United Kingdom Ready to Drink Cocktails Market Size, Share, and COVID-19 Impact Analysis, By Alcohol Base (Malt-based, Spirit-based, and Wine-based), By Distribution Channel (Hypermarkets/Supermarkets, Online, and Liquor Stores), and United Kingdom Ready to Drink Cocktails Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Ready to Drink Cocktails Market Insights Forecasts to 2035

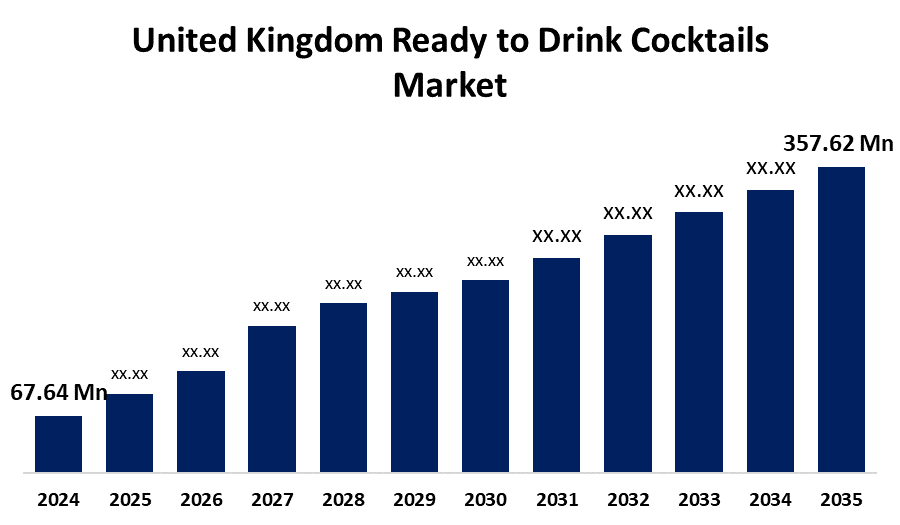

- The United Kingdom Ready to Drink Cocktails Market Size was estimated at USD 67.64 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.34% from 2025 to 2035

- The United Kingdom Ready to Drink Cocktails Market Size is Expected to Reach USD 357.62 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Ready to Drink Cocktails Market Size is anticipated to reach USD 357.62 Million by 2035, growing at a CAGR of 16.34% from 2025 to 2035. The increasing demand from consumers for high-quality, adaptable, and convenient alcoholic beverages. The market is growing rapidly due in part to consumer preferences for low-alcohol choices, creative flavors, and attractive packaging.

Market Overview

The UK ready to drink cocktails market refers to the industry includes the manufacturing, marketing, and distribution of pre-mixed alcoholic beverages, which are ready-to-consume concoctions of spirits, mixers, and flavorings. These drinks, which are provided in bottles or cans, give customers a simple and rapid substitute for making classic cocktails. With an emphasis on mobility, reliable quality, and creative taste profiles, the industry accommodates increasing lifestyle preferences and appealing to both casual consumers and cocktail connoisseurs. increasing consumer tastes in favor of low-alcohol, premium, and convenient options. The market is expanding due to the rise in at-home socializing, the increasing need for creative and health-conscious flavors, and the growing interest of younger demographics. Furthermore, retail advances and e-commerce platforms provide new companies and products more availability and a wider audience. The NHS Health Survey for Uk found that 79% of respondents said they drank alcohol in 2021, with almost half doing so on a weekly basis. Additionally, alcohol duty rates are periodically changed by the UK government, which could have an impact on RTD cocktail prices and usage trends.

Report Coverage

This research report categorizes the market for the UK ready to drink cocktails market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK ready to drink cocktails market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK ready to drink cocktails market.

United Kingdom Ready to Drink Cocktails Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 67.64 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 16.34% |

| 2035 Value Projection: | USD 357.62 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Alcohol Base and By Distribution Channel |

| Companies covered:: | Manchester Drinks Company Ltd., Asahi Group Holdings, Ltd., Diageo plc, The Absolut Company, Anheuser-Busch InBev, Pernod Ricard, Shanghai Bacchus Liquor Co., Ltd., Diageo plc, Halewood Wines & Spirits, Brown-Forman, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand from consumers for high-quality, transportable alcoholic beverages. The demand for ready-made cocktails is fueled by busy lifestyles and the growing popularity of at-home socializing. The market is also growing as the consequence of younger customers searching for innovative flavors, fewer alcoholic options, and recyclable containers. Accessibility is further improved and the segment's growth in the UK market is contributed to by the availability of RTD cocktails through a variety of retail channels, among which are supermarkets and online retailers.

Restraining Factors

The higher product costs in comparison to conventional beverages, a lack of consumer understanding of new brands, and difficulties with alcohol use regulations. Furthermore, the market for high-alcohol alternatives may decline due to concerns regarding health-conscious trends.

Market Segmentation

The UK ready to drink cocktails market share is classified into alcohol base and distribution channel.

- The malt-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK ready to drink cocktails market is segmented by alcohol base into malt-based, spirit-based, and wine-based. Among these, the malt-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by their individual taste identities, ease of use, and the growing acceptance of changes prompted by their lifestyle choices. Furthermore, a wide range of flavor choices, innovative product developments, and innovative packaging contribute to grow the market for malt-based RTD cocktails.

- The hypermarkets/supermarkets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK ready to drink cocktails market is segmented by distribution channel into hypermarkets/supermarkets, online, and liquor stores. Among these, the hypermarkets/supermarkets segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed because the ease of purchasing from a single location, expanded hours, and rapid services. A significant component of the segment's growth is the availability of an extensive range of brands and improved in-store shopping experiences, which further increase consumer demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK ready to drink cocktails market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Manchester Drinks Company Ltd.

- Asahi Group Holdings, Ltd.

- Diageo plc

- The Absolut Company

- Anheuser-Busch InBev

- Pernod Ricard

- Shanghai Bacchus Liquor Co., Ltd.

- Diageo plc

- Halewood Wines & Spirits

- Brown-Forman

- Others

Recent Developments:

- In August 2024, Heineken UK launched a range of RTD rum cocktails under the Red Stripe brand, including flavors like Rum Punch, Cherry & Cranberry, and Pineapple & Coconut. Available in 250ml cans, these cocktails combine real fruit juices with Caribbean rum, aiming to deliver authentic Jamaican flavors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK ready to drink cocktails market based on the below-mentioned segments:

UK Ready to Drink Cocktails Market, By Alcohol Base

- Malt-based

- Spirit-based

- Wine-based

UK Ready to Drink Cocktails Market, By Distribution Channel

- Hypermarkets/Supermarkets

- Online

- Liquor Stores

Need help to buy this report?