United Kingdom Renewable Energy Market Size, Share, and COVID-19 Impact Analysis, By Product (Bioenergy, Hydropower, Wind Power, and Solar Energy), By Application (Industrial, Residential, and Commercial), and United Kingdom Renewable Energy Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited Kingdom Renewable Energy Market Insights Forecasts to 2035

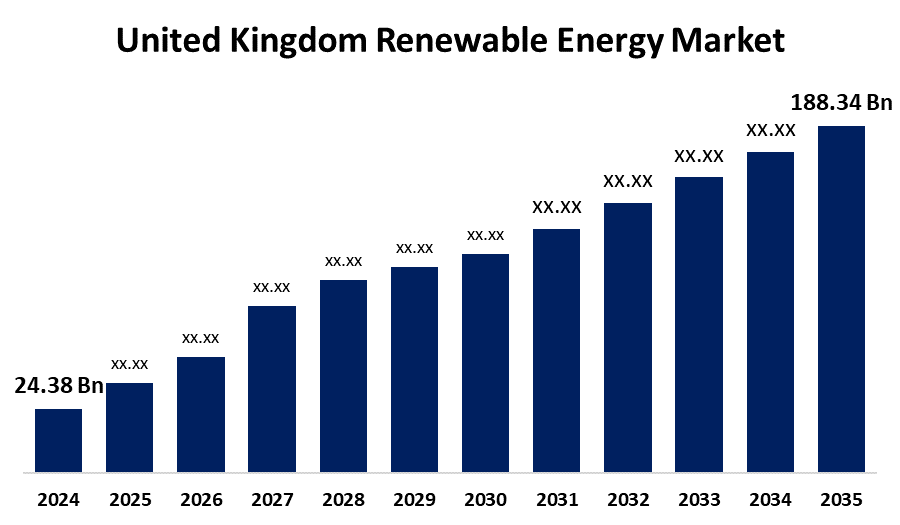

- The United Kingdom Renewable Energy Market Size was estimated at USD 24.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 20.43% from 2025 to 2035

- The United Kingdom Renewable Energy Market Size is Expected to Reach USD 188.34 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Renewable Energy Market Size is anticipated to reach USD 188.34 Billion by 2035, growing at a CAGR of 20.43% from 2025 to 2035. The growing investments in renewable energy, growing environmental concerns, and technical developments, these elements accelerate the transition away from fossil fuels and toward sustainable energy sources, which promotes market growth.

Market Overview

The UK renewable energy market refers to the industry that includes the generation, distribution, and use of energy in the UK that comes from renewable sources such biomass, solar, wind, and hydropower. It's essential for minimizing carbon emissions, improving energy security, and encouraging sustainability. Encouraged by governmental regulations, technical advancements, and ecological consciousness, the market facilitates the country's shift to a low-carbon economy and contributes to reaching long-term climate objectives and energy independence. Significant prospects brought forth through technical advancements, government incentives, and the growing need for sustainable energy. Growth in green hydrogen, offshore wind, and solar energy provides the UK an opportunity to lead the world in sustainable energy solutions, create employment opportunities, and encourage new investment. Developments in energy storage devices, floating solar panels, offshore wind turbines, and green hydrogen technology. These advancements encourage sustainable growth and the country's energy transition by increasing efficiency, lowering prices, and increasing system stability.

Report Coverage

This research report categorizes the market for the UK renewable energy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK renewable energy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK renewable energy market.

United Kingdom Renewable Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 20.43% |

| 2035 Value Projection: | USD 188.34 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 253 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Acconia, Enel Spa, General Electric, Invenergy, Schneider Electric, Siemens Gamesa Renewable Energy, Suzlon Energy Ltd., ABB, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The significant backing from the government in the form of financing and regulations, growing environmental awareness, and pledges to accomplish net-zero emissions by 2050. Investment in sustainable energy solutions has been stimulated by the loss of fossil fuel sources and the rise in energy demand. Improvements in wind, solar, and energy storage technology are reducing costs and increasing efficiency. Further driving forward, the transition to renewable energy adoption is the cooperation of both the private and public sectors in addition to rising industry and consumer awareness.

Restraining Factors

The substantial initial investment costs, constraints on grid infrastructure, and sporadic electricity production from solar and wind sources. Large-scale project development is further hampered by regulatory uncertainty, protracted planning approvals, and land availability concerns, several of that having an impact on the rate of acceptance and growth of renewable energy.

Market Segmentation

The UK renewable energy market share is classified into product and application.

- The wind power segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK renewable energy market is segmented by product into bioenergy, hydropower, wind power, and solar energy. Among these, the wind power segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing demand for renewable energy, cost at 1-2 cents per kWh, and improvements in technology. Adoption and commercial expansion are further accelerated by offshore wind's improved efficiency, consistent wind currents, and environmental friendliness as compared to fossil fuels.

- The industrial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK renewable energy market is segmented by application into industrial, residential, and commercial. Among these, the industrial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of growing utility-scale project expansion, growing demand for renewable electricity, and growing use of solar panels. It is anticipated that long-term incorporation of renewable energy sources into manufacturing processes will significantly speed up the energy transition.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK renewable energy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acconia

- Enel Spa

- General Electric

- Invenergy

- Schneider Electric

- Siemens Gamesa Renewable Energy

- Suzlon Energy Ltd.

- ABB

- Others.

Recent Developments:

- In September 2024, Octopus Energy announced plans to invest £2 billion in UK clean energy projects by 2030. This investment includes the acquisition of four solar projects in England, with a combined capacity of 222 megawatts, expected to produce enough power for 80,000 homes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK renewable energy market based on the below-mentioned segments:

UK Renewable Energy Market, By Product

- Bioenergy

- Hydropower

- Wind Power

- Solar Energy

UK Renewable Energy Market, By Application

- Industrial

- Residential

- Commercial

Need help to buy this report?