United Kingdom Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Software, System Infrastructure Software, Development and Deployment Software, Productivity Software), By Mode of Deployment (On-premises, Cloud-based), and United Kingdom Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Software Market Insights Forecasts to 2035

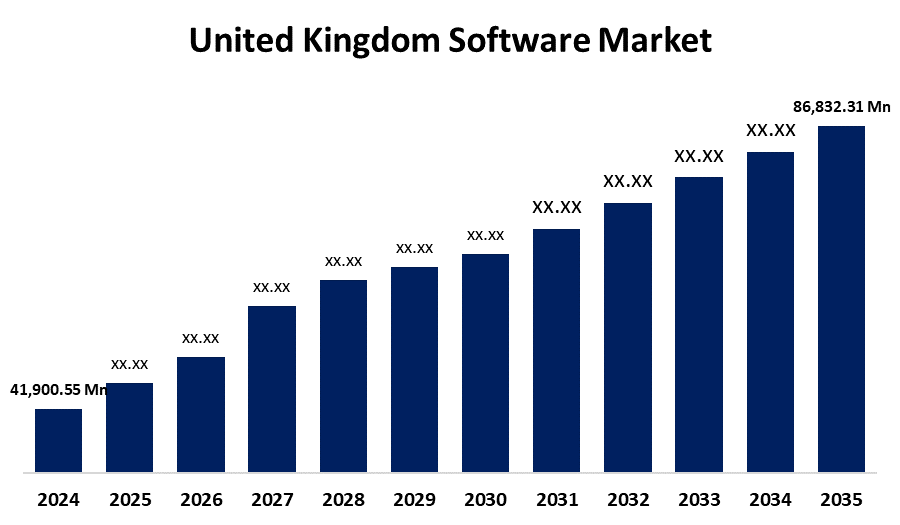

- The United Kingdom Software Market Size was estimated at USD 41,900.55 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.85% from 2025 to 2035

- The United Kingdom Software Market Size is Expected to Reach USD 86,832.31 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Software Market Size is anticipated to reach USD 86,832.31 Million by 2035, growing at a CAGR of 6.85% from 2025 to 2035. The market expansion is propelled by IoT and smart device adoption, increasing as a result of growing digitization. Consequently, this increases the need for software that works with various devices, which showcases the need for software and related accessories that help to drive the market growth.

Market Overview

The United Kingdom software market refers to the sector that assists in the information and technology sector, which focuses on the development and utilization of software solutions across several industries. Application software, system infrastructure software, development and deployment software, and productivity software are all included. Furthermore, the industry is primarily driven by the rapid advancements in technology. Additionally, major leaders in the hardware industry, these businesses also make investments in software development, which is driving market expansion. Moreover, research and development (R&D), startup development, and digitization are further supported by the implementation of several projects and regulations. Further, the governments' support boosts the market expansion, such as the UK and the EU, which launched a new AI collaboration aimed at accelerating innovation and research across various sectors, including healthcare, clean energy, and advanced technologies. Moreover, the UK's Competition and Markets Authority (CMA) has cleared Microsoft's partnership with OpenAI, concluding that Microsoft does not have "de facto control" over OpenAI and that the collaboration does not require an antitrust investigation. The CMA had been reviewing concerns stemming from Microsoft’s $1 billion investment in OpenAI.

Report Coverage

This research report categorizes the market for the United Kingdom software market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom software market.

United Kingdom Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 41,900.55 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.85% |

| 2035 Value Projection: | USD 86,832.31 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type and By Mode of Deployment |

| Companies covered:: | The Sage Group plc,Darktrace plc,Clarivate Plc ,Softcat plc,Endava plc,Ideagen plc,Kainos Group plc,Alphawave IP Group plc and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom software is influenced by government programs, research projects that improve software capabilities, and technical developments. Further, initiatives for digital transformation, the growing use of cloud-based solutions, and the incorporation of AI and machine learning into software are all important motivators for market development. Moreover, growing company data volume and automation of company processes are the main factors propelling the market's expansion. Data integration is invested in by local companies to enhance their operational effectiveness and comply with stringent privacy regulations like GDPR, which fuels the market. Also, strategic alliances between clients and vendors have an impact on the UK's software market, extending the scope of data integration services.

Restraining Factors

The market expansion can be restricted by several obstacles, such as integrating new software with current infrastructures may be difficult, involve high costs, be time-consuming, and periodic risk for concern of data integrity. Moreover, the software industry is governed by several laws, including those about data protection, intellectual property rights, so it can be difficult and time-consuming to ensure compliance with these rules, especially for software firms that operate across different jurisdictions.

Market Segmentation

The United Kingdom software market share is classified into type and mode of deployment.

- The development and deployment software segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom software market is segmented by type into application software, system infrastructure software, development and deployment software, and productivity software. Among these, the development and deployment software segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. The segment growth is driven by the growing demand for effective data management solutions that can manage complex data environments is what is behind this increase. Effective data extraction, transformation, and loading are made possible by software solutions in this market, which aid in real-time analytics and decision-making. As companies look to use data insights for strategic advantages, this trend is anticipated to continue.

- The cloud-based segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The United Kingdom software market is divided by mode of deployment into on-premises and cloud-based. Among these, the cloud-based segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period. This is because driven by expanding enterprise use, technological infrastructure, and supportive government regulations. This change puts the country at the leading edge of the digital transformation sector and encourages the use of cloud computing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Sage Group plc

- Darktrace plc

- Clarivate Plc

- Softcat plc

- Endava plc

- Ideagen plc

- Kainos Group plc

- Alphawave IP Group plc

- Others

Recent Developments:

- In March 2025, A UK-based health and safety software platform officially launched with a £5 million investment to support workplace risk management and compliance. Developed by a team of health and safety professionals, the platform integrates services from William Martin, Elogs, and Prosure360, offering solutions such as risk management software, contractor vetting, e-learning, and compliance guidance.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom software market based on the below-mentioned segments:

United Kingdom Software Market, By Type

- Application Software

- System Infrastructure Software

- Development and Deployment Software

- Productivity Software

United Kingdom Software Market, By Mode of Deployment

- On-premises

- Cloud-based

Need help to buy this report?