United Kingdom Pre-Insulated Pipes Market Size, Share, and COVID-19 Impact Analysis, By Product (Flexible Pre-Insulated Pipes, Rigid Pre-Insulated Pipes), By End Use (Residential, Commercial, Industrial), and United Kingdom Pre-Insulated Pipes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Pre-Insulated Pipes Market Insights Forecasts to 2035

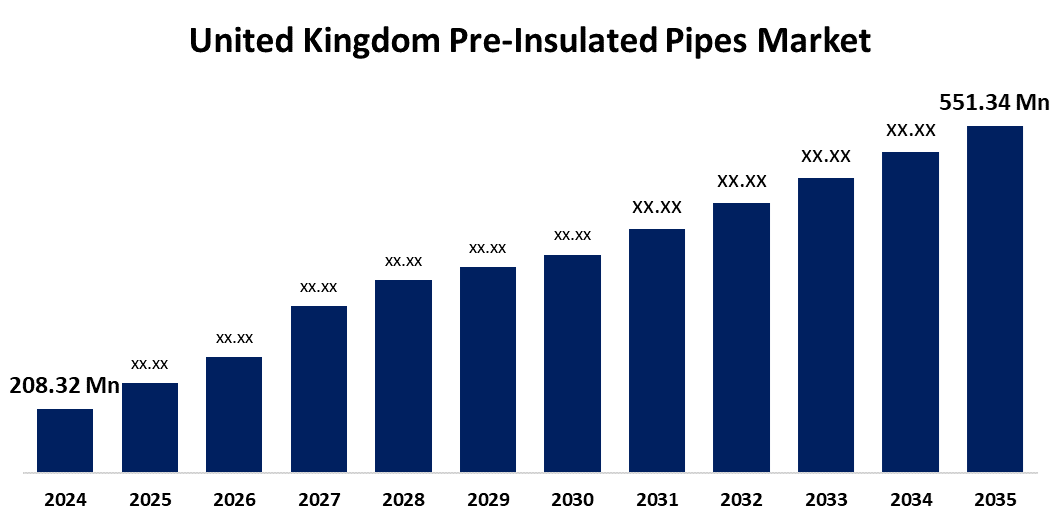

- The United Kingdom Pre-Insulated Pipes Market Size Was Estimated at USD 208.32 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.25% from 2025 to 2035

- The United Kingdom Pre-Insulated Pipes Market Size is Expected to Reach USD 551.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the United Kingdom Pre-Insulated Pipes Market is anticipated to reach USD 551.34 Million by 2035, growing at a CAGR of 9.25% from 2025 to 2035. The market expansion is influenced by the growing need for environmentally friendly and successful thermal insulation options for district cooling and heating systems.

Market Overview

The United Kingdom pre-insulated pipes market refers to the business focused on the production and application of pipes and pipeline systems that balance the temperature of the fluid inside them. The temperature of the fluids in the pipes is sustained by using pre-insulated pipes. Biogas plants, home connections, district heating and cooling systems, and many other applications use these pipes. Pre-insulated pipes must be manufactured with close attention to detail in order to guarantee pipe quality. To prevent heat loss, the insulated pipes provide primary thermal resistance. These pipes essentially consist of an outer casing, an insulation layer, and a carrier pipe. Various raw materials are used to make the layers, depending on the intended use. Pre-insulated pipes find application in a variety of industries, including water treatment, infrastructure & utilities, vineyards, food processing, and oil & gas. Recently, the government announced to investment in a local company which exceeded the market growth across the UK. For instance, with the announcement of £300 million in funding to assist up to 200 heat networks nationwide, the Government's Spending Review has made room for £2 billion in infrastructure improvements in UK cities. More than 400,000 homes' worth of heat will be produced by these heat networks, which will also encourage up to £2 billion in private capital investment.

Report Coverage

This research report categorizes the market for the United Kingdom pre-insulated pipes market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom pre-insulated pipes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom pre-insulated pipes market.

United Kingdom Pre-Insulated Pipes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 208.32 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.25% |

| 2035 Value Projection: | USD 551.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Durotan Ltd, Rothwells Nelson, Dixon Group Europe Ltd, CPV Ltd, InsulatedPipe.co.uk and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom pre-insulated pipes is driven by governments placing a higher priority on energy efficiency, and as urbanization speeds up, local energy networks have emerged as vital infrastructure for reducing heat loss and optimizing energy utilization. The industry is growing as a result of increased government legislation to reduce carbon emissions and build energy-efficient infrastructure. Further, the industry is growing rapidly as a result of they are more affordable and have better designs, which satisfy the consumer and vendor as well. The effectiveness and dependability of pipeline monitoring systems are increased by developments in insulating materials and monitoring technologies drive the market expansion.

Restraining Factors

The price volatility of raw materials, high upfront cost in contrast to traditional pipes, strong and delayed regulations, and availability of alternative merchandise for pipes, all of this slowed down the market expansion.

Market Segmentation

The United Kingdom pre-insulated pipes market share is classified into product and end use.

- The flexible pre-insulated pipes segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The United Kingdom pre-insulated pipes market is segmented by product into flexible pre-insulated pipes and rigid pre-insulated pipes. Among these, the flexible pre-insulated pipes segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. The segment growth is driven by the growing need for piping solutions that are both easy to install and efficient for district heating and cooling systems in homes and businesses. These pipes' exceptional flexibility makes it possible to route complicated and limited installations more simply, which drastically cuts down on labor expenses. Additionally, because they are lightweight, they can be deployed more quickly, which is very useful for urban infrastructure projects where installation speed and space limits are important factors.

- The commercial segment held the largest share in 2024 and is predicted to grow at a substantial CAGR during the forecast period.

The United Kingdom pre-insulated pipes market is differentiated by end use into residential, commercial, and industrial. Among these, the commercial segment held the largest share in 2024 and is predicted to grow at a substantial CAGR during the forecast period. This is because of the increased need for thermal insulation technologies in commercial structures that are both economical and energy-efficient. The demand for effective district heating and cooling networks has increased due to the growing number of commercial buildings being constructed, including shopping malls, office buildings, hotels, hospitals, and educational institutions. For long-distance fluid transportation, pre-insulated pipelines provide a dependable way to preserve the fluids' thermal integrity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom pre-insulated pipes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Durotan Ltd

- Rothwells Nelson

- Dixon Group Europe Ltd

- CPV Ltd

- InsulatedPipe.co.uk

- Others

Recent Developments:

- In July 2024, REHAU launched RAUVIPEX, a new standard in pre-insulated pipes designed for district heating and heat transfer applications. RAUVIPEX is known for its flexibility, durability, and excellent insulation properties. It features PE-Xa carrier pipes, PUR foam insulation, and a robust outer jacket, making it highly efficient for transporting heat within networks. The improved flexibility allows for easier installation and reduced construction time.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom pre-insulated pipes market based on the below-mentioned segments:

United Kingdom Pre-Insulated Pipes Market, By Product

- Flexible Pre-Insulated Pipes

- Rigid Pre-Insulated Pipes

United Kingdom Pre-Insulated Pipes Market, By End Use

- Residential

- Commercial

- Industrial

Need help to buy this report?