United Kingdom Sodium Silicate Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid and Solid), By Form (Crystalline and Anhydrous), and United Kingdom Sodium Silicate Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited Kingdom Sodium Silicate Market Insights Forecasts to 2035

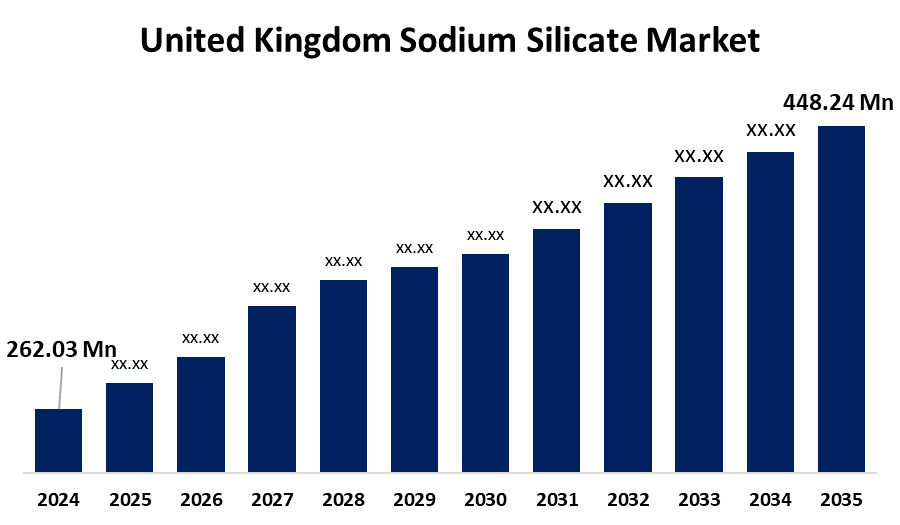

- The United Kingdom Sodium Silicate Market Size Was Estimated at USD 262.03 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.00% from 2025 to 2035

- The United Kingdom Sodium Silicate Market Size is Expected to Reach USD 448.24 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Sodium Silicate Market Size is anticipated to reach USD 448.24 Million by 2035, growing at a CAGR of 5.00% from 2025 to 2035. The increasing use in the water treatment, construction, detergent, and automotive sectors. The market's growing trajectory is primarily due to expanding infrastructure development and increased demand for environmentally friendly cleaning products.

Market Overview

The United Kingdom sodium silicate market refers to the manufacturing, distributing, and using of sodium silicate compounds in a variety of sectors, such as water treatment, detergents, building, and textiles. Sodium silicates' renowned adhesive, binding, and corrosion-resistant properties make them a common choice for compositions needing chemical stability and durability. In the UK's expanding industrial landscape, this sector is essential to infrastructure projects, environmental applications, and industrial manufacturing. The increased need for water treatment, building supplies, and detergents. Its use in environmentally friendly cleaning products is increased by growing environmental concerns and the drive for sustainable solutions. Furthermore, with the increased focus on industrial efficiency and sustainability, advancements in chemical processing and applications in pulp, paper, and textiles present encouraging growth opportunities. The advancements in environmentally friendly manufacturing methods and the creation of niche product categories. In order to satisfy consumer demand for greener products and environmental restrictions, manufacturers are concentrating on eco-friendly formulas and energy-efficient production techniques.

Report Coverage

This research report categorizes the market for the United Kingdom sodium silicate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sodium silicate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sodium silicate market.

United Kingdom Sodium Silicate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 262.03 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.00% |

| 2035 Value Projection: | USD 448.24 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Liquid and Solid), By Form (Crystalline and Anhydrous) |

| Companies covered:: | ICL UK, Monarch Chemicals, Plater Group, Inoxia Ltd, Source Chemicals Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand in a number of sectors, including paper & pulp, water treatment, detergents, and construction. Because of its superior binding and sealing qualities, sodium silicate is utilized in cement formulations and fireproofing products in the building industry. Additionally, enterprises are being pressured by environmental concerns to use non-toxic and environmentally friendly chemicals, such as sodium silicate, in water treatment procedures. Its application in manufacturing as an adhesive, corrosion inhibitor, and deflocculant promotes market growth even more. Furthermore, the need for sodium silicate in both public and industrial applications is being driven by strict wastewater treatment rules and growing awareness of water conservation.

Restraining Factors

The supply chain disruptions and price volatility for raw materials constitute two of the main issues affecting the UK sodium silicate market. Silica sand and soda ash are the main raw materials used to make sodium silicate, and both are susceptible to price swings because of things including global supply-demand imbalances, political instability, and natural disasters that have an impact on mining operations.

Market Segmentation

The United Kingdom sodium silicate market share is classified into type and form.

- The liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sodium silicate market is segmented by type into liquid and solid. Among these, the liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing use of environmentally friendly cleaning products and water treatment systems is increasing demand for liquid sodium silicate as businesses move toward more economical and sustainable substitutes that provide environmental and performance advantages in a multitude of applications.

- The crystalline segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sodium silicate market is segmented by form into crystalline and anhydrous. Among these, the crystalline segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of demand in the market is being stimulated by growing industrial activity, the building industry, and the growing usage of sodium silicate in the manufacturing of glass and ceramics. In addition, the use of sodium silicate in sustainable products is encouraged by developments in chemical formulations and expanding environmental legislation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sodium silicate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ICL UK

- Monarch Chemicals

- Plater Group

- Inoxia Ltd

- Source Chemicals Ltd

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sodium silicate market based on the below-mentioned segments:

United Kingdom Sodium Silicate Market, By Type

- Liquid

- Solid

United Kingdom Sodium Silicate Market, By Form

- Crystalline

- Anhydrous

Need help to buy this report?