United Kingdom Server Market Size, Share, and COVID-19 Impact Analysis, By Product (Rack, Blade, Tower, Micro, and Open Compute Project), By Sales Channel (Direct, Reseller, Systems integrator, and Others), and United Kingdom Server Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom Server Market Insights Forecasts to 2035

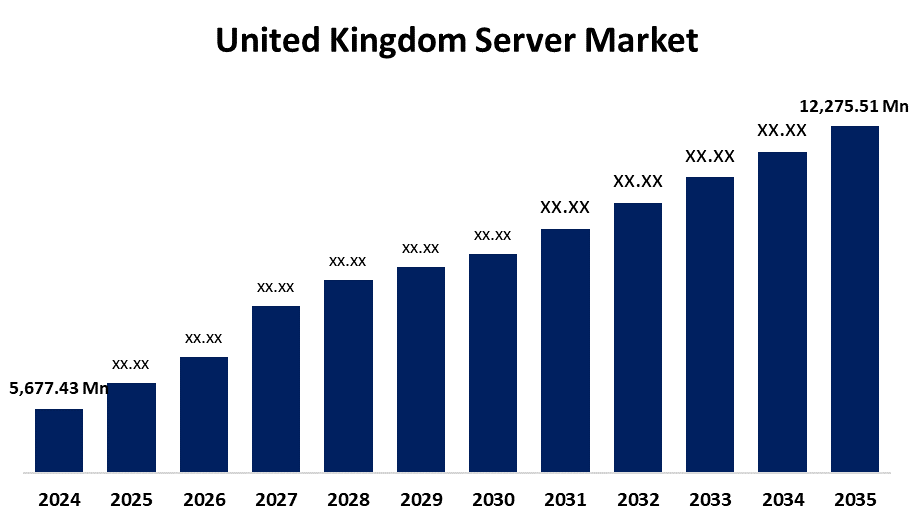

- The United Kingdom Server Market Size was estimated at USD 5,677.43 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.26% from 2025 to 2035

- The United Kingdom Server Market Size is Expected to Reach USD 12,275.51 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Server Market Size is anticipated to reach USD 12,275.51 Million by 2035, growing at a CAGR of 7.26% from 2025 to 2035. The growing number of data centers and the widespread use of smartphones are major factors propelling the server industry's growth.

Market Overview

The United Kingdom server market refers to the subsegment of the IT sector that focuses on the production and application of servers, which is a key part of any kind of seamless digital operation. Also, Multiple devices or processes can receive services from a single computer machine called a server. Several clients can share resources and data thanks to the servers' distributed services. The one server can serve several clients, while a single client can be used by multiple servers. Mail servers, print servers, file servers, database servers, web servers, game servers, and application servers are just a few of the various kinds of servers. Server OS, hardware, network connectivity, software, management and monitoring tools, and high availability characteristics are some of the common components found in all servers. The core of enterprise IT environments is servers, which offer processing power and storage for everything from apps, email, online content, media, cloud, and AI solutions, and more. They are made to do a single thing, like an email server that receives, stores, and then sends emails to the client that has requested them. The server also serves as a file and printer server, storing files, receiving print jobs from clients, and forwarding them to network-connected printers, among other functions.

Report Coverage

This research report categorizes the market for the United Kingdom server market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom server market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom server market.

United Kingdom Server Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,677.43 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.26% |

| 2035 Value Projection: | USD 12,275.51 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 506 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Sales Channel |

| Companies covered:: | UK Dedicated Servers Ltd, RapidSwitch Ltd, HOSTKEY (UK Operations), NTT Ltd, ApplianSys Ltd, Bytemark Ltd, Iomart Group plc, aql, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom server is influenced by the ongoing development of cutting-edge technologies like artificial intelligence (AI), big data, the internet of things (IoT), and 5G, as well as the growing uptake of creative solutions built on these technologies across a range of sectors and verticals. The market is evolving, and companies are building cutting-edge data centers to meet the rising demand, which extends the market growth. The rise in applications with specific needs and high computational demands drives users and service providers toward using cloud servers for better performance. Furthermore, the need for substantial investment in cooling systems by cloud service providers has become essential as physical servers generate a significant amount of heat.

Restraining Factors

However, market growth could slow down due to infrastructure is expensive for SMEs or groups with limited funding. For a startup with a limited budget, a server infrastructure is necessary to support its expanding user base. Their expansion aspirations are slowed down by the high upfront expenses associated with purchasing servers and related equipment, which also lead to financial difficulties.

Market Segmentation

The United Kingdom server market share is classified into product and sales channel.

- The rack segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom server market is differentiated by product into rack, blade, tower, micro, and open compute projects. Among these, the rack segment held the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The design and construction of rack servers accommodate both high and low computing requirements, and they are separately mounted in a rack and configured to fulfill a wide range of requirements. Additionally, rack servers use less floor space, are easily scalable, and have immediate cooling capabilities. High-density computing, the growing demand for scalable data centers, and developments in cutting-edge technologies like cloud, edge, and Internet of Things computing are all contributing factors to the segment's growth, which presents enormous growth prospects for market participants.

- The direct segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom server market is segmented by sales channel into direct, reseller, systems integrator, and others. Among these, the direct segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Customized designs and competitive prices from Original Design Manufacturers (ODMs) are responsible for the segment's growth. They can also enhance brand recognition and manage the consumer experience through direct distribution. Furthermore, by delivering products straight to clients when they are prepared for use, direct distribution can reduce lead times.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom server market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- UK Dedicated Servers Ltd

- RapidSwitch Ltd

- HOSTKEY (UK Operations)

- NTT Ltd

- ApplianSys Ltd

- Bytemark Ltd

- Iomart Group plc

- aql

- Others

Recent Developments:

- In January 2025, Corero Network Security and UK Dedicated Servers extended their partnership with a major upgrade to next-generation DDoS protection technology. UK Dedicated Servers became the first in the EMEA region to adopt Corero’s new NTD3400 solution, which features a 400G interface for enhanced network connectivity and scalability. This upgrade replaces their long-standing NTD1100 appliances and is designed to meet growing demand while future-proofing their infrastructure.

- In December 2021, the 10Gb/s Community Mirror Service by UK Servers was officially launched. It’s hosted in their Coventry data center and supports high-speed access to popular Linux distributions like CentOS, Debian, and Ubuntu via HTTP, FTP, and RSYNC.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom server Market based on the below-mentioned segments:

United Kingdom Server Market, By Product

- Rack

- Blade

- Tower

- Micro

- Open Compute Project

United Kingdom Server Market, By Sales Channel

- Direct

- Reseller

- Systems integrator

- Others

Need help to buy this report?