United Kingdom Retail Automation Market Size, Share, and COVID-19 Impact Analysis, By Product (Point-of-Sale (POS), RFID & Barcode, Camera, Electronic Shelf Label, Warehouse Robotics, and Others), By Implementation (In-store and Warehouse), and UK Retail Automation Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited Kingdom Retail Automation Market Size Forecasts to 2035

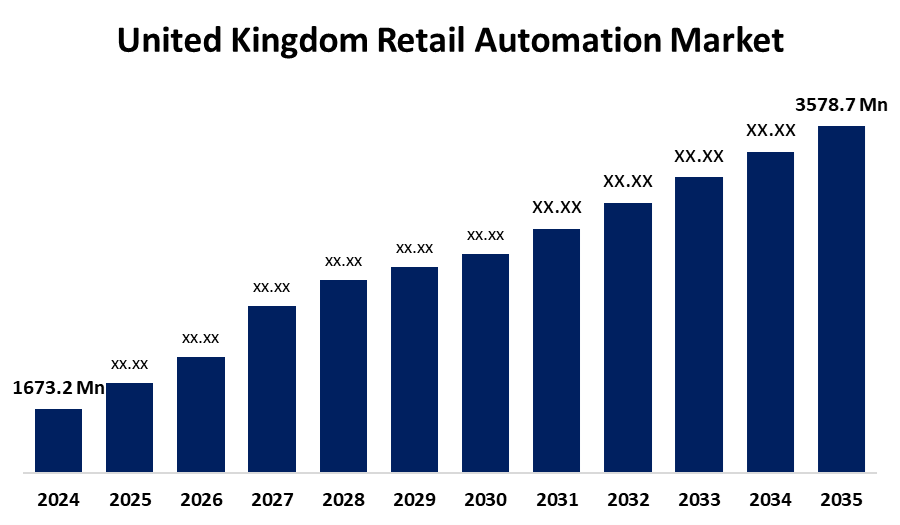

- The United Kingdom Retail Automation Market Size Was Estimated at USD 1673.2 Million in 2024

- The UK Retail Automation Market Size is Expected to Grow at a CAGR of around 7.16% from 2025 to 2035

- The UK Retail Automation Market Size is Expected to Reach USD 3578.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Retail Automation Market Size is anticipated to reach USD 3578.7 million by 2035, growing at a CAGR of 7.16% from 2025 to 2035. The desire for optimising retail operational workflows to increase company operations, supply chain transparency and visibility, and long-term organisational efficiency is driving market expansion.

Market Overview

The UK retail automation market refers to the use of technology such as artificial intelligence, robotics, and self-checkouts to streamline retail operations including inventory and point-of-sale systems. Driven by the expansion of e-commerce and the need for personalised experiences, it strives to increase efficiency, reduce costs, and improve customer satisfaction by automating processes that were previously performed by employees. Retail automation software leverages cloud-based point-of-sale (POS) systems, IoT, AI, and ML are merging to increase efficiencies and create a secure and intuitive platform for managing all retail operations. Due to a greater emphasis on convenience and transparency, many small merchants are investing in affordable point-of-sale (POS) systems. Robotics process automation and artificial intelligence (AI) enable manufacturers and retailers to lower costs through automations that improve the accuracy and efficiency of retail operations and are capable of automating general repetitive processes, such as inventory management. Robotics technology is being made increasingly more available in retail, leading the charge, while simultaneously addressing employment labor shortages and rising demand. Automation speeds up transactions and enables seamless product browsing and payment options, aligning with consumer preferences for online shopping. The demand for effective warehouse and inventory management systems is further fuelled by the growing diversity of products. When taken as a whole, these tendencies stimulate innovation among retail software suppliers and greatly expand the industry.

Report Coverage

This research report categorizes the market for the UK retail automation market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom retail automation market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom retail automation market.

United Kingdom Retail Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1673.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.16% |

| 2035 Value Projection: | USD 3578.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Implementation and COVID-19 Impact Analysis |

| Companies covered:: | NCR Corporation, Toshiba Global Commerce Solutions, Zebra Technologies, Diebold Nixdorf, Wincor Nixdorf (part of Diebold Nixdorf), Staples UK, Oracle Retail, Honeywell, and Other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Warehouse automation boosts cost efficiency by lowering labour expenses, minimising human error, and improving inventory management through intelligent tracking technologies. ML, IoT, robotics, AI, and other cutting-edge technologies improve speed, accuracy, and operational agility. Scalable, automated solutions are needed to meet growing customer needs for real-time tracking, quicker delivery, and customised shopping experiences. Adoption of warehouse automation is fuelled by these characteristics, which help companies exceed consumer expectations, enhance service quality, and obtain a competitive advantage in the dynamic supply chain market.

Restraining Factors

The technological complexity brought forth by advanced automation techniques, significant financial outlays, transformation initiatives, and lengthy payback times are necessary. These factors hamper the retail automation market during the forecast period.

Market Segmentation

The United Kingdom retail automation market share is classified into product and implementation.

- The point-of-sale (POS) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom retail automation market is segmented by product into point-of-sale (POS), RFID & barcode, camera, electronic shelf label, warehouse robotics, and others. Among these, the point-of-sale (POS) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased need for merchandise optimisation, growing Internet of Things (IoT) use, application programming interface (API), and robotics process automation are the drivers propelling the segment's expansion. Segment growth is also being driven by the rise of logistics warehouses, the expanding e-commerce and m-commerce retail trends, advancements in real-time data analytics, and the development of virtual marketing.

- The in-store segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom retail automation market is segmented by implementation into in-store and warehouse. Among these, the in-store segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is rising due to emphasis on omnichannel shopping, the advancements in robotics and artificial intelligence, and the shift towards contactless and self-service technologies. Operators are able to mitigate recurring upkeep costs associated with regular inspections by automating retail locations and relying on cloud-based technologies. Whether the problem is real-time or not, they can resolve it quickly, just by delivering and receiving notifications via the cloud.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom retail automation market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NCR Corporation

- Toshiba Global Commerce Solutions

- Zebra Technologies

- Diebold Nixdorf

- Wincor Nixdorf (part of Diebold Nixdorf)

- Staples UK

- Oracle Retail

- Honeywell

- Others

Recent Developments

- In March 2024, John Lewis & Partners collaborated with Locus Robotics, a warehouse automation solution provider, to improve the efficiency of its Milton Keynes distribution centre in the United Kingdom.

- In June 2024, InPost Group, a leader in logistics solutions for e-commerce, introduced a new model of Paczkomat machine, which allows the machines to be erected regardless of the availability of the electricity grid, owing to their photovoltaic panels and energy storage. The pilot will be carried out in Krakow and Gdansk, as well as in European markets, such as the UK, France, and Italy.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom retail automation market based on the below-mentioned segments:

United Kingdom Retail Automation Market, By Product

- Point-of-Sale (POS)

- RFID & Barcode

- Camera

- Electronic Shelf Label

- Warehouse Robotics

- Others

United Kingdom Retail Automation Market, By Implementation

- In-store

- Warehouse

Need help to buy this report?