offerings, the surveillance on climate change, agricultural conditions, and disaster assessment with real-time data analysis. The main factor is that they are affordable in price with ease of deployment.

- The electro-optical (EO) cameras segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom space camera market is segmented by technology into electro-optical (EO) cameras, infrared (IR) cameras, multispectral cameras, hyperspectral cameras, and others. Among these, the electro-optical (EO) cameras segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the growing need for high-resolution imaging in urban planning, disaster relief, and environmental monitoring. The governments and private companies are making substantial investments in satellites that have sophisticated EO sensors to take fine-grained pictures of the Earth's surface. Analysis and decision-making are becoming more accurate because of improved image processing capabilities and higher spatial resolution.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom space camera market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- XCAM Ltd

- Raptor Photonics

- Teledyne e2v

- Andor/ Oxford Instruments

- Photek Ltd

- Others

Recent Developments:

- In February 2025, the PUNCH mission (Polarimeter to UNify the Corona and Heliosphere) launched, which includes the main UK-built camera systems on a NASA mission to investigate the Sun. RAL Space leveraged the hard-won experience from previous missions, including SDO (Solar Dynamics Observatory) and STEREO (Solar Terrestrial Relations Observatory). The University of Birmingham and STFC were among the UK teams that created all of the Heliospheric Imagers (HIs) for STEREO and imaging electronics for SDO, which employed e2v CCDs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom space camera market based on the below-mentioned segments:

United Kingdom Space Camera Market, By Type

- Satellite Cameras

- CubeSat Cameras

- Onboard Spacecraft Cameras

- Others

United Kingdom Space Camera Market, By Technology

- Electro-Optical (EO) Cameras

- Infrared (IR) Cameras

- Multispectral Cameras

- Hyperspectral Cameras

- Others

Need help to buy this report?