United Kingdom Potash Market Size, Share, and COVID-19 Impact Analysis, By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate, and Others), By End Use (Agriculture and Others), and UK Potash Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited Kingdom Potash Market Forecasts to 2035

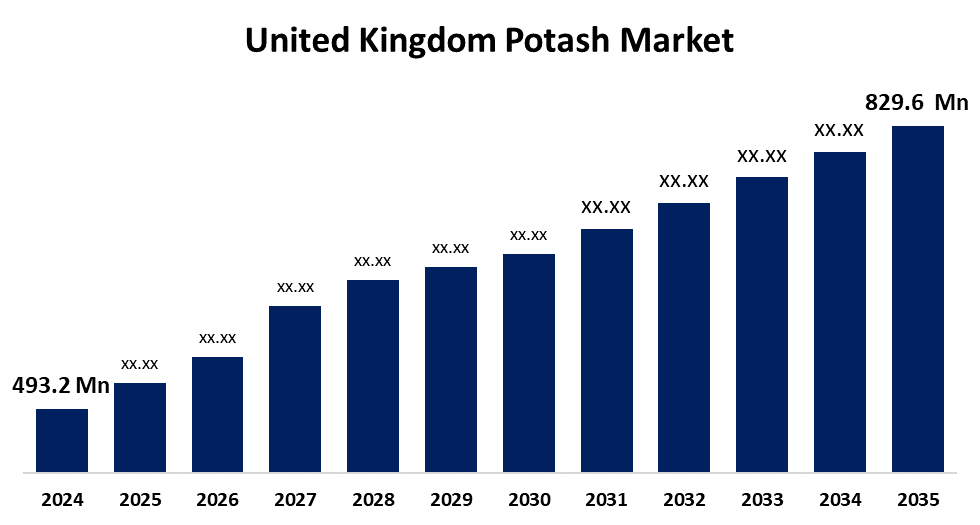

- The United Kingdom Potash Market Size Was Estimated at USD 493.2 Million in 2024

- The UK Potash Market Size is Expected to Grow at a CAGR of around 4.84% from 2025 to 2035

- The UK Potash Market Size is Expected to Reach USD 829.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the UK Potash Market is anticipated to reach USD 829.6 million by 2035, growing at a CAGR of 4.84% from 2025 to 2035. Rising food demand, increasing agricultural productivity, adoption of precision farming, and emphasis on sustainable practices, all driving higher use of potash fertilizers for better crop yields.

Market Overview

The UK potash market refers to a crucial nutrient that contains soluble potassium, supports important processes in plants, including photosynthesis, water management, and enzyme activity. Potash is primarily used in agriculture to enhance crop yields and quality. In response to sustained demand for food and pressure on agricultural productivity, potash is still a vital component of fertilizer blends to support soil fertility and increase crop yield.

Potash has an essential role in providing potassium for plant development, and farmers are keen to increase agricultural production and yield from the growing demand for food in the UK. Potash enhances nutrient absorption, root development, and plant health. Potash is fundamental within the flourishing agriculture sector of the UK to support soil health, soil fertility, and maximise yield potentials from numerous farmland soil types. Potash is applied directly within feed and some types of feed to enhance nutritional value and milk yield, along with potassium chloride, potassium carbonate, and potassium sulphate. Potash can be found in markets that include soap, detergent, water softeners, scouring powder, glass, and cosmetics. The need for potash is further supported by technological developments in industry, building, and agriculture. The UK market benefits from precision agriculture, specialty crop cultivation, and government initiatives, all driving consistent potash consumption. These combined factors ensure a stable and growing potash market in the UK, critical for sustaining agricultural productivity and supporting multiple industrial sectors.

Report Coverage

This research report categorizes the market for the UK potash market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom potash market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom potash market.

United Kingdom Potash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 493.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.84% |

| 2035 Value Projection: | USD 829.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Cleveland Potash Ltd, Anglo American, Frontier Agriculture, ICL Group, KS AG, EuroChem Group, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising demand, economies of scale, and strategic positioning are some of the factors driving market consolidation in the potash industry. Potash is a crucial component of fertiliser, and its varying demand and price have an impact on mergers and acquisitions. Market can increase their product options, improve their bargaining power, control market volatility, and obtain complementary resources through consolidation. Strategic partnerships improve the competitiveness and stability of markets. Trade obstacles, antitrust laws, and government regulations, however, can have a big influence on the direction and success of industry consolidation initiatives.

Restraining Factors

Currency fluctuations can have a major effect on the potash market because they change production expenses, especially for producers importing foreign materials or equipment. Currency levels and, hence, potash market conditions will also have an influence from a broader view of macroeconomic variables, such as inflation, interest rates, and geopolitical events. These factors hamper the potash market during the forecast period.

Market Segmentation

The United Kingdom potash market share is classified into product and end use.

- The potassium chloride segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom potash market is segmented by product into potassium chloride, potassium sulphate, potassium nitrate, and others. Among these, the potassium chloride segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Potassium chloride is Muriate of Potash (MOP), and its main use is as a source of potassium and a raw material for industrial applications such as nitrogen, phosphorus, and potassium (NPK) fertilizer production. The increasing population will result in more food being necessary to support that population, and will in turn increase food production. Consequently, potash products are quickly becoming more significant in agriculture to promote greater crop yields.

- The agriculture segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom potash market is segmented by end use into agriculture and others. Among these, the agriculture segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The agriculture sector needs to improve crop development, yield, and food security. This essential nutrient is beneficial in root development, plant development, and plant health. Potash, now an integral part of fertilizer blends used to increase agricultural outputs to meet growing demand, has become an essential part of modern agricultural practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom potash market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cleveland Potash Ltd

- Anglo American

- Frontier Agriculture

- ICL Group

- K S AG

- EuroChem Group

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom potash market based on the below-mentioned segments:

United Kingdom Potash Market, By Product

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

- Others

United Kingdom Potash Market, By End Use

- Agriculture

- Others

Need help to buy this report?