United Kingdom Regenerative Medicine Market Size, Share, and COVID-19 Impact Analysis, By Product (Cell Therapy, Gene Therapy, Tissue Engineering, and Platelet Rich Plasma), By Application (Orthopedics, Wound Care, Oncology, Rare Diseases, and Others), and UK Regenerative Medicine Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Regenerative Medicine Market Forecasts to 2035

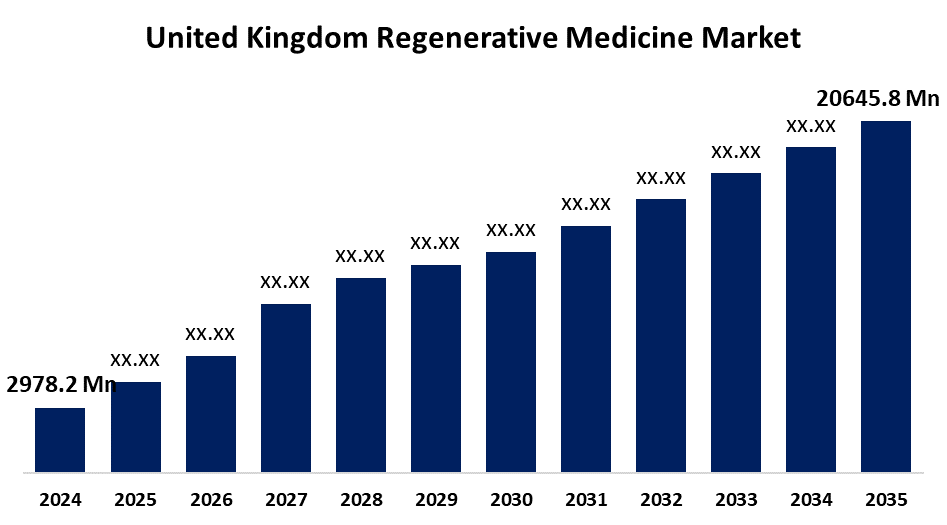

- The United Kingdom Regenerative Medicine Market Size Was Estimated at USD 2978.2 Million in 2024

- The UK Regenerative Medicine Market Size is Expected to Grow at a CAGR of around 19.25% from 2025 to 2035

- The UK Regenerative Medicine Market Size is Expected to Reach USD 20645.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Regenerative Medicine Market is anticipated to reach USD 20645.8 million by 2035, growing at a CAGR of 19.25% from 2025 to 2035. Recent advances in biological therapies have resulted in a gradual shift in preference for personalised medical strategies over traditional treatment approaches.

Market Overview

The UK regenerative medicine market refers to a rapidly expanding area that aims to mend or replace damaged tissues and organs with cells, tissues, or genetic elements. It has the potential to treat or cure chronic, terminal, and difficult-to-treat disorders, including some types of cancer. The regenerative medicine industry in the UK is expanding quickly as a result of rising demand and the uptake of advanced technologies. The industry is growing as a result of growing applications in the treatment of different diseases and more partnerships supported by government funding. Research into new regeneration therapeutics is being accelerated by the increasing incidence of degenerative and chronic hereditary diseases, as well as increased healthcare expenditures. Businesses creating biological treatments are discovering new prospects. The clinical trial pipeline persists, and funding from government and private sources continues to advance research. Further, effective products, such as tissue grafts, patches, ointments, and scaffolds, are creating responsive demand in dermatology and musculoskeletal care. In addition, innovations in nanotechnology have significantly enhanced the performance of some products, providing another substantial driver to market growth.

Report Coverage

This research report categorizes the market for the UK regenerative medicine market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom regenerative medicine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom regenerative medicine market.

United Kingdom Regenerative Medicine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2978.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 19.25% |

| 2035 Value Projection: | USD 20645.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Tissue Regenix, Smith & Nephew, Integra LifeSciences, Ixaka, Orchard Therapeutics, Bicycle Therapeutics, Immunocore, AstraZeneca, Pfizer, Novartis, Amgen, Medtronic, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing regenerative medicine investments in the UK are stimulating active research and development, with investors supporting firms concentrating on advanced treatments. Significant partnerships, mergers, and research collaborations have been prompted by this financing boom. Regenerative medicine is becoming more prevalent in oncology, neurology, and cardiology in addition to tissue restoration. Companies in the life sciences and pharmaceuticals are actively working on clinical trials to create cutting-edge therapies that will outperform conventional approaches. The introduction of innovative treatments as a result of these initiatives is promoting market expansion and innovation.

Restraining Factors

Industry constraints in the UK around regenerative medicine either hinder adoption or slow the commercialization of advanced therapies and products, because of high development and production costs, complex regulatory approvals, and ethical issues regarding the introduction of regenerative medicine technology. Alternatively, constraints on adoption are also seen with insufficient reimbursement policies and long timelines for clinical trials. These factors hamper the regenerative medicine market during the forecast period.

Market Segmentation

The United Kingdom regenerative medicine market share is classified into product and application.

- The cell therapy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom regenerative medicine market is segmented by product into cell therapy, gene therapy, tissue engineering, and platelet-rich plasma. Among these, the cell therapy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cell therapy segment's increasing applications for the treatment of autoimmune diseases, cancers, infectious diseases, musculoskeletal disorders, and joint injuries, the market has begun to gain traction using the products offered in this segment.

- The orthopedics segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom regenerative medicine market is segmented by application into orthopedics, wound care, oncology, rare diseases, and others. Among these, the orthopedics segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The steady rise in the prevalence of bone related injuries and osteoarthritis. The market is evolving due to advocating the use of these products to promote healing as well as relieve pain and discomfort.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom regenerative medicine market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tissue Regenix

- Smith & Nephew

- Integra LifeSciences

- Ixaka

- Orchard Therapeutics

- Bicycle Therapeutics

- Immunocore

- AstraZeneca

- Pfizer

- Novartis

- Amgen

- Medtronic

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom regenerative medicine market based on the below-mentioned segments:

United Kingdom Regenerative Medicine Market, By Product

- Cell Therapy

- Gene Therapy

- Tissue Engineering

- Platelet Rich Plasma

United Kingdom Regenerative Medicine Market, By Application

- Orthopedics

- Wound Care

- Oncology

- Rare Diseases

- Others

Need help to buy this report?