United Kingdom Rapid Tests Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Consumables, and Others), By Technology (Immunoassay, Molecular Diagnostics, and Other Technologies), and United Kingdom Rapid Tests Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Rapid Tests Market Insights Forecasts to 2035

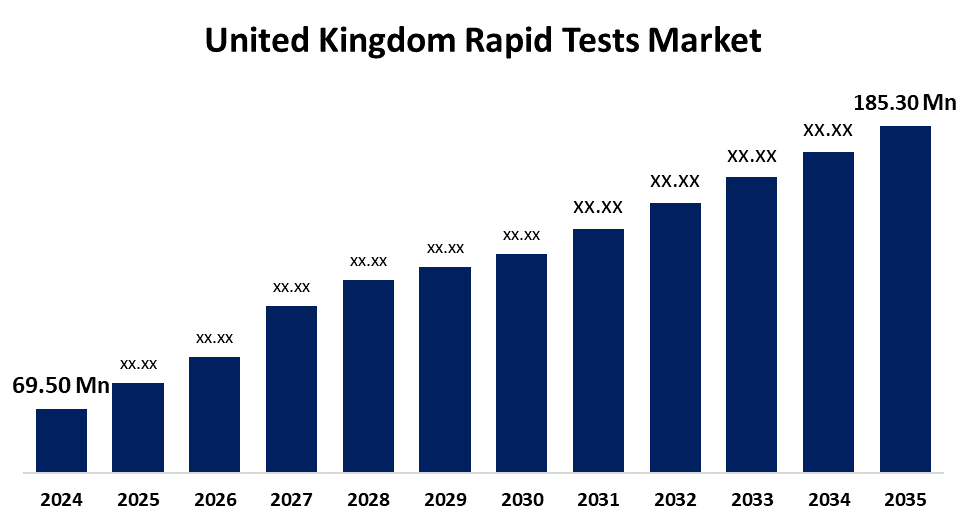

- The United Kingdom Rapid Tests Market Size was Estimated at USD 69.50 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.32% from 2025 to 2035

- The United Kingdom Rapid Tests Market Size is Expected to Reach USD 185.30 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United Kingdom Rapid Tests Market Size is Anticipated to Reach USD 185.30 Million by 2035, Growing at a CAGR of 9.32% from 2025 to 2035. The main drivers of the market's expansion are the aging population, the prevalence of target diseases, and the increased use of point-of-care and self-testing devices.

Market Overview

The rapid tests market encompasses diagnostic tools designed to deliver quick and reliable results, often within minutes, without the need for complex laboratory infrastructure. These tests are especially suited for point-of-care, home use, emergency response, and resource-limited settings. These tests, which include point-of-care molecular diagnostics, lateral flow devices (LFDs), and saliva-based assays, are intended for use in workplaces, pharmacies, clinical settings, and increasingly in homes. The UK quick testing market, which is distinguished by its speed, affordability, and ease of use, is essential for early illness diagnosis, public health monitoring, and pandemic preparedness. With the help of government programs, technical advancements, and rising consumer interest in self-directed healthcare, the industry is still developing as demand moves toward more general health and wellness applications. The adoption of POC molecular diagnostic products is also anticipated to be fueled by the introduction of mobile applications, such as Roche Diagnostics' Cobas Infinity Point-of-Care, which meet the needs of the POC coordinator and help to increase productivity by completing the task on the smartphone regardless of the destination.

Report Coverage

This research report categorizes the market for the United Kingdom rapid tests market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom rapid tests market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom rapid tests market.

United Kingdom Rapid Tests Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 69.50 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.32% |

| 2035 Value Projection: | USD 185.30 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product, By Technology and COVID-19 Impact Analysis. |

| Companies covered:: | Abingdon Health, CIGA Healthcare, Omega Diagnostics, Newfoundland Diagnostics, SureScreen Diagnostics and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom rapid tests is influenced by rising public awareness of infectious diseases, which has led to a surge in demand for easy-to-use, at-home diagnostic instruments that allow for quicker health decisions without requiring professional visits. Rapid tests for new health risks are being developed and used more quickly due to government funding and support, including programs like the Diagnostic Accelerator. The market's reach is also increased by extending applications outside infectious disorders, such as environmental monitoring, pet health, pregnancy, and vitamin deficiency screening. Customers in the UK have even greater accessibility thanks to the growth of internet shopping and pharmacy availability. When taken as a whole, these elements support the UK's increasing recognition of quick testing as a vital instrument for proactive health management.

Restraining Factors

The emerging uses, such as those for stroke, vitamin deficiencies, or environmental toxins, require substantial testing before being included in NHS pathways, and clinical validation and regulatory approval present a significant hurdle. Adoption is further hampered by cost and reimbursement issues, which have slowed the market expansion.

Market Segmentation

The United Kingdom rapid tests market share is classified into product, and technology.

- The consumables segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom rapid tests market is segmented by product into instruments, consumables, and others. Among these, the consumables segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The commercialization of various PoC assays and increased testing rates for upper respiratory disease diagnosis are responsible for this. Additionally, the market is anticipated to rise in the upcoming years due to an increase in Point-of-Care (POC) and self-test product demand, as well as growing product releases and R&D initiatives related to molecular diagnostic technologies.

- The immunoassay segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom rapid tests market is segmented by technology into immunoassay, molecular diagnostics, and other technologies. Among these, the immunoassay segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. There are numerous highly effective fast immunoassays on the market. Next-generation lateral flow Digital Immunoassay (DIA) methods for the qualitative detection of RSV viral antigens, including as Directigen, QuickVue, Sofia, and BD Veritor, are immunoassay-based fast diagnostics for RSV. Furthermore, the most popular diagnostic test is the fast RSV antigen test. Most RSV antigen test results are available within an hour and are typically conducted on-site, in an emergency room, or a doctor's office.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom rapid tests market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abingdon Health

- CIGA Healthcare

- Omega Diagnostics

- Newfoundland Diagnostics

- SureScreen Diagnostics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom rapid tests market based on the below-mentioned segments:

United Kingdom Rapid Tests Market, By Product

- Instruments

- Consumables

- Others

United Kingdom Rapid Tests Market, By Technology

- Immunoassay

- Molecular Diagnostics

- Other Technologies

Need help to buy this report?