United Kingdom Residential Vacuum Cleaner Market Size, Share, and COVID-19 Impact Analysis, By Type (Upright, Canister, Robotic, Stick, and Handheld), By Distribution Channel (Online and Offline), and United Kingdom Residential Vacuum Cleaner Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Residential Vacuum Cleaner Market Insights Forecasts to 2035

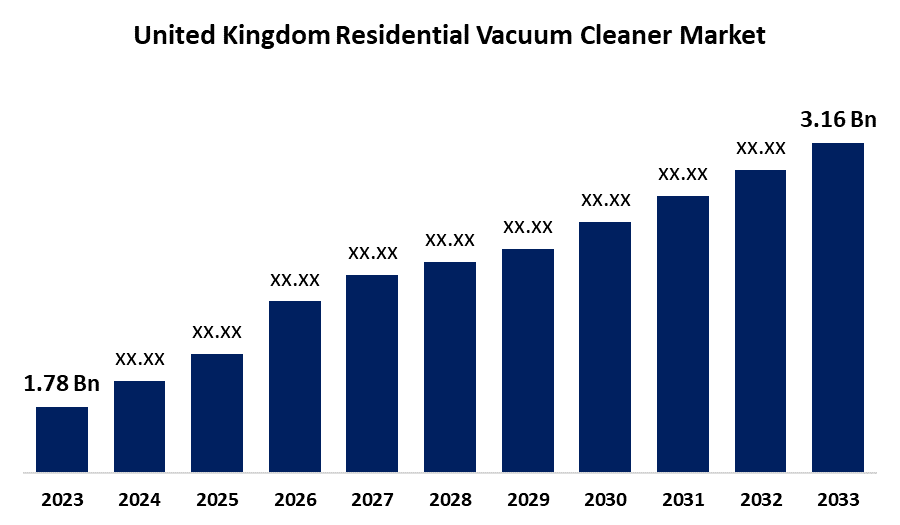

- The United Kingdom Residential Vacuum Cleaner Market Size Was Estimated at USD 1.78 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.36% from 2025 to 2035

- The United Kingdom Residential Vacuum Cleaner Market Size is Expected to Reach USD 3.16 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Residential Vacuum Cleaner Market Size is anticipated to reach USD 3.16 Billion by 2035, growing at a CAGR of 5.36% from 2025 to 2035. The increased awareness of hygiene, busy lifestyles, the expanding trend of pet ownership, and the growing demand for smart and robotic vacuum cleaners all contribute to the need for conventional and effective home cleaning solutions.

Market Overview

The United Kingdom residential vacuum cleaner market refers to the industry involved in the production, promotion, and sale of vacuum cleaners for household use. Because they efficiently eliminate dust, grime, and allergens from floors, carpets, and other surfaces, these appliances are crucial for preserving indoor hygiene and cleanliness. In order to satisfy the various cleaning requirements of UK households, the market offers a range of equipment, including upright, canister, robotic, and handheld vacuum cleaners. The UK's small residences and urban lifestyle are in line with the growing need for intelligent, energy-efficient, and portable vacuum cleaners. Specialized cleaning solutions are becoming more and more necessary as pet ownership increases. Adoption of vacuum cleaners with HEPA filters and other innovative filtration technology is additionally driven by rising awareness of indoor air quality. Developments in robotic and cordless vacuum technology meet the need for automation and reassurance in household cleaning, while the growth of e-commerce platforms improves product accessibility. The introduction of smart sensors, robotic vacuums with AI-powered navigation, HEPA filtration systems for increased air quality, and lightweight, energy-efficient cordless vacuums made for enhanced user convenience and performance in small spaces.

Report Coverage

This research report categorizes the market for the United Kingdom residential vacuum cleaner market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom residential vacuum cleaner market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom residential vacuum cleaner market.

United Kingdom Residential Vacuum Cleaner Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.78 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.36% |

| 2035 Value Projection: | USD 3.16 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type and By Distribution Channel |

| Companies covered:: | Dyson Ltd., Shark Ninja (Euro-Pro), Henry (Numatic), Vax Ltd., Hoover, Philips, Miele, Bosch, Samsung, LG Electronics, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing focus on hygiene and cleanliness among consumers, particularly in aftermath of the pandemic. The need for time-saving, convenient cleaning products like robotic and cordless vacuum cleaners is being driven by the increase in dual-income homes and rushed schedules. Technological innovations that improve product appeal include voice control integration, HEPA filtration, and smart features. Increasing pet ownership also increases the demand for strong vacuum cleaners that can remove allergens and pet hair. The need for tiny, multipurpose vacuum cleaners is further supported by urbanization and the reduction of living regions. Increasing e-commerce channels gives customers more options and enhances accessibility.

Restraining Factors

The high prices of advanced models, which prevent certain customers from purchasing them. Long-term adoption is further hampered by regular maintenance, short battery life in cordless versions, and issues with product durability. Consumer purchase decisions and regulatory scrutiny are also impacted by environmental concerns around electronic waste.

Market Segmentation

The United Kingdom residential vacuum cleaner market share is classified into type and distribution channel.

- The stick segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom residential vacuum cleaner market is segmented by type into upright, canister, robotic, stick, and handheld. Among these, the stick segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing consumer demand for cleaning products that are portable, cordless, and require up a smaller space. They are particularly favored in contemporary homes due to their strength, convenience of use, and adaptability for small spaces.

- The online segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom residential vacuum cleaner market is segmented by distribution channel into online and offline. Among these, the online segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increasing use of e-commerce, convenient product comparison, alluring prices, and doorstep delivery. Online vacuum cleaner sales are increasing as a consequence of consumers' preference for the convenience and variety provided by digital platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom residential vacuum cleaner market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dyson Ltd.

- Shark Ninja (Euro-Pro)

- Henry (Numatic)

- Vax Ltd.

- Hoover

- Philips

- Miele

- Bosch

- Samsung

- LG Electronics

- Others.

Recent Developments:

- In May 2025, Samsung launched the Bespoke AI Jet Ultra, a cordless stick vacuum cleaner boasting 400W suction power and dual batteries for up to 160 minutes of cleaning. To promote this, Samsung offered 78 units for free in a marketing campaign coinciding with Dyson founder Sir James Dyson's birthday.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom residential vacuum cleaner market based on the below-mentioned segments:

United Kingdom Residential Vacuum Cleaner Market, By Type

- Upright

- Canister

- Robotic

- Stick

- Handheld

United Kingdom Residential Vacuum Cleaner Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?