United Kingdom Pork Meat Market Size, Share, and COVID-19 Impact Analysis, By Product (Centrifugal Pork Meat, Triturating Pork Meat, and Masticating Pork Meat), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, and Others), and United Kingdom Pork Meat Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Pork Meat Market Insights Forecasts to 2035

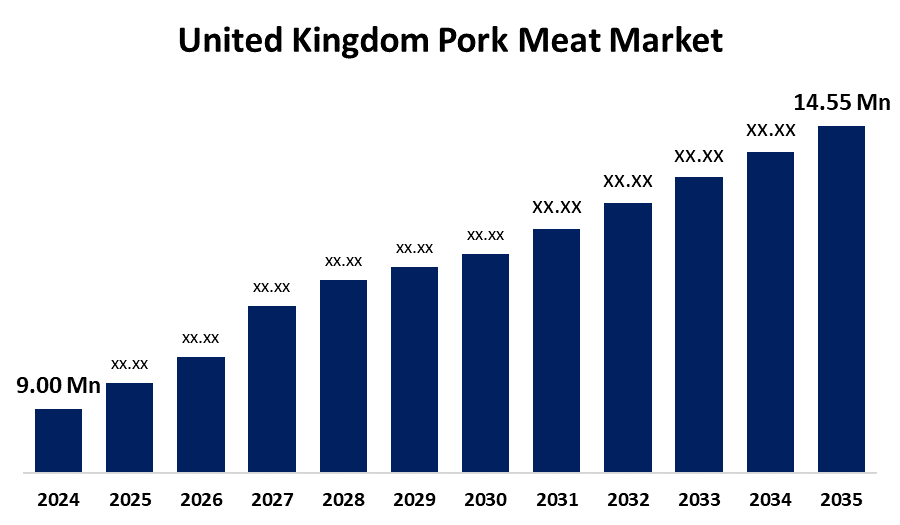

- The United Kingdom Pork Meat Market Size was estimated at USD 9.00 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.46% from 2025 to 2035

- The United Kingdom Pork Meat Market Size is Expected to Reach USD 14.55 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Pork Meat Market is anticipated to reach USD 14.55 million by 2035, growing at a CAGR of 4.46% from 2025 to 2035. The growing disposable incomes have tremendous impact on eating patterns since they tend to satiate their taste buds, which is the main driver of the market for pork meat.

Market Overview

The United Kingdom pork meat market refers to the industry focused on the production, processing, and distribution of domesticated pigs. This market is divided into several areas, such as processed pork products (including bacon, ham, and sausages), fresh pork, and by-products utilized in other industries. Factors including customer preferences, trade rules, feed prices, animal health standards, and cultural dietary customs all have an impact on the market. It has a well-balanced nutritional profile and a delicious appearance. It also provides a good amount of protein, which is why those who want to gain weight often choose it. The emergence of substitute protein sources has spurred innovation in pork products, as businesses investigate plant-based and lab-grown substitutes to satisfy changing consumer preferences. The environment of the hog meat market is greatly influenced by international trade agreements and geopolitical concerns. Furthermore, improvements in production techniques and technology have increased hog farming's productivity and efficiency, guaranteeing a consistent supply to satisfy rising demand. All of these elements work together to foster the market for hog meat's steady expansion, offering producers, processors, and merchants the chance to profit from consumers' growing demand for pork products.

Report Coverage

This research report categorizes the market for the United Kingdom pork meat market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom pork meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom pork meat market.

United Kingdom Pork Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.00 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.46% |

| 2035 Value Projection: | USD 9.00 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Anal |

| Companies covered:: | Cranswick plc, Karro Food Group, Dunbia, Baird Foods Group, Tulip Ltd, Pork Farms, Wall’s, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom pork meat is primarily driven by rising consumer demand, technology advancements, and changing supply chain efficiencies. Pig health and growth rates are increased by innovative farming methods and genetics, which also increases production efficiency. Further supporting market growth are robust retail and foodservice alliances as well as growing export prospects, especially in the UK. Further driving demand is the tendency toward processed pig products like sausages and ready meals, as well as convenience foods. This tendency is especially noticeable in cities, where consumers have a strong need for convenience and prepared foods. Additionally, as economies in emerging areas have grown, dietary preferences have changed, making pork more widely available and reasonably priced for a wider range of consumers. It is projected that the demand for protein sources like pigs would increase as people live more contemporary, urban lifestyles.

Restraining Factors

The market expansion could be restricted due to fluctuating costs and the supply of pork meat, environmental laws require waste treatment, and the volatility of feed prices, which decline when consumer preferences change in favor of plant-based diets or other proteins.

Market Segmentation

The United Kingdom pork meat market share is classified into product, and distribution channel.

- The chilled pork meat segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom pork meat market is divided by product into chilled pork meat, and frozen pork meat. Among these, the chilled pork meat segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is growing due to the high consumer appetite for premium, fresh meat products. Many customers believe that fresh pork tastes better and is more nutritious than frozen pork. This trend is particularly strong in areas where using fresh foods is emphasized in culinary traditions. The demand for chilled pork keeps growing as consumers who are health-conscious look for fresh options, which fuels market expansion.

- The supermarkets & hypermarkets segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom pork meat market is segmented by distribution channel into supermarkets & hypermarkets, specialty stores, online, and others. Among these, the supermarkets & hypermarkets segment dominated the market in 2024 and is expected to grow at a substantial CAGR over the forecast period. This is because its offer a one-stop shopping experience. It is easy to incorporate into diets because of its accessibility, which encourages customers to buy it as part of their usual shopping routine. Customers can choose from fresh, frozen, and processed pig options in these stores' well-organized meat areas, which also improve the shopping experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom pork meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cranswick plc

- Karro Food Group

- Dunbia

- Baird Foods Group

- Tulip Ltd

- Pork Farms

- Wall’s

- Others

Recent Developments:

- In March 2024, Pork Farms, the UK’s leading pork pie brand, made a bold move into the meat snacking category with the launch of four new ready-to-eat products, marking its first foray beyond traditional pies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom pork meat market based on the below-mentioned segments:

United Kingdom Pork Meat Market, By Product

- Chilled Pork Meat

- Frozen Pork Meat

United Kingdom Pork Meat Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Need help to buy this report?