United Kingdom Sleep Apnea Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Diagnostic Devices, Therapeutic Devices, and Sleep Apnea Masks), By End Use (Hospitals and Sleep Labs and Home Care), and UK Sleep Apnea Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Sleep Apnea Devices Market Size Forecasts to 2035

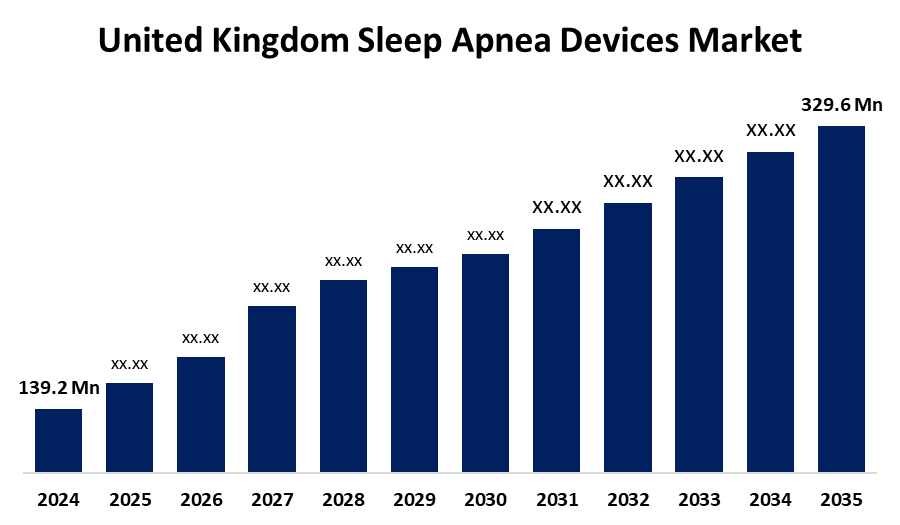

- The United Kingdom Sleep Apnea Devices Market Size Was Estimated at USD 139.2 Million in 2024

- The UK Sleep Apnea Devices Market Size is Expected to Grow at a CAGR of around 8.15% from 2025 to 2035

- The UK Sleep Apnea Devices Market Size is Expected to Reach USD 329.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Sleep Apnea Devices Market Size is anticipated to reach USD 329.6 million by 2035, growing at a CAGR of 8.15% from 2025 to 2035. The market for sleep apnea is boosted by the growing incidence of the sleep apnea condition, the quickly growing medical device industry, and technical developments.

Market Overview

The UK sleep apnea devices market refers to the devices developed to preserve the upper airway as you sleep, hence highlighting obstructive sleep apnoea (OSA). For diagnosing and treating sleep apnea, a disorder that causes breathing interruptions during sleep. It includes diagnostic tools like polysomnography and treatment devices such as CPAP machines, oral appliances, and ASV systems. The market for sleep apnoea devices in the UK is expanding significantly due to factors like growing awareness, technology improvements, and the growing incidence of sleep apnoea, especially among the elderly. Increased demand for efficient treatments and higher diagnosis rates is being driven by expanding public health initiatives and better education. Data-tracking devices and remote monitoring are technological integrations that support the trend towards personalised healthcare. By pushing manufacturers to improve product features and integrate more comprehensive sleep problem therapies, the NHS is supporting innovation. There’s growing demand for devices that are more comfortable, user-friendly, and adjusted to the patient’s lifestyle. The trend toward home diagnostics and treatments, accelerated by the COVID-19 pandemic, highlights changing patient preferences and models of how health care is delivered. Together, these factors put the UK sleep apnea devices market in good stead for future growth and investment opportunities.

Report Coverage

This research report categorizes the market for the UK sleep apnea devices market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sleep apnea devices market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sleep apnea devices market.

United Kingdom Sleep Apnea Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 139.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.15% |

| 2035 Value Projection: | USD 329.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product Type, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Nox Medical, Zadix, Compumedics, Fisher and Paykel Healthcare, Itamar Medical, Philips, Natus Medical, Welch Allyn, ResMed, Sleepnet Corporation, Apex Medical, Breas Medical, Inspire Medical Systems, Somnomed, Medtronic, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK sleep apnea devices market is driven by a combination of growing obesity rates, which increases the occurrence of sleep apnea and public awareness as a result of NHS and other health initiatives; increasing demand for devices through better diagnosis and access to sleep assessments; and improved compliance, which affects patient and the market, due to new technologies like portable monitoring and ease of use for CPAP devices with better treatment, compliance and uptake with sleep apnea.

Restraining Factors

The high cost of advanced devices, the lack of awareness in some segments, and discomfort or poor compliance with CPAP therapy. In addition to costs, factors delaying diagnosis, the availability of skilled professionals needed to conduct sleep studies, and the regulatory barriers that could limit the extent of the uptake and accessibility of sleep apnea treatment options. These factors hamper the sleep apnea devices market during the forecast period.

Market Segmentation

The United Kingdom sleep apnea devices market share is classified into product type and end use.

- The therapeutic devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sleep apnea devices market is segmented by product type into diagnostic devices, therapeutic devices, and sleep apnea masks. Among these, the therapeutic devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This includes chin straps, nasal, oral, or positive airway pressure devices. The players in the market are introducing innovations such as smaller masks, softer fabrics, noise-reducing features, and lighter-weight and more comfortable products. Advanced technologies are shaping new products that improve PAP device effectiveness and achieve optimal clinical outcomes. Where there is favourable insurance approval associated with adherence criteria and increasing compliance rates to the PAP therapy.

- The home care segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sleep apnea devices market is segmented by end use into hospitals and sleep labs and home care. Among these, the home care segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Recent advancements in technology have resulted in the creation of quieter, simpler, and more portable devices for sleep apnoea, all designed for use at home. Portable CPAP, BiPAP, and APAP machines with lightweight masks and accessories enable patients to manage their sleep apnoea treatment at home. This market continues to grow as consumers opt for homecare settings that afford more comfort and convenience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sleep apnea devices market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nox Medical

- Zadix

- Compumedics

- Fisher and Paykel Healthcare

- Itamar Medical

- Philips

- Natus Medical

- Welch Allyn

- ResMed

- Sleepnet Corporation

- Apex Medical

- Breas Medical

- Inspire Medical Systems

- Somnomed

- Medtronic

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sleep apnea devices market based on the below-mentioned segments:

United Kingdom Sleep Apnea Devices Market, By Product Type

- Diagnostic Devices

- Therapeutic Devices

- Sleep Apnea Masks

United Kingdom Sleep Apnea Devices Market, By End Use

- Hospitals and Sleep Labs

- Home Care

Need help to buy this report?