United Kingdom Saccharin Market Size, Share, and COVID-19 Impact Analysis, By Product (Sodium Saccharin, Calcium Saccharin, and Liquid Saccharin), By Application (Food & Beverages, Pharmaceuticals, Tabletop Sweetener, and Others), and UK Saccharin Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Saccharin Market Forecasts to 2035

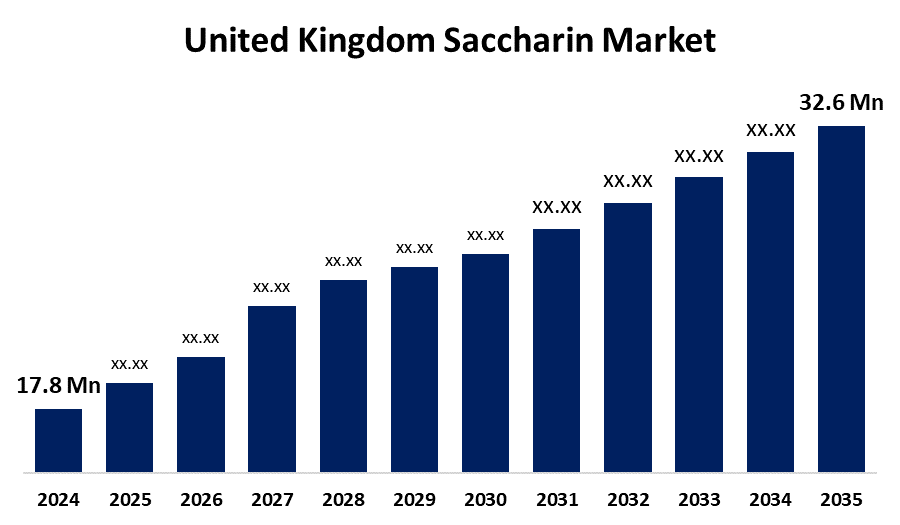

- The United Kingdom Saccharin Market Size Was Estimated at USD 17.8 Million in 2024

- The UK Saccharin Market Size is Expected to Grow at a CAGR of around 5.66% from 2025 to 2035

- The UK Saccharin Market Size is Expected to Reach USD 32.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Saccharin Market Size is anticipated to reach USD 32.6 Million by 2035, growing at a CAGR of 5.66% from 2025 to 2035. The driving factor for the UK saccharin market is an increase in consumer demand for low-calorie sweeteners, driven by rising health consciousness and the increasing prevalence of lifestyle diseases related to obesity and diabetes.

Market Overview

The UK saccharin market refers to a high-intensity sweetener that can be used as an alternative to sugar. 200–700 times sweeter than table sugar (sucrose), it is a white, crystalline powder. They can be used in food and drink, pharmaceuticals, personal care items, and industrial operations like electroplating because of their stability in hot and acidic environments.

As more consumers become aware of the health risks associated with high sugar intake, they increasingly utilize saccharin, a zero-calorie artificial sweetener. Saccharin is widely used in the food and beverage industry soft drinks, baked products, sugar-free snacks, etc. Saccharin is chosen in such products because it is more stable in heat and acids compared to the other alternative sweeteners, it has a high sweetness intensity, and most importantly, it is inexpensive. Saccharin has also expanded its applications to pharmaceuticals, where it masks the bitter taste in medications, and personal care products such as toothpaste and mouthwash. It is also being used by the animal feed industry to enhance feed flavour. Saccharin is becoming more versatile due to improvements in its taste and solubility brought about by continuous research and development. Its usage is also being encouraged by regulatory assistance, such as the removal of saccharin from lists of harmful substances and the approval of it as a food additive. In the UK, the sweetener's increasing accessibility and market growth have also been facilitated by urbanisation, increased disposable incomes, and the expansion of internet retail platforms.

Report Coverage

This research report categorizes the market for the UK saccharin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom saccharin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom saccharin market.

United Kingdom Saccharin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.66% |

| 2035 Value Projection: | USD 32.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 145 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Tate & Lyle, Cargill, DuPont, Ingredion, Aspartame International, PureCircle, GLG Life Tech Corporation, Plater Group, Airedale Group, Kilo Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for low-calorie and sugar-free products has led to the use of saccharin in food and beverages, pharmaceuticals, and animal feed. Saccharin remains a popular sweetener because it is stable, very low calorie, or is inexpensive as health-aware consumers seek cleaner labels and sugar alternatives. Its applications have increased due to technological advancements that increase the efficiency and purity with which saccharin can be used. Saccharin is particularly beneficial for diabetics and those on low-calorie diets since it adds sweetness without adding calories or affecting blood sugar. It is ideal also for syrups, pharmaceuticals, and sugar-free food products.

Restraining Factors

Consumer preference for natural sweeteners has led to less usage of artificial sweeteners. Even with the regulatory commendation and in plant-based and health-focused products, saccharin can be a challenge due to concerns about health risks, and a negative perception of synthetic additives. These factors hamper the saccharin market during the forecast period.

Market Segmentation

The United Kingdom saccharin market share is classified into product and application.

- The sodium saccharin segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom saccharin market is segmented by product into sodium saccharin, calcium saccharin, and liquid saccharin. Among these, the sodium saccharin segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Sodium saccharin is the most widely used type of sweetener due to its excellent water solubility and extreme sweetness, approximately 300–500 times that of common sugar. Sodium saccharin is so versatile that it is appropriate for multiple applications, including sweeteners for sugar-free snacks, baked goods, candies, jams, and soft drinks. Sodium often also used in mouthwash and toothpaste as a flavor enhancer and to mask poop the. Only the pharmaceutical industry uses sodium saccharin for syrups, various medicines, and chewable tablets.

- The food & beverages segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom saccharin market is segmented by application into food & beverages, pharmaceuticals, tabletop sweetener, and others. Among these, the food & beverages segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Saccharin is commonly used as a non-nutritive sweetener in food and beverage applications because it is highly sweet, stable, and intense. Evolving consumer preferences for low-calorie, sugar-free, and no-calorie products, growing health concerns such as obesity and diabetes, and regulatory pressure to reduce sugar in processed foods also drive saccharin use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom saccharin market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tate & Lyle

- Cargill

- DuPont

- Ingredion

- Aspartame International

- PureCircle

- GLG Life Tech Corporation

- Plater Group

- Airedale Group

- Kilo Ltd

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom saccharin market based on the below-mentioned segments:

United Kingdom Saccharin Market, By Product

- Sodium Saccharin

- Calcium Saccharin

- Liquid Saccharin

United Kingdom Saccharin Market, By Application

- Food & Beverages

- Pharmaceuticals

- Tabletop Sweetener

- Others

Need help to buy this report?