United Kingdom PVC Footwear Market Size, Share, and COVID-19 Impact Analysis, By Product (Shoes, and Flip Flops), By Distribution Channel (Offline, and Online), and United Kingdom PVC Footwear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom PVC Footwear Market Insights Forecasts to 2035

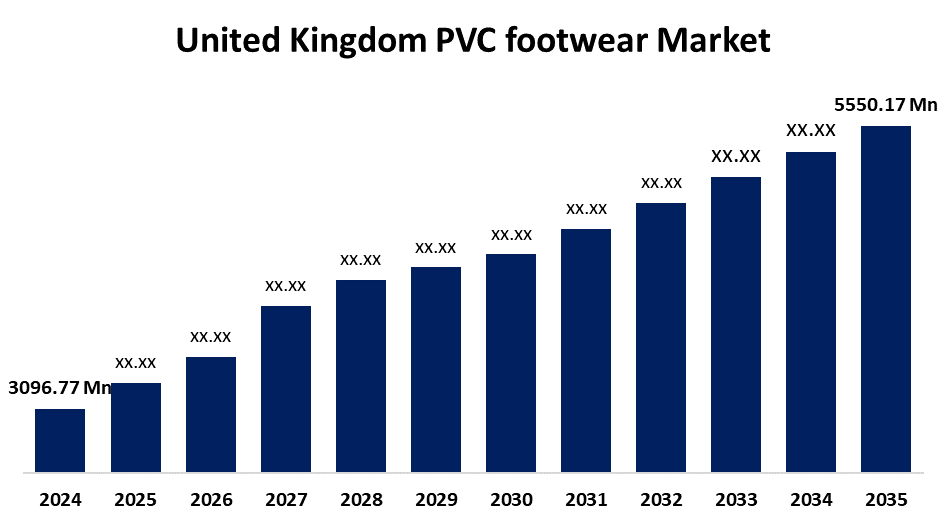

- The United Kingdom PVC Footwear Market Size was estimated at USD 3096.77 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.45% from 2025 to 2035

- The United Kingdom PVC Footwear Market Size is Expected to Reach USD 5550.17 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom PVC Footwear Market is anticipated to reach USD 5550.17 million by 2035, growing at a CAGR of 5.45% from 2025 to 2035. The PVC footwear market reveals that it is now seeing strong growth due to both improvements in PVC technology and rising customer desire for reasonably priced and long-lasting footwear solutions.

Market Overview

The United Kingdom PVC footwear market refers to the industry focused on the production, distribution, and application of predominantly composed of polyvinyl chloride (PVC), which a strong, waterproof, and reasonably priced. Its strength, low production costs, and flexibility, PVC (polyvinyl chloride) has gained popularity as a material for a variety of footwear, including sandals, rain boots, work shoes, and casuals. Its toughness and resistance to water, chemicals, abrasion, and weathering make it suitable for footwear used in demanding locations, such as factories or construction sites. The need for PVC industrial boots and working shoes can also be explained by urbanization and the growth of infrastructure. The industry's offerings are shifting from utilitarian to design-focused as function and style become more entwined. Businesses are expanding their PVC product lines with striking hues, ergonomic molds, and fashionable shapes. With Gen Z and millennial consumers who value aesthetic appeal and affordability, the change is assisting in gaining traction in the fashion and leisure sectors.

Report Coverage

This research report categorizes the market for the United Kingdom PVC footwear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom PVC footwear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom PVC footwear market.

United Kingdom PVC footwear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3096.77 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.45% |

| 2035 Value Projection: | USD 5550.17 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Hunter Boot Ltd, SATRA Technology Centre, Ansell (imported), Longlast Safety (imported), Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom PVC footwear is boosted by the major economic change, growing fashion sentiment, and the need for footwear that is not affected by the weather. The industry is driven by a robust retail infrastructure and the expansion of tactics. Moreover, consumers are seeking a wider variety of footwear designs as a result of urbanization and immigration, which is driving consistent growth throughout the course of the projection period. Innovation and technical breakthroughs are driving a revolution in the PVC footwear industry, changing product design, production methods, and performance characteristics. The PVC footwear business is undergoing to satisfy the growing demand for individualized and fashionable footwear. Another aspect of innovation that increases the usefulness of PVC footwear is the integration of smart technology, such as materials that regulate temperature or fitness-tracking capabilities.

Restraining Factors

The price volatility of raw materials, supply chain disruptions, customs delays, fluctuating imports, a lack of product differentiation, and a perception that it is inexpensive or disposable, and stricter workplace safety regulations necessitate the use of.

Market Segmentation

The United Kingdom PVC footwear market share is classified into product, and distribution channel.

- The shoes segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom PVC footwear market is segmented by product into shoes, and flip flops. Among these, the shoes segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment growth is contributed to the market expansion due to its affordability, weather resistance, and durability. PVC shoes are popular among consumers since they are available in a variety of styles and designs. Rainy or damp weather is appropriate for footwear made with PVC as the raw material because it is water-resistant. It keeps the feet comfy and dry by providing moisture protection.

- The online segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom PVC footwear market is segmented by distribution channel into offline, and online. Among these, the online segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is because of its affordability and scalability in large-scale due, as the most recent examples of the different shoe designs, styles, and features can be found in these resources. Retailers can peruse these catalogs and place orders with the authorized representative of the brand or the manufacturer directly. These platforms offer customers, retailers, and manufacturers a practical means of communication and transaction facilitation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom PVC footwear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hunter Boot Ltd

- SATRA Technology Centre

- Ansell (imported)

- Longlast Safety (imported)

- Others

Recent Developments:

- In April 2022, DPD UK partnered with Rock Fall Safety Footwear, a British-headquartered company based in Derbyshire, to introduce a new sustainable safety boot range for drivers and warehouse staff. For truckers and other professionals who need protective footwear, leading package delivery company DPD UK teamed up with creative footwear company Rock Fall to develop a new line of sustainable safety boots.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom PVC footwear market based on the below-mentioned segments:

United Kingdom PVC Footwear Market, By Product

- Shoes

- Flip Flops

United Kingdom PVC Footwear Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?