United Kingdom Power Rental Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Diesel, Natural Gas, and Other), By Equipment (Generator, Transformers, Load Banks, and Other), By End-user (Mining, Construction, Manufacturing, Utility, Events, Oil & Gas, and Others), and United Kingdom Power Rental Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited Kingdom Power Rental Market Insights Forecasts to 2033

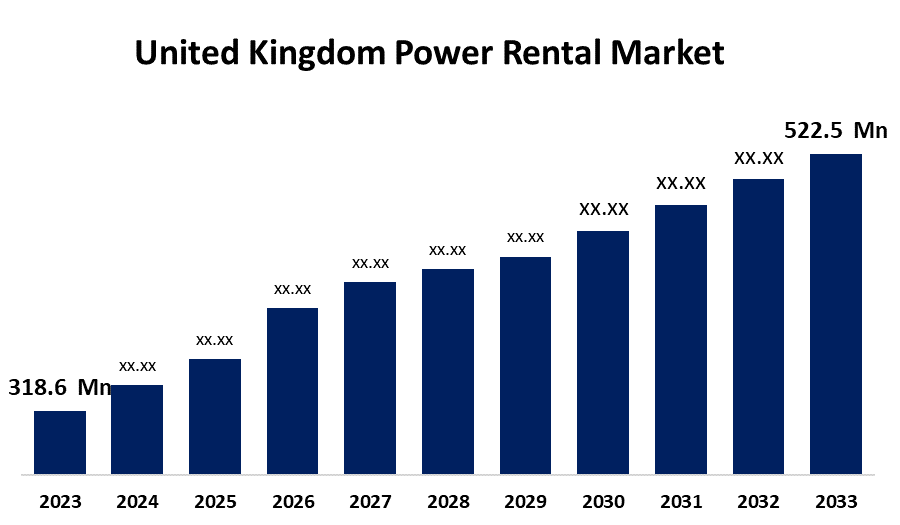

- The United Kingdom Power Rental Market Size was valued at USD 318.6 Million in 2023.

- The United Kingdom Power Rental Market Size is Growing at a CAGR of 5.07% from 2023 to 2033

- The United Kingdom Power Rental Market Size is Expected to reach USD 522.5 Million by 2033

Get more details on this report -

The United Kingdom Power Rental Market Size is Anticipated to Exceed USD 522.5 Million by 2033, Growing at a CAGR of 5.07% from 2023 to 2033. The increasing emphasis on clean energy & investments, as well as the approval of various standards & guidelines for enhancing the safety aspect of fuels or equipment, are driving the growth of the power rental market in the UK.

Market Overview

The power rental market refers to the industry encompassing the temporary provision of power-generating equipment and services to meet short-term or immediate energy needs. The service is crucial for businesses and organizations that need a reliable power supply during outages, construction projects, events, or when a permanent grid connection is unavailable. Growing industrialization, the need for a constant energy supply, and demand for a stable power supply are the several factors that drive the power rental market. Integration of power rental equipment with renewable energy supply, such as solar and wind power, is anticipated to drive the growth opportunities in the power rental market.

Report Coverage

This research report categorizes the market for the UK power rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom power rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK power rental market.

United Kingdom Power Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 318.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.07% |

| 2033 Value Projection: | USD 522.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Fuel Type, By Equipment, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | United Rentals, Inc., Sunbelt Rentals, Inc., Aggreko, Caterpillar, Atlas Copco, Cummins Inc., KOHLER, Boels Rental, HSS Hire Group, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing preference for clean energy through substantial investment in renewable energy sources, such as offshore wind, solar, and onshore wind, is significantly contributing to driving the power rental market. Safety aspects of fuels and equipment in power rental encompass various hazards such as fire, electrical issues, and environmental concerns, contributing to propel the market for power rental. Further, the increasing demand for a reliable and flexible power supply in sectors including construction, industrial operations, and events is driving the market demand.

Restraining Factors

The rigorous government regulations, as well as increasing operating expenditure of fuel generators, are challenging the power rental market.

Market Segmentation

The United Kingdom power rental market share is classified into fuel type, equipment, and end-user.

- The diesel segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom power rental market is segmented by fuel type into diesel, natural gas, and other. Among these, the diesel segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. The strict environmental regulations for energy-efficient solutions along with the increasing number of natural disasters, grid failure, and power outages are driving the market demand in the diesel segment.

- The generator segment held the largest revenue share of the power rental market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom power rental market is segmented by equipment into generator, transformers, load banks, and other. Among these, the generator segment held the largest revenue share of the power rental market in 2023 and is expected to grow at a significant CAGR during the projected period. The equipment is used in the oil & gas industry, especially for drilling and digging activities. The cost associated with purchasing new generators, along with the development in the oil & gas and construction sectors, is propelling the market.

- The construction segment accounted for the largest revenue share of the power rental market in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom power rental market is segmented by end-user into mining, construction, manufacturing, utility, events, oil & gas, and others. Among these, the construction segment accounted for the largest revenue share of the power rental market in 2023 and is expected to grow at a significant CAGR during the projected period. Power rental solutions offer a reasonable, constant supply of energy throughout the building process. The rising emphasis on the development of physical infrastructure by the government and private organizations contributes to driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. power rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- United Rentals, Inc.

- Sunbelt Rentals, Inc.

- Aggreko

- Caterpillar

- Atlas Copco

- Cummins Inc.

- KOHLER

- Boels Rental

- HSS Hire Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Power Rental Market based on the below-mentioned segments:

UK Power Rental Market, By Fuel Type

- Diesel

- Natural Gas

- Other

UK Power Rental Market, By Equipment

- Generator

- Transformers

- Load Banks

- Other

UK Power Rental Market, By End-user

- Mining

- Construction

- Manufacturing

- Utility

- Events

- Oil & Gas

- Others

Need help to buy this report?