United Kingdom Road Freight Transport Market Size, Share, and COVID-19 Impact Analysis, By Destination (Domestic and International), By Truckload Specification (Full-Truck-Load (FTL) and Less Than-Truck-Load (LTL)), By End-User (Agricultural, Fishing, & Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, and Others), and United Kingdom Road Freight Transport Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited Kingdom Road Freight Transport Market Insights Forecasts to 2033

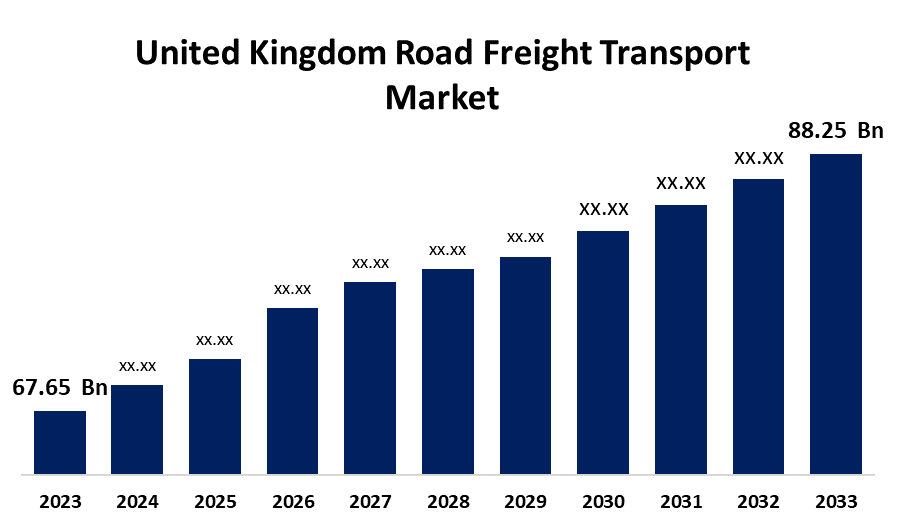

- The United Kingdom Road Freight Transport Market Size was valued at USD 67.65 Billion in 2023.

- The United Kingdom Road Freight Transport Market Size is Growing at a CAGR of 2.69% during the forecast period 2023 to 2033

- The United Kingdom Road Freight Transport Market Size is anticipated to reach USD 88.25 Billion by 2033

Get more details on this report -

The United Kingdom Road Freight Transport Market Size is anticipated to Exceed USD 88.25 Billion by 2033, Growing at a CAGR of 2.69% from 2023 to 2033. The rising demand for inland transportation for logistics, increasing e-commerce sales, and adoption of advanced technologies, including artificial intelligence (AI) & machine learning (ML), are driving the growth of the road freight transport market in the UK.

Market Overview

The road freight transport market refers to the industry encompassing commercial transportation of goods via a network of roads using motor vehicles. Road freight transport is a versatile method for both domestic and international shipments, suitable for a wide range of cargo, from raw materials to finished products. It is a fundamental part of the supply chain and logistics industry, facilitating the delivery of goods from one location to another. The increasing demand for inland transportation for logistics, as well as the convenience & flexibility of road freight transportation, are driving the road freight transport market. Factors including e-commerce growth, urbanization, and demand for efficient logistics solutions are offering market growth opportunities for road freight transport. Further, companies' growing emphasis on optimizing logistics networks, investment in technology, and building strategic partnerships are bolstering market growth opportunities.

Report Coverage

This research report categorizes the market for the UK road freight transport market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom road freight transport market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK road freight transport market.

United Kingdom Road Freight Transport Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 67.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.69% |

| 2033 Value Projection: | USD 88.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Destination, By Truckload Specification, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | A.P. Moller - Maersk, Culina Group, DACHSER, Deutsche Bahn AG (including DB Schenker), DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Gist Ltd., Gregory Distribution Ltd., Howard Tenens, Kinaxia Logistics Limited, Turners (Soham) Ltd., and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rising demand for inland transportation due to factors including economic growth, population movement, and the need for efficient logistics is driving the market demand. The increasing e-commerce sales, driving demand for road freight transport, particularly for last-mile delivery, lead to the market growth for road freight transport. Further, the adoption of advanced technologies such as AI, IoT, blockchain, automation, and robotics for enhancing the efficiency, transparency, and sustainability leads to propelling the market growth.

Restraining Factors

The poor road infrastructure, increasing prices of fuel, increasing labor costs, and fluctuation in logistics costs are challenging the road freight transport market as these factors lead to an increase in the operating expenses for trucking companies and can lead to delays and reduced efficiency.

Market Segmentation

The United Kingdom Road Freight Transport Market share is classified into destination, truckload specification, and end-user.

- The domestic segment dominates the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom road freight transport market is segmented by destination into domestic and international. Among these, the domestic segment dominates the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. It includes the movement of goods by road within a country’s borders, facilitating local and regional distribution of goods. The robust internal distribution network contributes to driving the market in the domestic segment.

- The full-truck-load (FTL) segment dominates the United Kingdom road freight transport market and is expected to grow at a significant CAGR during the projected period.

The United Kingdom road freight transport market is segmented by truckload specification into full-truck-load (FTL) and less than-truck-load (LTL). Among these, the full-truck-load (FTL) segment dominates the United Kingdom road freight transport market and is expected to grow at a significant CAGR during the projected period. Full truckload is a shipping model where a truck carries one dedicated shipment, having several advantages over alternative trucking shipment modes, LTL, or less than a full truckload shipment.

- The wholesale & retail trade segment dominates the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom road freight transport market is segmented by end-user into agricultural, fishing, & forestry, construction, manufacturing, oil & gas, mining & quarrying, wholesale & retail trade, and others. Among these, the wholesale & retail trade segment dominates the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. Strong e-commerce growth and a burgeoning middle-class population are responsible for propelling the market in the wholesale & retail trade segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. road freight transport market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- A.P. Moller - Maersk

- Culina Group

- DACHSER

- Deutsche Bahn AG (including DB Schenker)

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Gist Ltd.

- Gregory Distribution Ltd.

- Howard Tenens

- Kinaxia Logistics Limited

- Turners (Soham) Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Sweden’s AB Volvo received an order for 300 electric trucks from Danish logistics firm DSV. Sweden's AB Volvo (VOLVb.ST), opened a new tab, said that it had received an order for 300 electric trucks from Danish logistics firm DSV

- In November 2023, UPS announced that it had completed the acquisition of MNX Global Logistics (MNX), a global time-critical logistics provider. The acquisition of MNX expands UPS's capabilities in time-critical logistics, especially for healthcare customers in the US, Europe, and Asia.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Road Freight Transport Market based on the below-mentioned segments:

UK Road Freight Transport Market, By Destination

- Domestic

- International

UK Road Freight Transport Market, By Truckload Specification

- Full-Truck-Load (FTL)

- Less Than-Truck-Load (LTL)

UK Road Freight Transport Market, By End-User

- Agricultural, Fishing, & Forestry

- Construction

- Manufacturing

- Oil & Gas

- Mining & Quarrying

- Wholesale & Retail Trade

- Others

Need help to buy this report?