United Kingdom Satellite Transponder Market Size, Share, and COVID-19 Impact Analysis, By Bandwidth (C-Band, KU-Band, KA-Band, K-Band, and Others), By Service (Leasing, Maintenance and Support, and Others), and United Kingdom Satellite Transponder Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsUnited Kingdom Satellite Transponder Market Insights Forecasts to 2035

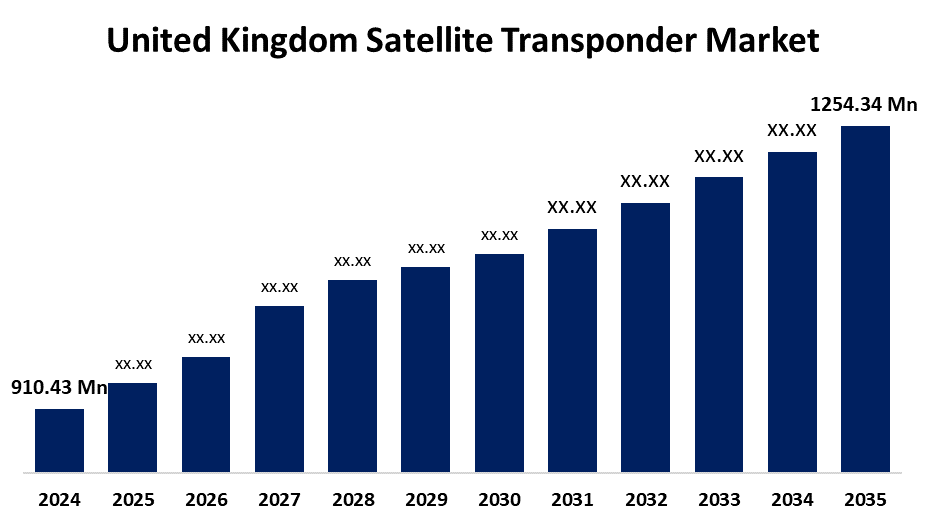

- The United Kingdom Satellite Transponder Market Size was estimated at USD 910.43 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.96% from 2025 to 2035

- The United Kingdom Satellite Transponder Market Size is Expected to Reach USD 1254.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the United Kingdom Satellite Transponder Market Size is anticipated to reach USD 1254.34 Million by 2035, growing at a CAGR of 2.96% from 2025 to 2035. The market is expanding as a result of the widespread use of mobile devices and the expanding uptake of broadband services. Furthermore, it is anticipated that the growing use of satellite communications for government and military purposes would present substantial growth prospects.

Market Overview

The United Kingdom satellite transponder market refers to the industry focused on the production and application of a communication link between the satellite's transmitting and receiving antennas and the ground-based base station. In a satellite, a transponder serves as both the transmitter and the receiver. Typically, satellites are connected to wireless communications devices. The focus of satellite operators has shifted to providing bandwidth-correlated high-capacity satellite transponders that can increase transponder throughput, so reducing costs and, in essence, providing the user with additional value. It sends the signal at different frequencies after receiving it, which helps different navigation, location, and identification systems like GPS work. In order to avoid signal interference, it also chooses distinct frequency settings for uplink and downlink. For example, when a control point requests it, the Radio-Frequency Identification Device (RFID) sends out a coded signal. The position of the transponder output signal is continuously tracked. Furthermore, the gadget can function over thousands of kilometers because the input (receiver) and output (transmitter) frequencies are pre-assigned.

Report Coverage

This research report categorizes the market for the United Kingdom satellite transponder market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom satellite transponder market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom satellite transponder market.

United Kingdom Satellite Transponder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 910.43 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.96% |

| 2035 Value Projection: | USD 1254.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Bandwidth, By Service |

| Companies covered:: | Surrey Satellite Technology Ltd (SSTL), OneWeb (Oneweb.World), Inmarsat Plc, Avanti Communications, Talia Communications Ltd, Satlink Ltd, ETL Systems Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom satellite transponders is driven by the rising demand for high-definition television (HDTV) sets and the proliferation of some applications. Additionally, the market growth has been positively driven by rising frequency adoption rates for voice, video, and data communications. The growing demand for satellite-based Internet of Things services, the rise of new space technologies, and the expanding use of software-defined satellites are some of the major trends in the satellite transponder industry. The market is anticipated to be shaped by these trends, which will present fresh chances for expansion and creativity. Market companies are concentrating on creating flexible and affordable transponder solutions in order to take advantage of these prospects, as well as investigating new markets and applications.

Restraining Factors

However, the market expansion could be restricted because of high capital & operational costs, spectrum & orbital resource scarcity, regulatory & licensing complexity, supply chain & technological dependencies.

Market Segmentation

The United Kingdom satellite transponder market share is classified into bandwidth and services.

- The C-band segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom satellite transponder market is divided by bandwidth into C-band, Ku-band, Ka-band, K-band, and others. Among these, the C-band segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its employment in conventional satellite applications like television broadcasting, the C-Band market is also anticipated to increase steadily. Further, powered by reliable, high-capacity connections, even in inclement weather.

- The leasing segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom satellite transponder market is segmented by service into leasing, maintenance and support, and others. Among these, the leasing segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period. The majority of consumers (media firms, telcos, and the government) would rather lease capacity than create assets because satellite launch and production are expensive. Flexibility and less risk without heavy hardware ownership or long-term obligations, leasing enables market players to expand use or switch providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom satellite transponder market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Surrey Satellite Technology Ltd (SSTL)

- OneWeb (Oneweb.World)

- Inmarsat Plc

- Avanti Communications

- Talia Communications Ltd

- Satlink Ltd

- ETL Systems Ltd

- Others

Recent Developments:

- In September 2024, AMSAT-UK officially announced an exciting new project, the FUNcube Lite payload aboard the upcoming Jovian-1 satellite, a 6U CubeSat being developed by Space South Central, the UK’s largest regional space cluster. This initiative is part of the JUPITER program, a collaboration between the universities of Surrey, Portsmouth, and Southampton, designed to provide hands-on experience in the space industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom satellite transponder market based on the below-mentioned segments:

United Kingdom Satellite Transponder Market, By Bandwidth

- C-Band

- KU-Band

- KA-Band

- K-Band

- Others

United Kingdom Satellite Transponder Market, By Service

- Leasing

- Maintenance and Support

- Others

Need help to buy this report?