United Kingdom Protein Supplements Market Size, Share, and COVID-19 Impact Analysis, By Source (Plant-Based, Animal-Based, and Others), By Product (Protein Powder, RTD, Protein Bars, and Others), and United Kingdom Protein Supplements Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Protein Supplements Market Insights Forecasts to 2035

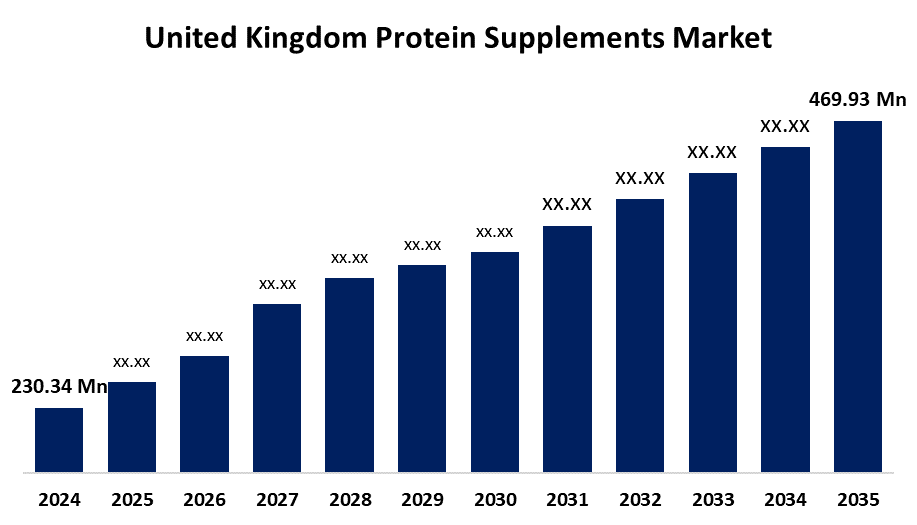

- The United Kingdom Protein Supplements Market Size was estimated at USD 230.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.70% from 2025 to 2035

- The United Kingdom Protein Supplements Market Size is Expected to Reach USD 469.93 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Protein Supplements Market Size is anticipated to reach USD 469.93 Million by 2035, growing at a CAGR of 6.70% from 2025 to 2035. The protein supplement market in the UK is projected by several factors propelling the pea protein market is the rising consumer demand for organic supplements and health and wellness goods. Moreover, the expansion of the market is further aided by the growing need for textured protein in ready-to-eat goods and convenient foods.

Market Overview

The United Kingdom protein supplements market refers to the marketplace focused on the production and application of protein are required to meet the daily basic requirement for protein, as the diet alone may not be sufficient. Protein supplements are crucial for enhancing the body's metabolism. Protein supplements can be used before or after high-intensity activities to increase stamina and endurance. Numerous ailments are caused by a lack of proteins, and taking these protein supplements will aid in taking preventative action. Consuming protein supplements also aids in the fight against issues, including immune system weakness, obesity, and malnutrition. One kind of nutritional and bodybuilding supplement that bodybuilders and athletes frequently utilize to boost their protein intake without also increasing their intake of fats and carbohydrates is protein supplements. The protein content of these supplements is higher than that of other protein sources when taken orally. Further, a strong government backup bolstered the market expansion. For instance, the UK government has invested £75 million in alternative protein innovation since 2021, following recommendations from the National Food Strategy. This funding represents 60% of the £125 million initially suggested to advance plant-based foods, cultivated meat, and fermentation-derived proteins.

Report Coverage

This research report categorizes the market for the United Kingdom protein supplements market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom protein supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom protein supplements market.

United Kingdom Protein Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 230.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.70% |

| 2035 Value Projection: | USD 469.93 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Product |

| Companies covered:: | SCI-MX Nutrition, Bulk, Myprotein, Free Soul, Protein Works, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom protein supplements is driven by the need for expansion in a health-conscious professional. Among millennials, protein supplements are becoming more and more popular. The demand for protein supplements is anticipated to increase over time as a result of the need to improve health through a balanced diet. The market is expanding as a result of the rise of e-commerce, as more consumers purchase protein supplements, bars, and snacks online due to convenience. Additionally, innovations in plant-based protein products, including protein-enriched snacks, beverages, and ready-to-eat meals, are helping cater to the growing demand for sustainable and nutritious food options. The increased interest in sports nutrition, along with advancements in protein production technologies, further supports this growth. As the market continues to evolve, the demand for protein is expected to rise across various applications, including fitness, health, and the food & beverage industry.

Restraining Factors

The market expansion is restrained by the high cost of many protein products, especially those that are plant-based or organic, which makes it challenging for them to be widely accepted. It is challenging for producers to maintain cost effectiveness and stable pricing structures since copper prices are impacted by geopolitical factors, supply chain interruptions, and variations in mining output.

Market Segmentation

The United Kingdom protein supplements market share is classified into source and product.

- The animal-based segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom protein supplements market is segmented by source into plant-based, animal-based, and others. Among these, the animal-based segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because they include all of the essential amino acids, and animal-derived proteins are traditionally regarded as complete. Whey, casein, egg, chicken, and beef are examples of meat and dairy proteins that are included in this category. Excellent amino acid profiles and good digestibility are characteristics of all forms of whey protein, including isolates, concentrates, and hydrolysates.

- The protein powder segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom protein supplements market is divided by product into protein powder, RTD, protein bars, and others. Among these, the protein powder segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its affordability and scalability in large-scale manufacturing. The metal injection molding produces precise and lightweight materials; it is becoming more and more popular in the aerospace and miniaturized electronics industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom protein supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SCI-MX Nutrition

- Bulk

- Myprotein

- Free Soul

- Protein Works

- Others

Recent Developments:

- In February 2024, SCI-MX, a UK-based sports nutrition brand, launched a new Clear Whey Protein Isolate. This product offered a refreshing alternative to traditional milky protein powders and was available in Tropical Island Punch and Apple & Blackcurrant flavors. Each serving contained over 90% whey protein, 21g of protein, and less than 90 kcal, with zero fat.

- In September 2020, London-based start-up GROUNDED teamed up with SIG to bring its 100% natural plant-based protein shakes to market. These shakes were designed for health-conscious, mobile consumers and featured cocoa and plant protein as key ingredients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom protein supplements Market based on the below-mentioned segments:

United Kingdom Protein Supplements Market, By Source

- Plant-Based

- Animal-Based

- Others

United Kingdom protein supplements Market, By Product

- Protein Powder

- RTD

- Protein Bars

- Others

Need help to buy this report?