United Kingdom Retail Pharmacy Market Size, Share, and COVID-19 Impact Analysis, By Type (Prescription, OTC), By Distribution Channel (Chain Pharmacies, Independent Pharmacies), and United Kingdom Retail Pharmacy Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Retail Pharmacy Market Insights Forecasts to 2035

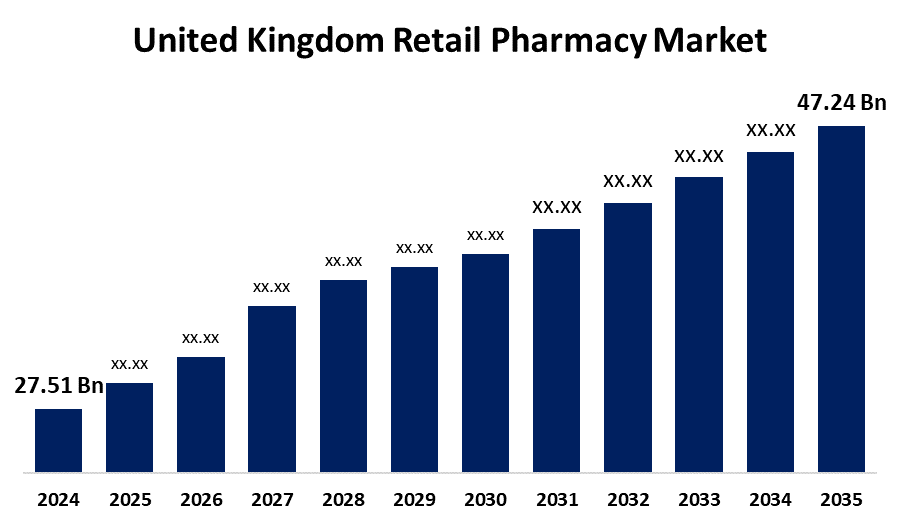

- The United Kingdom Retail Pharmacy Market Size was estimated at USD 27.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.04% from 2025 to 2035

- The United Kingdom Retail Pharmacy Market Size is Expected to Reach USD 47.24 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Retail Pharmacy Market Size is anticipated to reach USD 47.24 Billion by 2035, growing at a CAGR of 5.04% from 2025 to 2035. The development in the healthcare sector across the country and the UK contribution in healthcare at the global level might hike the pharma market across the country.

Market Overview

The United Kingdom retail pharmacy market refers to the business focused on the organization and utilization of medication for every class of patient, with precise guidance of medication adherence. Prescription and over-the-counter (OTC) drugs, medical supplies, and wellness products are vital responsibilities performed by retail pharmacies in the British retail pharmacy industry. Offering vital services including medicine delivery, medical advice, and health awareness promotion, it is an integral part of the nation's healthcare system. The UK’s retail pharmacies are subject to stringent regulations and function within a well-organized framework that guarantees patient safety and the quality of medical supplies. With a growing emphasis on individualized care and the incorporation of digital health solutions, the UK retail pharmacy industry is developing, adjusting, and rapidly changing healthcare with technology breakthroughs, upholding its fundamental role in public health through retail pharma outlets.

Report Coverage

This research report categorizes the market for the United Kingdom retail pharmacy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom retail pharmacy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom retail pharmacy market.

United Kingdom Retail Pharmacy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 27.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.04% |

| 2035 Value Projection: | USD 47.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Prescription, OTC), By Distribution Channel (Chain Pharmacies, Independent Pharmacies) |

| Companies covered:: | Superdrug, LloydsPharmacy, Well Pharmacy, AAH Pharmaceuticals, L. Rowland & Company, Holland & Barrett, St Peter’s Hill Pharmacy, Converse Pharma Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom retail pharmacy is mainly influenced by the rising incidence of chronic illnesses and regular drug management. Moreover, medication therapy management, wellness, and vaccination programs are the variables that expand the market growth for retail pharmacy. Further, growing technical development and support in every industry vertical, especially for pharma and healthcare, that expanding the market growth of retail pharmacy across the UK with the help of e-commerce platforms or applications. This kind of revenue might be put forward in the healthcare sector with the help of retail pharmacy. Moreover, expanding over-the-counter (OTC) medication boosts the market expansion. Additionally, government incentives that support healthcare accessibility and the legislation of the pharmaceutical industry play a vital role in shaping the market growth.

Restraining Factors

The market growth of this industry could be hindered by strict price restrictions on medications in strong regulations and laws, and the denial of e-commerce for high-risk prescription medicines. The rivalry from alternative sales channels and certain pharmacies' delayed acceptance of technology are due to privacy concerns, which are further obstacles.

Market Segmentation

The United Kingdom retail pharmacy market share is classified into type and distribution channel.

- The prescription segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom retail pharmacy market is segmented by type into prescription, and OTC. Among these, the prescription segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by an aging population, rising rates of chronic illnesses, and improvements in medical care. Moreover, there is a constant need for novel treatments and specialized pharmaceuticals, prescription drugs continue to be essential to the healthcare system.

- The chain pharmacies segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom retail pharmacy market is divided by distribution channel into chain pharmacies, and independent pharmacies. Among these, the chain pharmacies segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is because multiple locations throughout different areas provide a large selection of items, competitive pricing, and cutting-edge technological solutions like loyalty programs and smartphone apps. Many customers choose them because of their widespread presence and well-known brand, and they strengthen their position in the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom retail pharmacy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Superdrug

- LloydsPharmacy

- Well Pharmacy

- AAH Pharmaceuticals

- L. Rowland & Company

- Holland & Barrett

- St Peter's Hill Pharmacy

- Converse Pharma Group

- Others

Recent Developments:

- In May 2024, Superdrug opened 25 new stores across the UK. This expansion created over 500 jobs and included some of its biggest-ever stores, with locations in Cardiff, Bluewater Shopping Centre, and Westfield Stratford City. The company also extended seven existing stores and refitted 60 to enhance sustainability and customer experience.

- In January 2024, Boots launched the NHS Pharmacy First Service in England, marking a significant shift in patient care for minor ailments. This service allowed patients to receive advice and treatment for seven common conditions, such as sinusitis, sore throat, earache, infected insect bites, impetigo, shingles, and uncomplicated urinary tract infections without needing a GP appointment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom retail pharmacy market based on the below-mentioned segments:

United Kingdom Retail Pharmacy Market, By Type

- Prescription

- OTC

United Kingdom Retail Pharmacy Market, By Distribution Channel

- Chain Pharmacies

- Independent Pharmacies

Need help to buy this report?