United Kingdom Rubber Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural, and Synthetic), By Application (Tire, Non-Tire Automotive, Footwear, Industrial Goods, and Others), and UK Rubber Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Rubber Market Forecasts to 2035

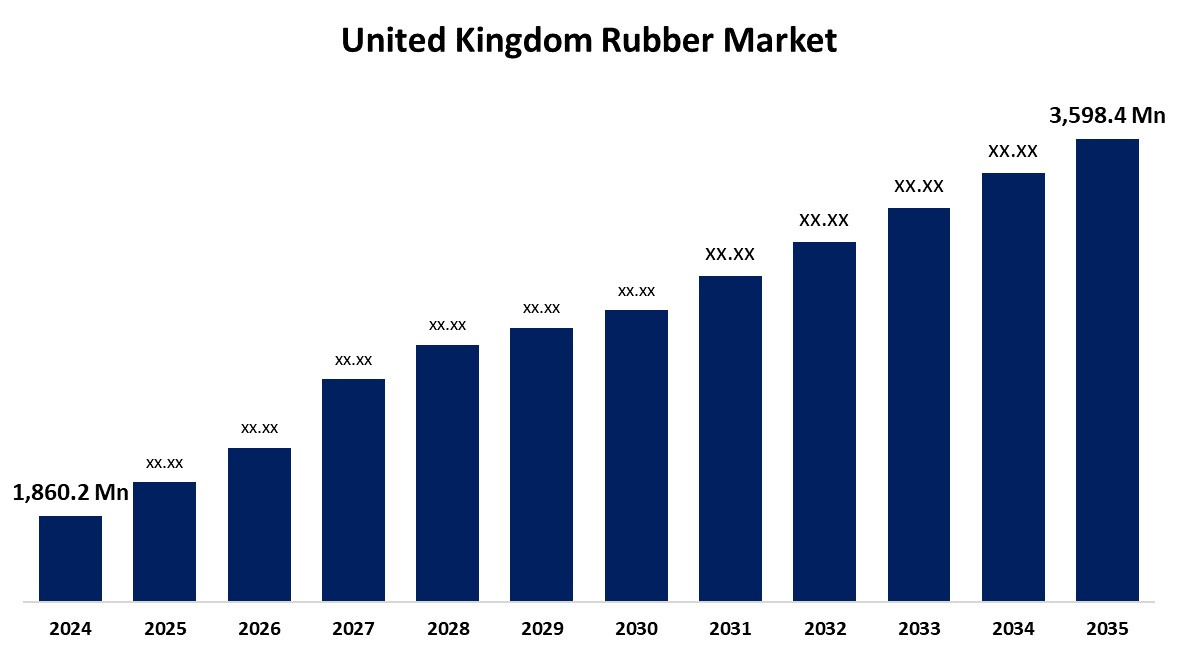

- The United Kingdom Rubber Market Size Was Estimated at USD 1,860.2 Million in 2024

- The UK Rubber Size is Expected to Grow at a CAGR of around 6.18% from 2025 to 2035

- The UK Rubber Market Size is Expected to Reach USD 3,598.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Rubber Market Size is Anticipated to Reach USD 3,598.4 Million by 2035, Growing at a CAGR of 6.18% from 2025 to 2035. The market is expanding rapidly, fuelled by rising demand in the automotive and healthcare industries, ongoing developments in rubber manufacturing technology, and the effects of economic expansion and urbanization.

Market Overview

The UK rubber market refers to the manufacturing, processing, and distribution of both natural and synthetic rubber products. These rubber products serve a broad spectrum of industries, including automotive, construction, industrial, healthcare, consumer goods, and packaging. Demand for rubber products is influenced by economic conditions, technological advancements, evolving consumer preferences, and regulatory changes. The market is highly competitive, featuring numerous manufacturers, processors, and distributors. Besides natural and synthetic rubber, specialty rubbers such as neoprene, used in wetsuits and electrical insulation, and silicone, utilized in high-temperature environments and medical devices, are also available for specialized applications. Furthermore, the growth of infrastructure and urbanization has boosted the demand for rubber in construction and industrial applications. Advances in synthetic rubber technology have enhanced its qualities, leading to wider adoption across various industries. Additionally, a stronger focus on sustainability has driven progress in recycled and eco-friendly rubber products, influencing consumer preferences and regulatory standards, which in turn contributes to the ongoing expansion of the rubber market. The rapid growth in UK automobile manufacturing is expected to substantially boost the demand for natural rubber, particularly for tire production. Rubber constitutes about 15% of a typical car tire and 30% of a truck tire. Its unique performance characteristics make it indispensable to the automotive sector. According to the Society of Motor Manufacturers and Traders, UK automotive production increased by 21% in January 2024 compared to the previous month, with 29,590 hybrid and electric vehicles produced. More than 75% of these vehicles were exported, and exports have been steadily rising. This trend is expected to drive higher natural rubber demand in the UK throughout the forecast period.

Report Coverage

This research report categorizes the market for the UK rubber market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom rubber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK rubber market.

United Kingdom Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,860.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.18% |

| 2035 Value Projection: | USD 3,598.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis. |

| Companies covered:: | Fenner plc, Aquaseal Rubber Ltd, Avon Protection (Avon Rubber), James Walker & Co. Ltd, Bandvulc Tyres Ltd, Giti Tire, Trelleborg Sealing Solutions UK Ltd, HiQ Tyres, Dun & Bradstreet lists, Michelin, Pirelli, Goodyear, Dunlop, Martins Rubber, Rubbertech and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the automotive industry, driven by increasing vehicle ownership and the transition to electric cars, has greatly boosted the demand for rubber, which is crucial for tires and various vehicle parts. Innovations in synthetic rubber production have enhanced product quality, efficiency, and environmental sustainability, leading to a broader range of rubber uses. Automation in production boosts output and reduces errors. Meanwhile, the healthcare sector’s need for medical-grade rubber, especially highlighted by the COVID-19 pandemic, is growing rapidly, driven by increased use of disposable gloves and medical devices. Together, these factors are major drivers of the expanding rubber market across multiple industries.

Restraining Factors

Raw material price volatility is a crucial limiting factor for rubber industry growth. Fluctuations in the availability and cost of these resources influence manufacturing costs and, eventually, product pricing. Economic changes, geopolitical events, and environmental concerns can all disrupt supply networks and generate price volatility. Such volatility makes it difficult for producers to maintain constant profit margins. competition from alternative materials like plastics and polymers, environmental regulations, and health concerns associated with some rubber products. This factor can hinder the UK rubber market during the forecast period.

Market Segmentation

The United Kingdom rubber market share is classified into type and application.

- The synthetic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK rubber market is segmented by type into natural and synthetic. Among these, the synthetic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is primarily due to its adaptability and superior performance in critical applications. Unlike natural rubber, synthetic variations such as styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR) offer increased resistance to abrasion, heat, and aging, making them excellent for industrial and automotive applications. The automotive end-use industry uses synthetic rubber to make a variety of products including as adhesives, gaskets, hoses, roll covers, pipes, tires, and waste tubes. The building sector is driven by a fast-growing population and increased urbanisation rates. Major industry companies spend in research and development to reduce costs and improve material quality. Furthermore, its price and availability lead to its widespread use across a variety of industries. Furthermore, as polymer technologies progress, synthetic rubber evolves, providing eco-friendly and sustainable options that correspond with environmental goals. Strengthening its position as a key player in the rubber industry.

- The tire segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK rubber market is segmented by application into tire, non-tire automotive, footwear, industrial goods, and others. Among these, the tire segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is primarily driven by increased global demand for automotive and robust transportation networks. Rubber, both natural and synthetic, is an important material in tire manufacturing due to its outstanding flexibility, durability, and traction capabilities. The growing popularity of electric vehicles (EVs) and high-performance automobiles has fuelled innovation in tire design, necessitating sophisticated rubber compounds for increased efficiency and safety. Furthermore, with a growing emphasis on sustainability, tire producers are turning to environmentally friendly procedures such as recycled rubber and bio-based components. These trends ensure that the tire industry remains a key driver of global rubber market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK rubber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Fenner plc

- Aquaseal Rubber Ltd

- Avon Protection (Avon Rubber)

- James Walker & Co. Ltd

- Bandvulc Tyres Ltd

- Giti Tire

- Trelleborg Sealing Solutions UK Ltd

- HiQ Tyres

- Dun & Bradstreet lists

- Michelin

- Pirelli

- Goodyear

- Dunlop

- Martins Rubber

- Rubbertech

- Others

Recent Developments:

- In April 2024, R&G bought the UK-based PAR Group on April 30, 2024, considerably boosting its UK aftermarket seals and gaskets capabilities. This acquisition opens up potential for organic growth, synergies and cross-selling in the rubber products sector.

- In April 2024, Brenntag, a German chemicals and ingredients distributor, announced the acquisition of Lawrence Industries Ltd., a UK-based speciality distributor. This deal broadens Brenntag's presence in material science, which includes rubber, coatings, adhesives, sealants, and elastomers.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK rubber market based on the below-mentioned segments:

United Kingdom Rubber Market, By Type

- Natural

- Synthetic

United Kingdom Rubber Market, By Application

- Tire

- Non-Tire Automotive

- Footwear

- Industrial Goods

- Others

Need help to buy this report?