United Kingdom Self-Monitoring Blood Glucose Market Size, Share, and COVID-19 Impact Analysis, By Type (Self-Monitoring Blood Glucose Devices and Continuous Blood Glucose Monitoring Devices), By Distribution Channel (Online and Offline), and United Kingdom Self-Monitoring Blood Glucose Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Self-Monitoring Blood Glucose Market Insights Forecasts to 2035

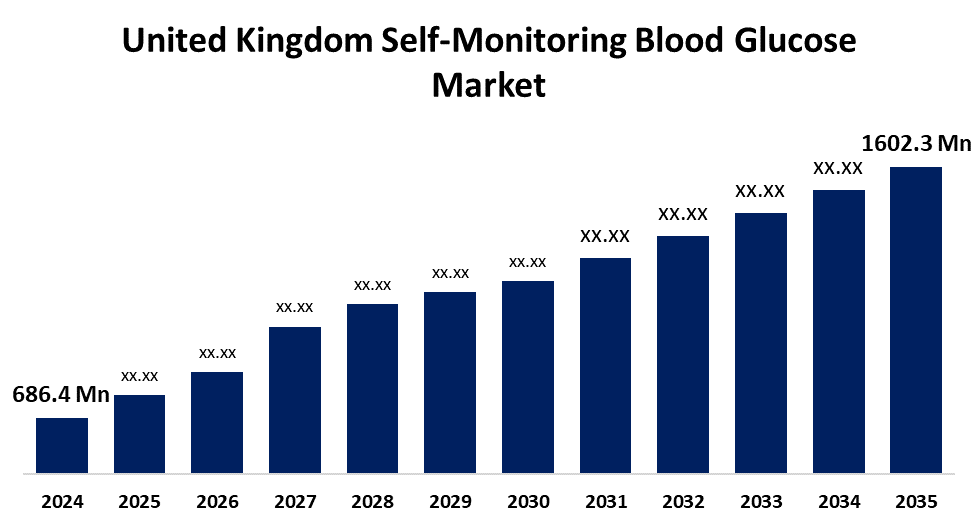

- The United Kingdom Self-Monitoring Blood Glucose Market Size Was Estimated at USD 686.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.01% from 2025 to 2035

- The United Kingdom Self-Monitoring Blood Glucose Market Size is Expected to Reach USD 1602.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Self-Monitoring Blood Glucose Market Size is Anticipated to reach USD 1602.3 Million By 2035, Growing at a CAGR of 8.01% from 2025 to 2035. The increasing incidences of diabetes, expanding health monitoring awareness, improvements in glucose monitoring technology, and a worldwide need for simple to utilize, precise, and real-time blood glucose monitoring equipment.

Market Overview

The United Kingdom self-monitoring blood glucose market refers to the industry involves the development and application of tools that enable individuals, particularly those with diabetes, to measure their blood glucose levels on their own. By providing real-time data, these portable monitoring devices assist patients in efficiently managing their conditions. The market for glucose meters, test strips, lancets, and associated accessories is being pushed by the UK's growing diabetes prevalence, technical improvements, and growing awareness of chronic illness management and self-care. The increase in prediabetes and diabetes cases. The market demand is rising as a consequence of government measures supporting digital healthcare solutions and growing awareness of proactive health management. Improved accuracy and user comfort are provided by technological innovations including continuous glucose monitoring and gadgets that connect to smartphones. Growth prospects in this market are further enhanced by an older population and rising acceptance of home healthcare methods. The integration of smartphone apps with Bluetooth-enabled glucometers to share data and track in real time. By improving accuracy, user convenience, and tailored health insights, non-invasive sensors, AI-driven predictive analytics, and continuous glucose monitoring (CGM) systems are revolutionizing the management of diabetes.

Report Coverage

This research report categorizes the market for the United Kingdom self-monitoring blood glucose market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom self-monitoring blood glucose market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom self-monitoring blood glucose market.

United Kingdom Self-Monitoring Blood Glucose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 686.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.01% |

| 2035 Value Projection: | USD 1602.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Lifescan, Dexcom, Roche Diabetes Care, Abbott Diabetes Care, Ascensia Diabetes Care, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising health consciousness, a growing number of individuals with diabetes, and a focus on early disease management. Government programs encouraging early diagnosis and self-care, along with the rising prevalence of type 1 and type 2 diabetes, greatly contribute to market expansion. The ease and adherence of users are being improved by technological innovations including smartphone integration, continuous glucose monitoring (CGMs), and portable glucometers. The need for self-monitoring solutions is also growing as the outcome of sedentary lifestyles, poor eating habits, and an aging population. In order to avoid complications, cut down on hospitalizations, and enhance long-term health outcomes, medical practitioners are also increasingly recommending home monitoring.

Restraining Factors

The high expense of sophisticated monitoring equipment, restrictive reimbursement guidelines, and misunderstanding among some demographics. Furthermore, widespread adoption and regular use may be hampered by device inaccuracy, human discomfort during frequent testing, and the complexity of certain monitoring systems.

Market Segmentation

The United Kingdom self-monitoring blood glucose market share is classified into type and distribution channel.

- The self-monitoring blood glucose devices segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom self-monitoring blood glucose market is segmented by type into self-monitoring blood glucose devices and continuous blood glucose monitoring devices. Among these, self-monitoring blood glucose devices segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing rates of diabetes, increasing awareness of blood sugar control, easy-to-use technology, and government programs encouraging home monitoring, all of which help patients better manage their illness through enabling them to regularly check their blood sugar levels.

- The offline segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom self-monitoring blood glucose market is segmented by distribution channel into online and offline. Among these, the offline segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is widely available at pharmacies and medical facilities, providing rapid access to products and individualized support. Nonetheless, the online market is expanding quickly due to factors including rising internet usage, convenience of shopping, and tech-savvy customers' demand for doorstep delivery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom self-monitoring blood glucose market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lifescan

- Dexcom

- Roche Diabetes Care

- Abbott Diabetes Care

- Ascensia Diabetes Care

- Others.

Recent Developments:

- In August 2022, Dexcom launched the Dexcom ONE CGM system, which provides real-time glucose monitoring without the need for finger pricks. The system delivers continuous data directly to smartphones or receivers, assisting individuals with Type 1 or Type 2 diabetes in managing their condition more effectively.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom self-monitoring blood glucose market based on the below-mentioned segments

United Kingdom Self-Monitoring Blood Glucose Market, By Type

- Self-Monitoring Blood Glucose Devices

- Continuous Blood Glucose Monitoring Devices

United Kingdom Self-Monitoring Blood Glucose Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?