United Kingdom Rum Market Size, Share, and COVID-19 Impact Analysis, By Type (White Rum, Dark and Gold Rum, Spiced Rum, Others), By Nature (Plain Rum, Flavored Rum, Organic Rum, Conventional Rum, Other Categories), and United Kingdom Rum Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Rum Market Insights Forecasts to 2035

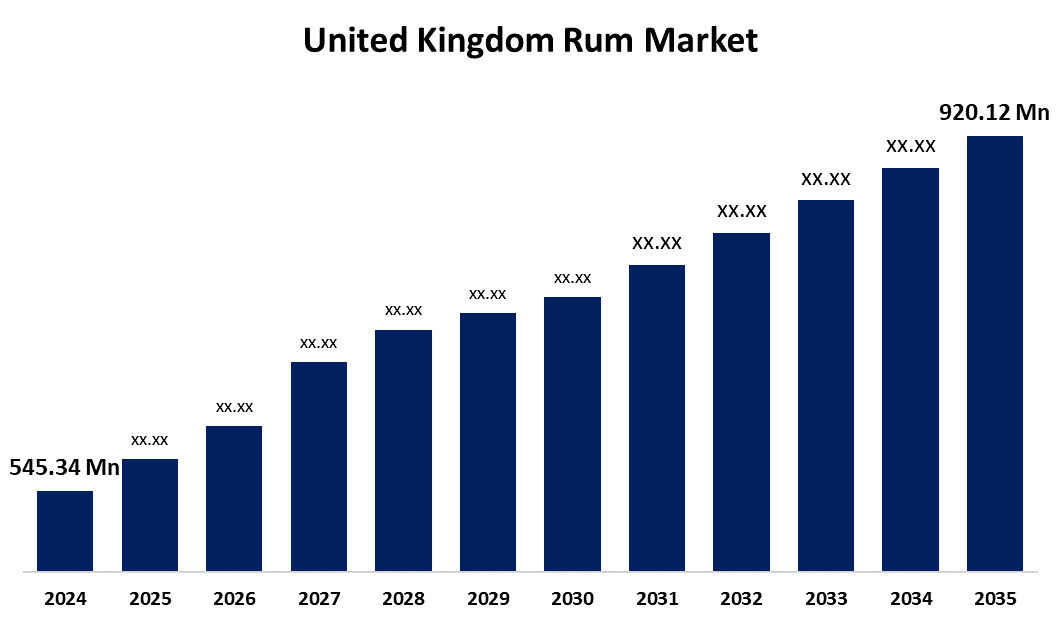

- The United Kingdom Rum Market Size was Estimated at USD 545.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.87% from 2025 to 2035

- The United Kingdom Rum Market Size is Expected to Reach USD 920.12 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the United Kingdom Rum Market Size is anticipated to reach USD 920.12 Million by 2035, Growing at a CAGR of 4.87% from 2025 to 2035. The industry is expanding rapidly due to millennials' growing desire for distilled liquor and their attraction to spirits with unique personalities and cultural roots.

Market Overview

The remaining fermented sugarcane juice or molasses is used to make rum as an extended beverage industry across the country, and overall revenue and this process, application, and distribution is known as the rum market within the UK territory. The UK country always attracts consumers, local citizens, and national and international vendors with the help of its cultural heritage, along with the hype of super food and super drink, making the country's food and beverages sector. Barrels of oak are used to mature rum, giving it color and flavor. Sugarcane was brought to the Caribbean by European invaders, and this is where rum originated. As a rare and traditional beverage, its manufacture and consumption are intricately woven into the fabric of culture, representing resiliency, legacy, and camaraderie. Rums can be white, silver, golden, amber, dark, and spiced. White Rum, which is used in cocktails, has a milder flavor and color. Moreover, to improve its flavor and color, Golden Rum is matured for a short time in oak barrels. Longer maturing gives dark rum, spiced with nutmeg, vanilla, and cinnamon, a deeper flavor. Rum is used to flavor cakes, sauces, and marinades. It can be consumed straight or blended. Companies are using cutting-edge marketing techniques to attract consumers in new customer categories. Limited edition rums are being introduced, which contributes to the urgency and uniqueness of the product. Additionally, the strategies increase brand appeal and stimulate customer interest and loyalty when paired with compelling narrative and focused promotions.

Report Coverage

This research report categorizes the market for the United Kingdom rum market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom rum market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom rum market.

United Kingdom Rum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 545.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.87% |

| 2035 Value Projection: | USD 920.12 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Nature, and COVID-19 Impact Analysis |

| Companies covered:: | Campari Group, Main Rum Company Limited, Pernod Ricard UK, The Island Rum Company AS, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing customer preference for premium and artisan rum products is one of the major factors propelling the national rum industry. Consumers are willing to investigate new and superior rum products as they get pickier about the alcoholic beverages they purchase, specifically for high-need on special occasions. The tendency has been further increased by the premiumization of alcoholic beverages, as customers are looking for small-batch, craft, and higher-quality rums with sophisticated flavor profiles. Additionally, the advent of novel and exotic flavors like tropical fruits, spices, and dessert-inspired varieties has increased the appeal of rum, particularly among younger and adventurous consumers, propelling sales both on and off the market. The rise in disposable income, which enables consumers to spend more on leisure and recreational activities, is a key aspect. The demand for high-end alcoholic beverages is increasing as the area's urbanization picks up speed.

Restraining Factors

The price volatility, stringent laws, and trade restrictions enforced by the country impact the rum sector. Gin, vodka, whiskey, and other alcoholic beverages are fierce rivals to the rum business may constrain the market share and development potential.

Market Segmentation

The United Kingdom rum market share is classified into type and nature.

- The spiced rum segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom rum market is segmented by type into white rum, dark and gold rum, spiced rum, and others. Among these, the spiced rum segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. The segment growth is driven by because young consumers who are looking for experiences that are novelty-driven and have sweeter, more approachable profiles find it very appealing. This sector is very adaptable and trend-responsive due to the growth of ready-to-drink (RTD) cocktails, mixology experimentation, and consumer demand for seasonal or exotic flavor infusions. Additionally, its reduced entrance hurdle in comparison to conventional aged rums encourages wider usage at festivals, social gatherings, and informal settings.

- The flavored rum segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom rum market is segmented by nature into plain rum, flavored rum, organic rum, conventional rum, and other categories. Among these, the flavored rum segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of customer demand for novel and intriguing flavors. Fruit, spice, and other aromatic infusions have increased the market's attractiveness for rum and drawn in a younger, more varied customer base.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom rum market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Campari Group

- Main Rum Company Limited

- Pernod Ricard UK

- The Island Rum Company AS

- Others

Recent Developments:

- In May 2025, Ron Barcelo officially partnered with Disaronno International UK to expand its presence in the UK market. This new distribution agreement will allow UK consumers to access a broader portfolio of premium rums, including Barceló Imperial Premium Blend 40 Aniversario, Imperial Onyx, Imperial, Organic, Gran Añejo, Blanco Añejado, and Dorado Añejado.

- In March 2025, Wray & Nephew launched Wray’s 43, a UK-exclusive white Jamaican rum with 43% ABV2. This marks the brand’s first new UK release in years, coinciding with its 200th anniversary.

- In May 2023, DropWorks, Britain’s newest rum brand, launched Clear Drop Rum, an innovative product created using a world-first distillation process. The distillery, located in Sherwood Forest, Nottinghamshire, is set to become Europe’s largest rum distillery.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom rum market based on the below-mentioned segments:

United Kingdom Rum Market, By Type

- White Rum

- Dark and Gold Rum

- Spiced Rum

- Others

United Kingdom Rum Market, By Nature

- Plain Rum

- Flavored Rum

- Organic Rum

- Conventional Rum

- Other Categories

Need help to buy this report?