United Kingdom Poultry Meat Market Size, Share, and COVID-19 Impact Analysis, By Form (Fresh/Chilled, Processed, and Marinated Products), By Distribution Channel (Off-Trade and On-Trade), and United Kingdom Poultry Meat Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Poultry Meat Market Insights Forecasts to 2035

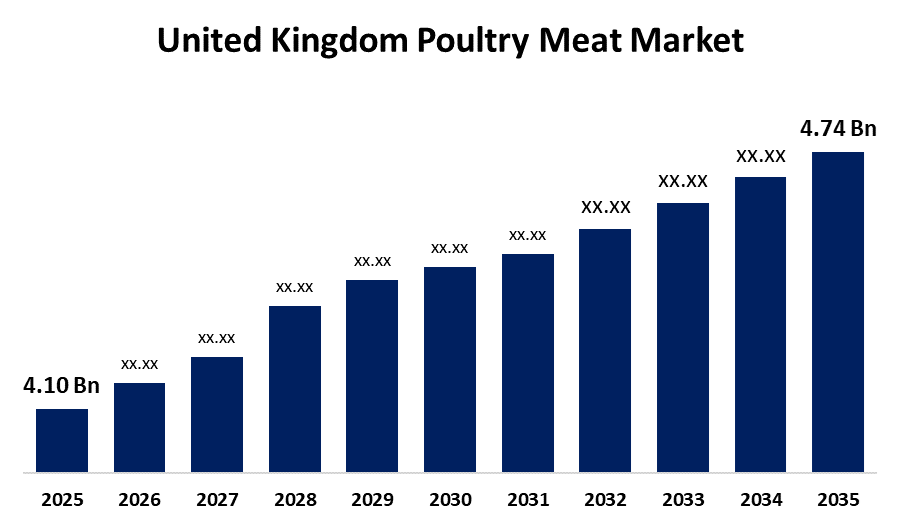

- The United Kingdom Poultry Meat Market Size Was Estimated at USD 4.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.33% from 2025 to 2035

- The United Kingdom Poultry Meat Market Size is Expected to Reach USD 4.74 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Poultry Meat Market is anticipated to reach USD 4.74 billion by 2035, growing at a CAGR of 1.33% from 2025 to 2035. The increasing demand for convenient and ready-to-eat food, rising consumer appetite for inexpensive, high-protein meat, technological developments in chicken production, and expanding awareness of the health advantages of eating poultry.

Market Overview

The United Kingdom poultry meat market refers to the industry includes the production, processing, marketing, and distribution of consumable poultry products, including turkey, chicken, and other birds. It supports the retail, foodservice, and industrial sectors by supplying both fresh and processed poultry meat. The market adjusts to the demand for sustainable, high-quality, and convenient poultry options throughout the UK, driven by shifting customer preferences, health consciousness, and technology improvements. Increasing consumer preference for ready-to-eat and convenient options, improvements in sustainable farming methods, and rising demand for organic and free-range poultry products. Growing health consciousness, creative product development, and the expansion of foodservice and retail channels all contribute to the market's potential, drawing in investments and allowing for the diversity of chicken alternates. Development of organic and antibiotic-free poultry, sophisticated breeding methods, processing automation, and the introduction of marinated and ready-to-cook goods. Consumer appeal and market evolution are further influenced by environmentally friendly packaging and plant-based poultry substitutes.

Report Coverage

This research report categorizes the market for the United Kingdom poultry meat market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom poultry meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom poultry meat market.

United Kingdom Poultry Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.33% |

| 2035 Value Projection: | USD 4.74 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Form, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | 2 Sisters Food Group, Moy Park, JBS SA, Avara Foods, Cranswick plc, Faccenda Foods, Banham Poultry, Hook 2 Sisters, Gressingham Foods, PD Hook, and key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing consumer demand for low-fat, high-protein, and inexpensive meat substitutes due to the perception that chicken is healthier than red meat. Increased consumption of poultry is a result of shifting dietary preferences and growing awareness of health benefits, which favor lean meats. The efficiency, quality, and safety of chicken production are improved by technological developments in farming and processing. Accessibility is improved by the growth of retail and foodservice outlets, such as quick-service eateries and supermarkets. Market expansion is also aided by consumers' increasing desire for ready-to-eat and readily available poultry products. Stricter laws and sustainability programs also encourage farmers to raise their game in order to comply with consumer demands for morally and ecologically conscious chicken production.

Restraining Factors

The high feed prices, avian flu outbreaks, stringent regulations, a lack of workers, the impact on the environment, concerns regarding animal welfare, restricted export prospects because of trade restrictions, supply chain interruptions, and pressure to use fewer antibiotics in chicken production.

Market Segmentation

The United Kingdom poultry meat market share is classified into form and distribution channel.

- The fresh/chilled segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom poultry meat market is segmented by form into fresh/chilled, processed, and marinated products. Among these, the fresh/chilled segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed because of the growing demand for high-quality, less-processed food, the strong customer preference for bigger flavor, texture, and nutritional value, and the focus placed by food services and merchants on providing fresh options for healthier meal choices.

- The off-trade segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom poultry meat market is segmented by distribution channel into off-trade and on-trade. Among these, the off-trade segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the growth of direct-to-consumer meat boxes, supermarket delivery services, and e-commerce platforms. Customers decide to purchase poultry meat online due to its convenient home delivery, digital adoption, competitive pricing, and enhanced accessibility through quick-commerce models.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom poultry meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 2 Sisters Food Group

- Moy Park

- JBS SA

- Avara Foods

- Cranswick plc

- Faccenda Foods

- Banham Poultry

- Hook 2 Sisters

- Gressingham Foods

- PD Hook

- Others.

Recent Developments:

- In January 2024, Meadow Vale introduced a new Sizzling Chicken Range, featuring hand-cut, deboned, and chargrilled fillets, thighs, and skewers. The range includes award-winning products like the Sizzling Shawarma and Piri Piri Chargrilled Chicken Boneless Thighs, catering to the growing demand for high-quality, ready-to-cook poultry options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom poultry meat market based on the below-mentioned segments:

United Kingdom Poultry Meat Market, By Form

- Fresh/Chilled

- Processed

- Marinated Products

United Kingdom Poultry Meat Market, By Distribution Channel

- Off-Trade

- On-Trade

Need help to buy this report?