United Kingdom Sourdough Market Size, Share, and COVID-19 Impact Analysis, By Type (Type I, Type II, and Type III), By Application (Breads, Cookies, Cakes, Waffles, Pizza, and Others), and UK Sourdough Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Sourdough Market Size Forecasts to 2035

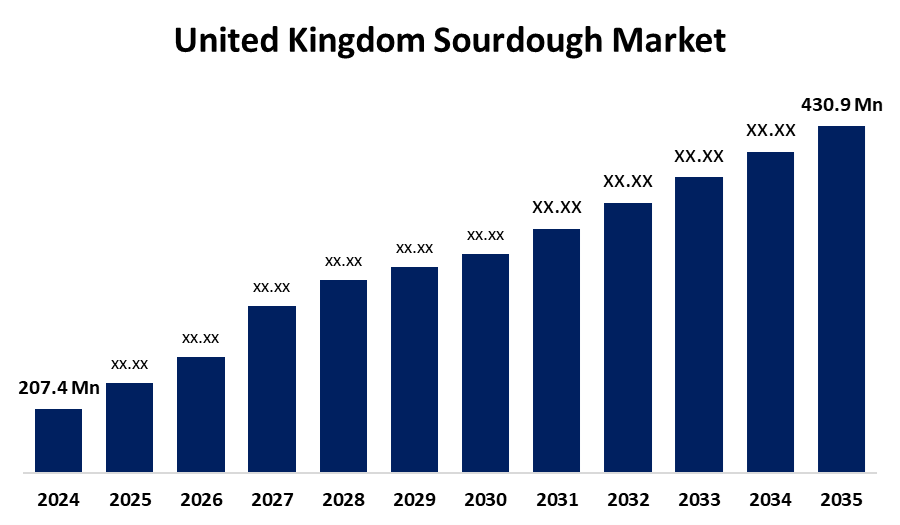

- The United Kingdom Sourdough Market Size Was Estimated at USD 207.4 Million in 2024

- The UK Sourdough Market Size is Expected to Grow at a CAGR of around 6.87% from 2025 to 2035

- The UK Sourdough Market Size is Expected to Reach USD 430.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Sourdough Market Size is anticipated to reach USD 430.9 million by 2035, growing at a CAGR of 6.87% from 2025 to 2035. The UK sourdough market growth is driven by rising health awareness, demand for artisanal and natural foods, increasing preference for fermented products, and expanding consumer interest in unique flavors and traditional baking methods.

Market Overview

The UK sourdough market refers to a fermented product with yeast and lactobacillus. sourdough is probiotic and nutrient-rich, loaded with magnesium, iron, folic acid, and zinc, thus making it a wholesome choice for a range of baked goods and desserts. In response to changing customer demands, the UK sourdough industry is expanding as a result of product innovation and diversification across food categories like pizza, crackers, and snacks. Improvements in fermentation and nutrition combinations increase the stability and quality of production, which appeals to both industrial bakers and consumers. Sourdough, which employs lengthier fermentation to remove artificial chemicals and is in line with organic and clean-label trends, is preferred by consumers who are more conscious of sustainable living and environmental protection. Demand for artisanal, naturally fermented sourdough bread, which is prized for its digestive benefits and lower glycaemic index, is driven by health-conscious UK consumers. Additionally, consumers are favouring ingredients that are sourced locally, which helps local bakers. New flavour creation and dietary needs, such as plant-based and gluten-free alternatives, are innovative prospects. Sourdough's popularity has grown as a result of post-pandemic lifestyle shifts, including an increase in home baking and internet purchasing. Manufacturers provide baking supplies and beginning kits to better engage customers. Overall, consumer trends that prioritise sustainability, health, and community involvement are poised to propel the UK sourdough market's growth.

Report Coverage

This research report categorizes the market for the UK sourdough market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sourdough market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sourdough market.

United Kingdom Sourdough Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 207.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.87% |

| 2035 Value Projection: | USD 430.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Sourdough Pizza, Sourdough Studios, Loaf, Baker and Spice, GAIL’s Bakery, The Welsh Bread Company, Paul UK, Baker Street, Bread Ahead, The Real Baking Company, E5 Bakehouse, Baker Brothers, Boulangerie Jules, Wild Flour, Peters Yard, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The sourdough market in the UK is growing at a fast pace due to the number of health-conscious consumers looking for digestible bread with a lower glycaemic index, coupled with NHS recommendations that include whole grains. The desire for artisan bread has also risen as major supermarkets offer more sourdough options. The market potential is increased by gluten-free sourdough choices, which address growing gluten sensitivity. In the UK, sourdough has become even more popular due to social media trends and influencer endorsements, particularly among millennials. This has increased consumer interest and market demand.

Restraining Factors

Higher production costs, short shelf life, consumer desire for convenience, inconsistent quality in artisanal producers, and competing bread alternatives from mass-produced brands, all of which restrict large-scale market growth and accessibility. These factors hamper the sourdough market during the forecast period.

Market Segmentation

The United Kingdom sourdough market share is classified into type and application.

- The type III segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sourdough market is segmented by type into type I, type II, and type III. Among these, the type III segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Adaptability and practicality on a large scale in commercial baking. Industrial bakers apply Type III to create uniformity and consistent quality through a defined standard taste and profiled controlled fermentation process. The sector continues to grow in popularity and is associated with the durability and nutrition of baked goods.

- The breads segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sourdough market is segmented by application into breads, cookies, cakes, waffles, pizza, and others. Among these, the breads segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bread is an essential good for the population. In addition, growth in the demand for bread goods is also driving the growth of the bread market. Also, the market is expected to continue to grow due to the high nutritional benefits and digestibility of sourdough breads. Also, the quality and artisanal nature of sourdough breads motivates home and commercial bakeries to use them both furthering their expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sourdough market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sourdough Pizza

- Sourdough Studios

- Loaf

- Baker and Spice

- GAIL's Bakery

- The Welsh Bread Company

- Paul UK

- Baker Street

- Bread Ahead

- The Real Baking Company

- E5 Bakehouse

- Baker Brothers

- Boulangerie Jules

- Wild Flour

- Peters Yard

- Others

Recent Developments:

- Dec 2024, Gail’s Bakery, known for its sourdough loaves and cinnamon buns, planned to open 40 new locations in the UK by 2025, bringing its total to over 150 stores. This expansion was attributed to attractive real estate deals and increased popularity.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sourdough market based on the below-mentioned segments:

United Kingdom Sourdough Market, By Type

- Type I

- Type II

- Type III

United Kingdom Sourdough Market, By Application

- Breads

- Cookies

- Cakes

- Waffles

- Pizza

- Others

Need help to buy this report?