United Kingdom Sclerotherapy Market Size, Share, and COVID-19 Impact Analysis, By Type (Ultrasound Sclerotherapy, Liquid Sclerotherapy, and Foam Sclerotherapy), By Application (Varicose Veins, Malformed Lymph Vessels, Hemorrhoids, and Hydroceles), and UK Sclerotherapy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Sclerotherapy Market Size Forecasts to 2035

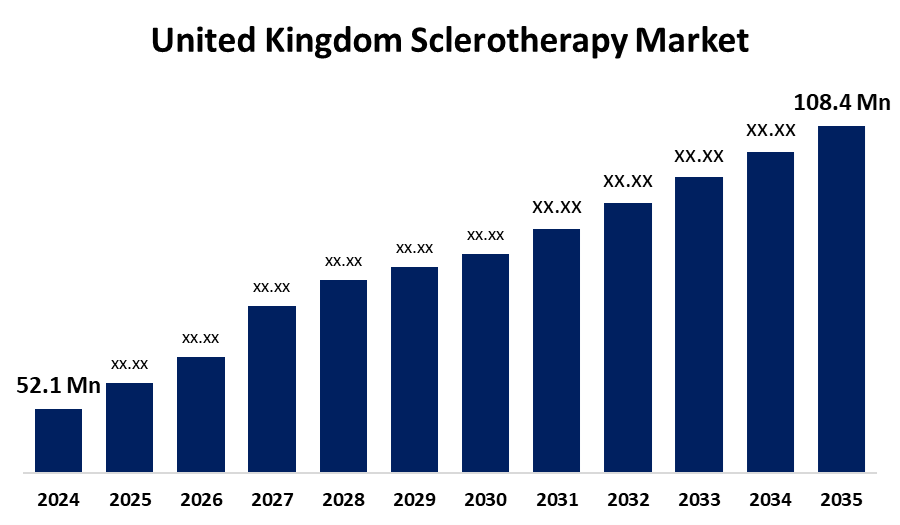

- The United Kingdom Sclerotherapy Market Size Was Estimated at USD 52.1 Million in 2024

- The UK Sclerotherapy Market Size is Expected to Grow at a CAGR of around 6.89% from 2025 to 2035

- The UK Sclerotherapy Market Size is Expected to Reach USD 108.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Sclerotherapy Market Size is anticipated to reach USD 108.4 million by 2035, growing at a CAGR of 6.89% from 2025 to 2035. The market for sclerotherapy is rising due to the prevalence of varicose veins, advancements in technology for venous problems, and the growing demand for minimally invasive procedures are all impacted by the ageing population. The market for sclerotherapy is greatly influenced by factors including the prevalence of venous disorders and technical advancements.

Market Overview

The UK sclerotherapy market refers to a medical procedure used to treat veins and varicosities. It involves directly injecting a sclerosant solution into the affected veins, which causes them to gradually collapse and disappear. This minimally invasive procedure is commonly used to improve vein aesthetics and alleviate venous insufficiency symptoms. The sclerotherapy market is being driven by the rising incidence of venous diseases, including varicose veins and chronic venous insufficiency, as patients seek less invasive, effective treatments that can improve their symptoms and appearance. Foam sclerotherapy and ultrasound-guided procedures are developments in sclerotherapy techniques and sclerosants that have enhanced the precision, effectiveness, and safety of the treatment, while also expanding the treatment to new venous diseases. These improvements increase the effectiveness and safety of the procedures, which leads providers to offer them more broadly.

Additionally, minimally invasive procedures have advantages over surgery, such as quicker recovery periods, fewer problems, and less scarring. patients are choosing them more and more. Patient demand and compliance are increasing as a result of increased knowledge and instruction regarding the benefits of sclerotherapy. The market for sclerotherapy is expected to increase significantly due to rising patient preferences, expanded indications, and technical advancements as healthcare systems make these cutting-edge therapies more accessible.

Report Coverage

This research report categorizes the market for the UK sclerotherapy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sclerotherapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sclerotherapy market.

United Kingdom Sclerotherapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.89% |

| 2035 Value Projection: | USD 108.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Viatris Inc., Boston Scientific, Medtronic, AngioDynamics, Chemische Fabrik Kreussler & Co. GmbH, BTG, Guy’s and St Thomas’, Veincentre, UK Vein Clinic Group Ltd, VeinCentre, AVA Clinics, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Sedentary lifestyles, obesity, and ageing are contributing to the increasing prevalence of varicose and spider veins, which is increasing demand for sclerotherapy, a minimally invasive, successful treatment that is less expensive and requires less recovery time than surgery. Innovations in technology, such as enhanced foam sclerotherapy and ultrasound imaging, improve patient outcomes by enhancing diagnostic and treatment effectiveness. The UK sclerotherapy market expansion is also being driven by healthcare professionals' adoption of sophisticated, user-friendly technology and patients' growing choice for quick, less invasive operations.

Restraining Factors

The market for sclerotherapy in the UK is constrained by low public awareness, expensive private clinic treatment, and limited NHS coverage. Additionally, despite sclerotherapy's efficacy as a minimally invasive treatment for vein-related illnesses, a lack of qualified experts and worries about side effects or recurrence prevent wider adoption. These factors hamper the sclerotherapy market during the forecast period.

Market Segmentation

The United Kingdom sclerotherapy market share is classified into type and application.

- The foam sclerotherapy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sclerotherapy market is segmented by type into ultrasound sclerotherapy, liquid sclerotherapy, and foam sclerotherapy. Among these, the foam sclerotherapy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Foam formulations give greater visibility and vein wall contact, which enhances their effectiveness. The popularity of foam sclerotherapy has grown, due mainly to patient preference for less invasive alternatives to established venous treatments. In addition, clinical studies continue to demonstrate the efficacy and safety of foam sclerotherapy for the treatment of various venous diseases, elevating its status as a leading treatment modality in the sclerotherapy industry.

- The hemorrhoids segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sclerotherapy market is segmented by application into varicose veins, malformed lymph vessels, hemorrhoids, and hydroceles. Among these, the hemorrhoids segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The large instances of adult haemorrhoids. Hemorrhoids are a common condition that often needs effective treatment options. Sclerotherapy is a non-invasive option that people who want pain relief find appealing. This segment continues to lead in market share due to a rise in the choice of non-surgical interventions and greater awareness of treatment options for haemorrhoids. Additionally, doctors are increasingly recommending sclerotherapy as a first-line treatment for the management of hemorrhoids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sclerotherapy market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Viatris Inc.

- Boston Scientific

- Medtronic

- AngioDynamics

- Chemische Fabrik Kreussler & Co. GmbH

- BTG

- Guy’s and St Thomas’

- Veincentre

- UK Vein Clinic Group Ltd

- VeinCentre

- AVA Clinics

- Others

Recent Developments:

- In November 2024, Guy’s and St Thomas’ NHS Trust launched London’s first nurse-led foam sclerotherapy service, reducing wait times from over 12 weeks to under 6 weeks for venous leg ulcer patients

- In Sept 2024, Veincentre, a leading private provider with over more than 40 clinics, recently opened new locations in Canterbury and expanded its Liverpool site to meet growing local demand

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sclerotherapy market based on the below-mentioned segments:

United Kingdom Sclerotherapy Market, By Type

- Ultrasound Sclerotherapy

- Liquid Sclerotherapy

- Foam Sclerotherapy

United Kingdom Sclerotherapy Market, By Application

- Varicose Veins

- Malformed Lymph Vessels

- Hemorrhoids

- Hydroceles

Need help to buy this report?