United Kingdom Sequencing Market Size, Share, and COVID-19 Impact Analysis, By Working Model (Pre-Sequencing, Sequencing, and Data Analysis), By End Use (Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities, and Other Users), and United Kingdom Sequencing Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Sequencing Market Insights Forecasts to 2035

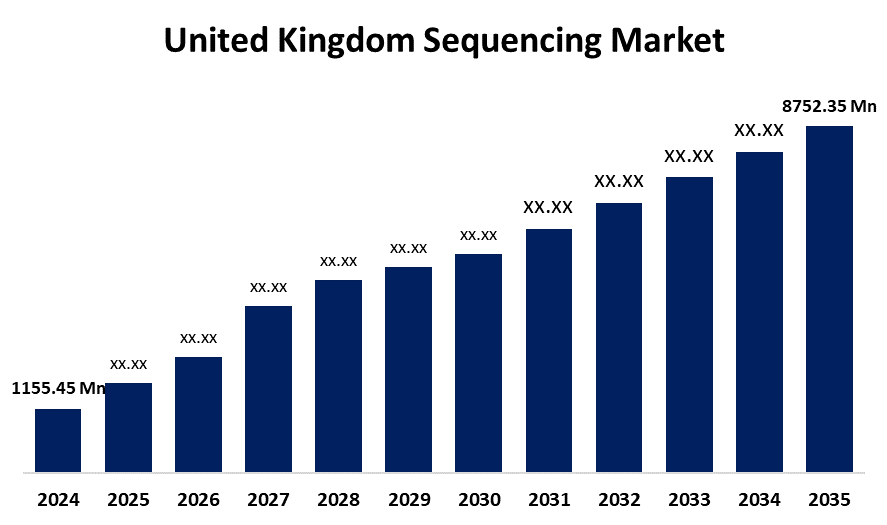

- The United Kingdom Sequencing Market Size was estimated at USD 1155.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 20.21% from 2025 to 2035

- The United Kingdom Sequencing Market Size is Expected to Reach USD 8752.35 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Sequencing Market Size is anticipated to reach USD 8752.35 Million by 2035, growing at a CAGR of 20.21% from 2025 to 2035. The market's expansion is developing due to a rising demand for consumer genomics, personalized medicine, gene therapy, and drug development.

Market Overview

The United Kingdom sequencing market refers to the business focused on the development, sale, and use of technologies and services for sequencing DNA and RNA. The sequencing market includes everything needed for sequencing DNA, RNA, and proteins, such as reagents and kits, equipment, evidence, experts, etc. The sequencing process uses a variety of instruments and methods to ascertain the amino acid sequence in a protein as well as the nucleotide sequence in DNA and RNA. Scientists can identify differences in genes and noncoding DNA (such as regulatory sequences), associations with diseases and phenotypes, and potential targets for new drugs by using sequencing data. The sequencing has considerably benefited several sectors, including disease research, developmental biology, epigenetics, evolution, genetic links between different species, the production of genetically modified creatures and vaccines, and more. The growing number of cases and the growing need for pharmacogenomics are driving growth in the healthcare sector. Major industry participants are making investments, and there are an increasing number of joint ventures and collaborations between them, which should lead to market expansion prospects.

Report Coverage

This research report categorizes the market for the United Kingdom sequencing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sequencing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sequencing market.

United Kingdom Sequencing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1155.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 20.21% |

| 2035 Value Projection: | USD 8752.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Working Model, By End Use |

| Companies covered:: | Eagle Genomics, Novogene (UK Office), DNASeq Ltd., Congenica, Illumina Cambridge Ltd., Oxford Nanopore Technologies, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom sequencing is driven by technology breakthroughs that have produced high-throughput sequencing platforms capable of generating large volumes of data quickly. Researchers can now sequence complete transcriptomes and genomes at a fraction of the time and expense needed with these platforms. Additionally, the accuracy, sensitivity, and speed of sequencing have increased due to the introduction of new chemicals and library preparation techniques, broadening the spectrum of sequencing applications. The market's level of M&A (mergers and acquisitions) activity has significantly increased. The increasing need for these technologies across a range of industries, including environmental research and agriculture, is what is driving this trend.

Restraining Factors

However, the cost and complexity of creating and promoting sequencing products might also be raised by laws. This may hinder market innovation and make it more difficult for smaller businesses to enter the market.

Market Segmentation

The United Kingdom sequencing market share is classified into working model and end use.

- The data analysis segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom sequencing market is segmented by working model into pre-sequencing, sequencing, and data analysis. Among these, the data analysis segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. The demand for sophisticated software and analytical tools to properly process and evaluate the increasing amount of sequencing data is growing. There will likely be an increase in demand for these services as a result of the data analysis segment's critical role in empowering researchers to extract valuable insights from sequencing data.

- The clinical research segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom sequencing market is divided by end use into academic research, clinical research, hospitals & clinics, pharma & biotech entities, and other users. Among these, the clinical research segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of clinical research, sequencing is essential because it helps create targeted medicines and sheds light on the genetic causes of disorders. The rising incidence of chronic illnesses, advances in technology, and increased funding for genomics research are all responsible for this surge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sequencing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eagle Genomics

- Novogene (UK Office)

- DNASeq Ltd.

- Congenica

- Illumina Cambridge Ltd.

- Oxford Nanopore Technologies

- Others

Recent Developments:

- In May 2025, Genomics England teamed up with researchers from EMBL’s European Bioinformatics Institute to develop SAVANA, a new AI-powered tool designed to enhance long-read DNA sequencing for cancer diagnostics.

- In February 2025, Ultima Genomics’ UG 100™ sequencing platform was selected for the UK Biobank’s groundbreaking human proteome study, set to be the largest and most comprehensive proteomics study ever conducted.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sequencing market based on the below-mentioned segments:

United Kingdom Sequencing Market, By Working Model

- Pre-Sequencing

- Sequencing

- Data Analysis

United Kingdom Sequencing Market, By End Use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

Need help to buy this report?