United Kingdom Semaglutide Market Size, Share, and COVID-19 Impact Analysis, By Product (Ozempic, Wegovy, Rybelsus, and Others), By Route of Administration (Parenteral and Oral), and UK Semaglutide Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Semaglutide Market Forecasts to 2035

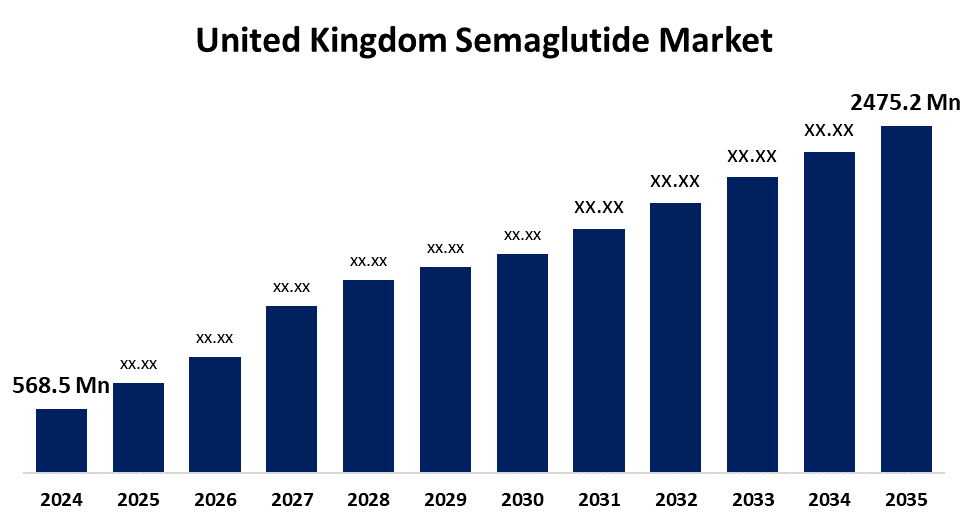

- The United Kingdom Semaglutide Market Size Was Estimated at USD 568.5 Million in 2024

- The UK Semaglutide Market Size is Expected to Grow at a CAGR of around 14.31% from 2025 to 2035

- The UK Semaglutide Market Size is Expected to Reach USD 2475.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Semaglutide Market Size is anticipated to reach USD 2475.2 Million by 2035, growing at a CAGR of 14.31% from 2025 to 2035. The UK semaglutide market is driven by the diabetes market growth historically stemmed from lifestyle changes, rising R&D investment, and expanding pharma presence. Future growth is driven by increasing diabetes prevalence, awareness, demand for safer treatments, supportive policies, and an aging population with higher diabetes risk.

Market Overview

The UK semaglutide market typically refers to the business surrounding the manufacture, marketing, and distribution of semaglutide, a drug used to treat type 2 diabetes and control obesity. It is now expanding its range of therapeutic applications. Its clinical relevance is evolving amid research examining its benefits to kidney function, heart health, and possibly even cognitive enhancement.

The UK semaglutide market is growing due to rising cases of type 2 diabetes and obesity, ongoing uptake of GLP-1 receptor agonists, and weight management therapies. Almost 5.6 million consumers in the UK have diabetes, and this number is rising. Market growth in the UK is also rising due to the rapid expansion of clinical indications, product launches, strong sales, and ongoing innovation in drug formulation and delivery, such as extended-release and oral formulations to improve compliance and reduce adverse events. Pharmaceutical companies are investing heavily in R&D, forming strategic partnerships, and expanding geographically. Notably, however, the semaglutide market has high barriers to entry, such as the challenges related to the development of peptide drugs, regulatory requirements, and high R&D costs. Regulatory bodies require extensive clinical validation, and pricing and reimbursement policies are critical for market access. Despite competition from other drugs and non-pharmacological interventions, semaglutide’s efficacy and convenience drive its continued growth.

Report Coverage

This research report categorizes the market for the UK semaglutide market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom semaglutide market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom semaglutide market.

United Kingdom Semaglutide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 568.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.31% |

| 2035 Value Projection: | USD 2475.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product and By Route of Administration |

| Companies covered:: | Novo Nordisk, Eli Lilly, Pfizer, AstraZeneca, Verdiva Bio, Boots UK, SemaPen Ltd, Amgen, Roche, Boehringer Ingelheim, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing rates of type 2 diabetes and obesity, which are caused by dietary changes and bad lifestyle choices, are driving the UK semaglutide market. It is a recommended medication because of its demonstrated efficacy in controlling blood sugar and promoting weight loss. Drug discovery breakthroughs, higher R&D spending, and rising patient and healthcare provider knowledge all contribute to the market's expansion by improving acceptance and broadening its therapeutic uses for a range of ailments.

Restraining Factors

Costs associated with treatment are the largest limiting factors for the semaglutide market in the UK, which may pose challenges for NHS funding and access for patients. Additional challenges to wider adoption and growth also stem from regulatory factors, shortages in supply, and prescribing restrictions by region. These factors hamper the semaglutide market during the forecast period.

Market Segmentation

The United Kingdom semaglutide market share is classified into product and route of administration.

- The ozempic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom semaglutide market is segmented by product into ozempic, wegovy, rybelsus, and others. Among these, the ozempic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. wide regulatory approvals, increasing use, and good clinical efficacy for type 2 diabetes. Broad distribution networks, favorable reimbursement practices, and ongoing clinical trials stand as a Leader. Growth was driven primarily by the drug's weekly dose, cardiovascular benefits, and expanding indications.

- The parenteral segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom semaglutide market is segmented by route of administration into parenteral and oral. Among these, the parenteral segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The widespread use of these soluble formulations of Ozempic and Wegovy is contributing to overall growth in this parenteral market. Their market leadership is supported by evidence of efficacy, and their previous widespread use as GLP-1 receptor agonists in obesity and diabetes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom semaglutide market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Eli Lilly

- Pfizer

- AstraZeneca

- Verdiva Bio

- Boots UK

- SemaPen Ltd

- Amgen

- Roche

- Boehringer Ingelheim

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom semaglutide market based on the below-mentioned segments:

United Kingdom Semaglutide Market, By Product

- Ozempic

- Wegovy

- Rybelsus

- Others

United Kingdom Semaglutide Market, By Route of Administration

- Parenteral

- Oral

Need help to buy this report?