United Kingdom Sailboat Market Size, Share, and COVID-19 Impact Analysis, By Hull Type (Monohull and Multi-hull), By Length (Up to 20ft., 20-50 ft., and Above 50 ft.), By Propulsion Technology (Variable Pitch Props, Fixed Pitch Props, and Folding Props), and UK Sailboat Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Sailboat Market Forecasts to 2035

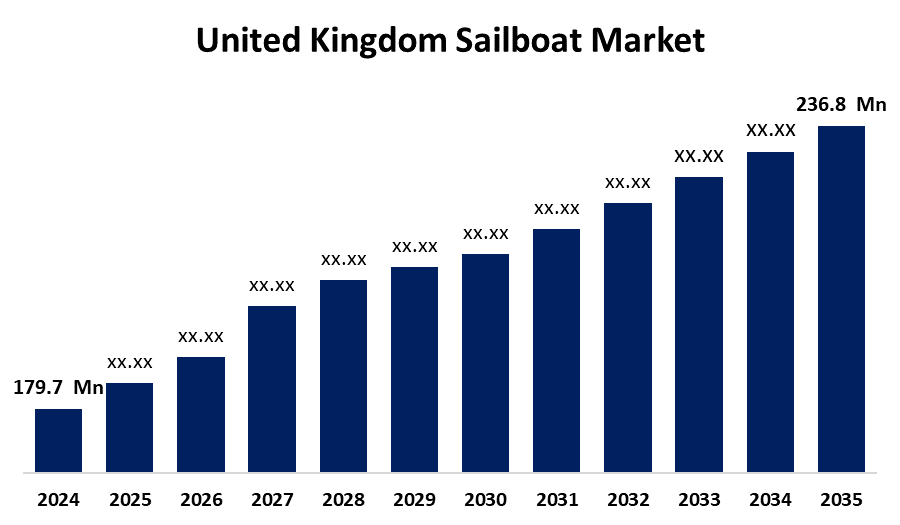

- The United Kingdom Sailboat Market Size Was Estimated at USD 179.7 Million in 2024

- The UK Sailboat Market Size is Expected to Grow at a CAGR of around 2.54% from 2025 to 2035

- The UK Sailboat Market Size is Expected to Reach USD 236.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Sailboat Market is anticipated to reach USD 236.8 million by 2035, growing at a CAGR of 2.54% from 2025 to 2035. A rise in disposable income levels has given the market a positive growth trajectory and increased its attractiveness to a larger audience.

Market Overview

The UK sailboat market includes the manufacture, distribution, and servicing of sailboats, which include boats that are moved by sails instead of engines. Sailboats may be tiny day sailors to large ocean-going yachts and are made for leisure sailors, racers, and cruise travellers. These market segments represent both sport and leisure portions of the marine industry. Growth in the sailboat industry is being driven by increased environmental awareness, improvements in technology, and a surge of interest in outdoor recreation. Sailboat manufacturers are investing exuberantly in heavy research and development to produce more environmentally friendly and efficient sailboats with electric propulsion systems and renewable energy systems. Innovations in technology that specialize in sailing, such as automated sail controllers and more sophisticated navigation devices, make sailing more enjoyable than ever. Environmental regulations concerning emissions and waste are promoting cleaner manufacturing and sustainable materials. Rising disposable incomes and enthusiasm for recreational sailing are boosting demand, particularly for mid-to-large sailboats 30–50 feet, that offer both performance and luxury, appealing to seasoned sailors. Simultaneously, mini yachts 20–30 feet are gaining traction due to their affordability and user-friendliness, opening new market opportunities. Overall, the industry is shifting toward greener, more advanced, and diverse product offerings to meet evolving consumer expectations and regulatory requirements.

Report Coverage

This research report categorizes the market for the UK sailboat market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom sailboat market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom sailboat market.

United Kingdom Sailboat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 179.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.54% |

| 2035 Value Projection: | USD 236.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Hull Type, By Length, By Propulsion Technology and COVID-19 Impact Analysis |

| Companies covered:: | Oyster Yachts, Berthon, Fairline, Sunseeker, Beneteau, The Multihull Centre, Discovery Yachts, Hanse Yachts, Jeanneau, Westerly Yachts, Dufour Yachts, Hallberg-Rassy, Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for sailboats is driven by the growing demand for luxury boats, rising disposable incomes, and the UK's interest in recreational boating. Innovations in lightweight, long-lasting materials improve performance and draw in more customers. Furthermore, when sailing organisations and events proliferate, community involvement and participation are encouraged, which boosts the market and increases consumer interest in sailing. The sailboat market presents a strong opportunity for growth through environmentally friendly innovations, growing interest in emerging markets, more entry-level models for beginner sailors, and smart technology. These trends will continue to promote accessibility, will make the market more sustainable, and will improve the user experience by attracting more customers and promoting further expansion within the UK market.

Restraining Factors

The high cost of maintenance and ongoing costs, the sailboat market is limited and unreasonable for plenty of people. Beginners are usually discouraged by a lack of sailing skills as well as safety concerns. These issues all work together to minimize market growth and create hesitation for prospective buyers. Seasonal use also lowers year-round usability, and it is usually limited by environmental and regulatory restrictions in protected areas. These factors hamper the sailboat market during the forecast period.

Market Segmentation

The United Kingdom sailboat market share is classified into hull type, length, and propulsion technology

- The monohull segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sailboat market is segmented by hull type into monohull and multi-hull. Among these, the monohull segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Historically, monohulls have been the choice of sailors. The classic style and aesthetic of monohulls were generally preferred by recreational sailors. Many sailors enjoy sailing for recreation, and many sailors enjoy sailing in the classic monohull shape. Monohulls are also commonly used in sailing competitions and racing tournaments, which promotes their continued popularity. The adventure and exploration have begun embracing monohull sailboats because their designs have evolved into more meaningfully long-distance cruising vessels.

- The 20-50 ft. segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sailboat market is segmented by length into up to 20 ft., 20-50 ft., and above 50 ft. Among these, the 20-50 ft. segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Advances in materials, including carbon fibre and advanced composites, have influenced the windage, durability, and overall performance of sailboats in the 20-50-foot length range. Similarly, advances in new navigation instruments, safety gear, and more environmentally sustainable motor technologies have made sailing easier and more enjoyable.

- The fixed pitch props segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom sailboat market is segmented by propulsion technology into variable pitch props, fixed pitch props, and folding props. Among these, the fixed pitch props segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fixed pitch props are one of the most important and most used parts in the market. They are very popular with sailors as they are dependable and easy to work with. Fixed pitch props operate the same all the time, as the angle of the blades is fixed. These boats are inexpensive, have little or no maintenance, and can sail or motor. Fixed pitch props are popular for their base level reliability and simplicity of use, especially for cruisers who appreciate being cost-effective and reliable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom sailboat market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oyster Yachts

- Berthon

- Fairline

- Sunseeker

- Beneteau

- The Multihull Centre

- Discovery Yachts

- Hanse Yachts

- Jeanneau

- Westerly Yachts

- Dufour Yachts

- Hallberg-Rassy

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom sailboat market based on the below-mentioned segments:

United Kingdom Sailboat Market, By Hull Type

- Monohull

- Multi-hull

United Kingdom Sailboat Market, By Length

- Up to 20ft.

- 20-50 ft.

- Above 50 ft.

United Kingdom Sailboat Market, By Propulsion Technology

- Variable Pitch Props

- Fixed Pitch Props

- Folding Props

Need help to buy this report?