United Kingdom Smoothies Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruit-based, Dairy-based), By Distribution Channel (Restaurants, Smoothie Bars, Supermarkets & Convenience Stores), and UK Smoothies Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Smoothies Market Forecasts to 2035

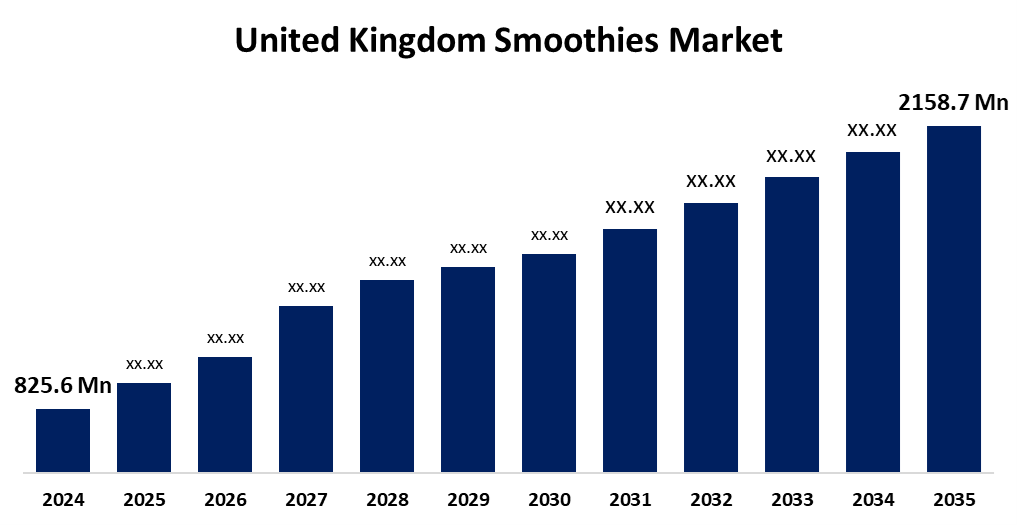

- The United Kingdom Smoothies Market Size Was Estimated at USD 825.6 Million in 2024

- The UK Smoothies Market Size is Expected to Grow at a CAGR of around 9.13% from 2025 to 2035

- The UK Smoothies Market Size is Expected to Reach USD 2158.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Smoothies Market Size is anticipated to Reach USD 2158.7 Million by 2035, Growing at a CAGR of 9.13% from 2025 to 2035. The growing desire for on-the-go meal options, their broad variety of flavours, and the growing demand for organic and culinary herbal beverages are some of the major reasons propelling the smoothie market share.

Market Overview

The UK Smoothies Market Size refers to a thick drink that is created by mixing raw fruits, vegetables, milk, yoghurt, ice cream, cottage cheese, and nutritional and herbal supplements. Smoothies are popular in the UK, mostly because of their high nutritional content. Along with the main course, they are also used as side drinks and as a meal substitute. The smoothie market is experiencing significant growth as consumers prioritize health, convenience, and nutrition in their dietary choices. Smoothies, made from fruits, vegetables, and supplements, are increasingly seen as complete meals, replacing traditional fast-food options. Chains like Tropical Smoothie Cafe offer nutrient-rich options such as the Chia Banana Boost and Detox Island Green smoothies. The wellness movement and social media platforms like Instagram and Pinterest have further boosted smoothie popularity through visually appealing, health-centric content. Brands like Innocent Smoothies leverage engaging social media strategies to connect with consumers and drive sales. The market is characterized by flavor innovation and customization, catering to evolving and adventurous taste preferences. Despite high fragmentation, companies pursue growth through mergers, partnerships, and new product development. Regulatory compliance remains essential for ensuring safety and transparency. While smoothies face competition from other ready-to-drink or meal replacement options, their nutritional value, convenience, and cultural relevance continue to make them a leading choice in the health-focused food and beverage sector.

Report Coverage

This research report categorizes the market for the UK smoothies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom smoothies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom smoothies market.

United Kingdom Smoothies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 825.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.13% |

| 2035 Value Projection: | USD 2158.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Innocent Drinks, Ellas Kitchen, PJs Smoothies, Bolthouse Farms, Mr Shericks Shakes, Sunshine Drinks Co, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing interest in plant-based diets, the need for quick and wholesome on-the-go solutions, and more health consciousness are driving the smoothie business in the UK. Diverse tastes are catered to by product improvements like as superfood, low-sugar, and customisable blends. Smoothie bars and online delivery services improve accessibility, while social media and influencer marketing increase customer involvement. Smoothies are a popular option for time-constrained and health-conscious UK consumers as a result of growing concerns about processed food and a shift in consumer attention towards cleaner, natural alternatives.

Restraining Factors

Factors are hindering growth in UK smoothie sales. Some smoothies, even though they are marketed as "healthier" options, often have a lot of sugar, which a lot of consumers are concerned about. Premium pricing is restrictive to many consumers, especially in economic downturns. Additionally, other health drinks are driving competition, short shelf life in some instances limits high volume sales, as well as regulations that cover labelling and health claims. These factors hamper the smoothies market during the forecast period.

Market Segmentation

The United Kingdom smoothies market share is classified into product and distribution channel.

- The fruit-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom smoothies market is segmented by product into fruit-based, dairy-based. Among these, the fruit-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The nutritional value of fruits, which includes important vitamins, minerals, and antioxidants, is well known. Because of this, consumers now frequently link fruit-based smoothies to wellbeing and health. Additionally, fruits are naturally sweet, and watery fruits like watermelon and berries add to the refreshing and hydrating qualities of smoothies. All of these elements have played a major role in fruit-based smoothie' in the UK.

- The smoothie bars segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom smoothies market is segmented by distribution channel into restaurants, smoothie bars, supermarkets & convenience stores. Among these, the smoothie bars segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Customers can choose particular fruits, veggies, bases, and add-ins to personalise their drinks at smoothie bars. Additionally, a broad variety of flavours and ingredient combinations are available on the menu at smoothie bars. Furthermore, because of the strong demand for smoothies, a lot of businesses in the smoothie industry are growing by opening bars.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom smoothies market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Innocent Drinks

- Ellas Kitchen

- PJs Smoothies

- Bolthouse Farms

- Mr Shericks Shakes

- Sunshine Drinks Co

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom smoothies market based on the below-mentioned segments:

United Kingdom Smoothies Market, By Product

- Fruit-based

- Dairy-based

United Kingdom Smoothies Market, By Distribution Channel

- Restaurants

- Smoothie Bars

- Supermarkets & Convenience Stores

Need help to buy this report?